On FundFire: MBC Strategic Discusses Thriving Through Investment Marketing

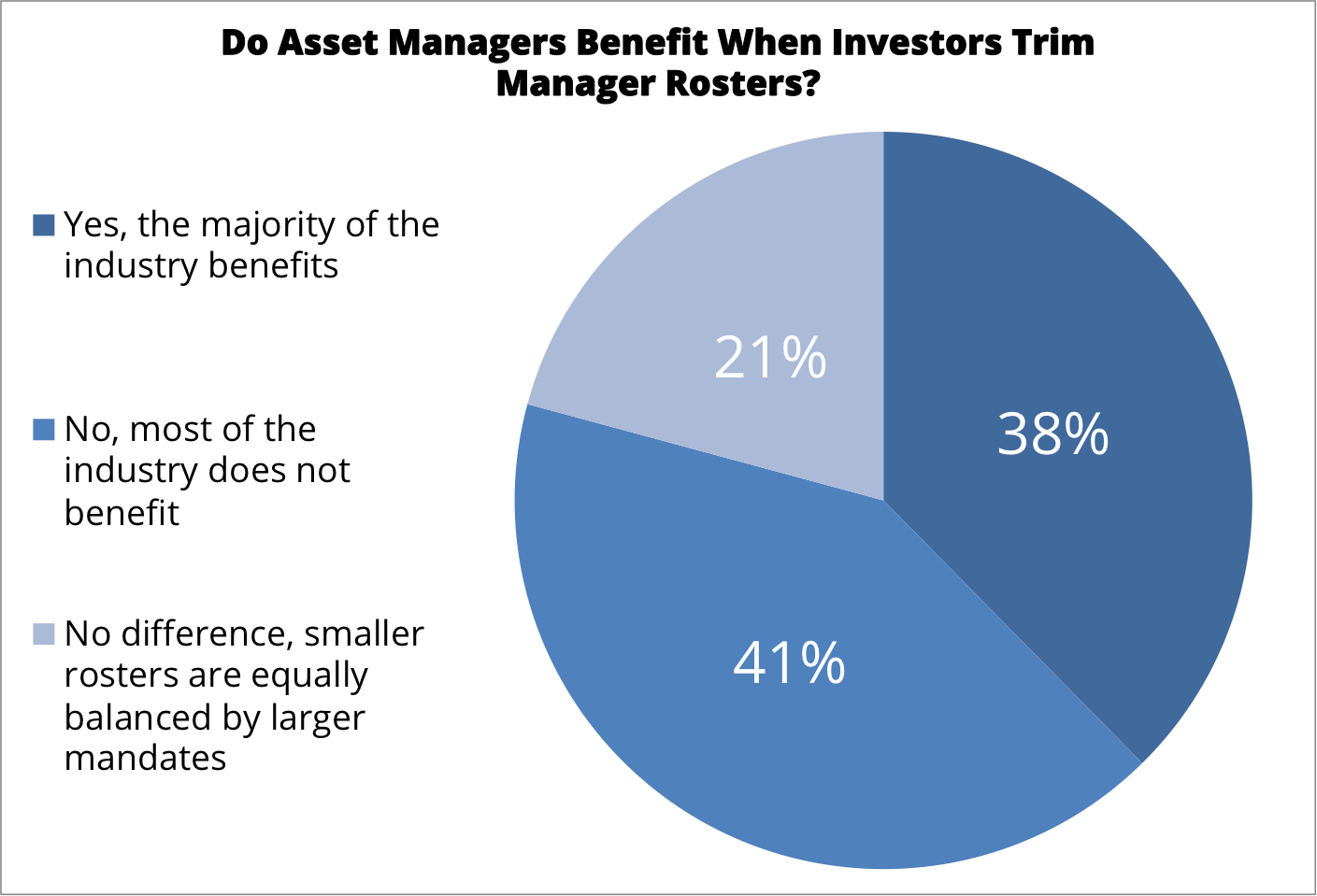

Many asset managers claim on paper to offer unique traditional and alternative product offerings allowing investors to diversify their investments. Yet, investors and industry insiders sometimes question whether these differences are as large as they are claimed to be. The result has been a manager roster cut allowing investors to consolidate their holdings, reduce the amount of due diligence and manager communication necessary, cut time spent reviewing different managers, and in theory produce similar or better returns.

Given this backdrop, asset managers are looking for ways to stand out among the crowd. The key to thriving in such investment climates is to form true strategic partnerships with investors by clearly communicating what you have to offer and how you plan to achieve it. Risk remains a top investor concern, making clear communication and branding a more compelling argument for investment than superior performance history to many. Though stellar returns are often tempting, investors without an understanding of how those returns were obtained or whether they can be sustained may be hesitant to fully buy in. This is where brand strategy and investment communications best serves asset managers – investors want to know what is going on, which in turn boosts their satisfaction and strengthens the long-term relationship with money management firms.

A number of components contribute to client satisfaction. Companies throughout history have sought to ensure satisfaction at almost any cost, knowing such satisfaction could itself pay dividends through future re-engagement. The availability of high-quality service, strong history and an in-depth knowledge of your product were understood to be instrumental in building a company’s reputation. In a field like asset management where individuals, corporations and governments are entrusting you to steward their hard-earned and deeply emotional assets, these factors are an even more crucial part of building a sustainable business – trust is likely the most important asset a money manager can have.

MBC Strategic’s founder Matt Brunini gave insight regarding this issue in a recent FundFire article. Highlighting how strong communication both with managers and of your brand affects an investor’s perception of a manager, Brunini said “For those firms that really communicate well and manage expectations upfront, providing this authentic and transparent information…probably will not have that problem. Asset managers that can convey their story from the onset of the relationship will be more likely to see better flows.”

This ability to convey a story is essential in connecting with investors and also having them understand your investment strategy and what makes one unique. By simply providing additional insight and proving their important responsibility on every possible investment, managers lose the risk of cutbacks and gain complete trust. Investors are also likely to better understand when and how they should expect your management style to outperform or suffer losses. Brunini adds “Those that survive will be a better fit with the asset owner. With more information, there should be better matching.”

FundFire is the leading source of competitive intelligence for the Separately Managed Accounts industry. Each morning FundFire delivers a mix of original articles and summaries on the most important industry news to over 80,000 readers. This helps investors, managers and consultants stay abreast of the changes in their industry.