Answer Engine Optimization (AEO) for Investment Firms | Marketing Beyond SEO

Generative AI marks a sea change in how investors discover information, transferring influence from traditional search rankings to AI-driven answers. This shift in search behavior creates both challenges and opportunities in finance, with Answer Engine Optimization (AEO) for investment firms now essential to staying relevant and visible.

Answer Engine Optimization (AEO) is the practice of structuring content so generative AI models can read, understand, and surface it in their answers.

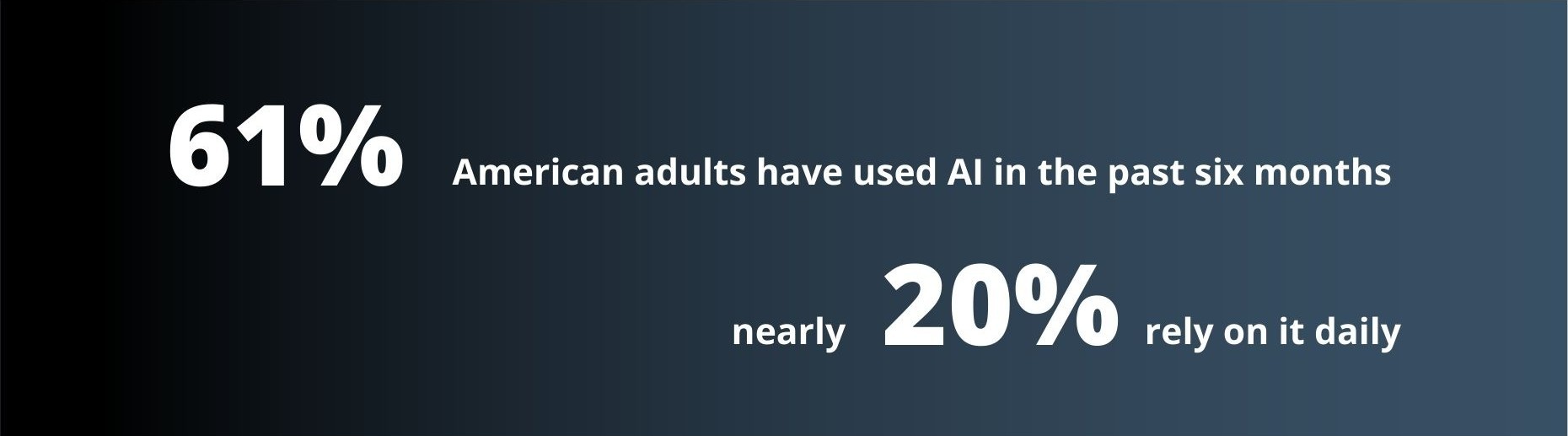

This is rapidly becoming the new norm for online research and decision-making, considering a recent Menlo Ventures study found that 61% of American adults have used AI in the past six months, and nearly 20% rely on it daily.

Generative engines work by crawling vast amounts of content, summarizing it, and delivering direct answers without necessarily referring users back to the original source. For context, Cloudflare CEO Matthew Prince noted that ChatGPT crawled roughly 1,500 pages for every visitor it returned to a publisher, while Claude’s ratio was closer to 60,000:1.

For financial brands that fail to adapt, the impact can be felt across the marketing stack. The consequences include loss of visibility, reduced organic reach, and diminished control over how expertise in investing, planning, or products is presented to potential clients.

Such rapid adoption requires a rethink of investment brand marketing, especially when it comes to promoting services, strategies, and thought leadership online. This article will go over why now is the time to evolve your digital presence, dig into how AEO actually works, and outline the steps you need to take to stand out in this new era.

Why Does AI Marketing Matter for Investment Firms?

For financial and investment organizations, the marketing stakes are high because visibility and credibility are substantial drivers of investor decisions. In the SEO era, firms could analyze digital footprints from clicks, page views, and sign-ups. In the AEO era, that visibility is gone. Generative engines are black boxes: an investor may absorb your insights on wealth management or retirement planning without ever landing on your site.

The unfair reality is that the prospect may then look elsewhere for providers of those very services. The opportunity for conversion is lost, despite the brand already being in the investor’s line of sight. As Bain & Company concluded in a recent report: “The AI-powered funnel shuts out sellers well before the journey reaches them.”

At the same time, this very dynamic creates an opening for firms that embrace AEO. Bain also noted in the same report that AI-powered search can deliver conversion rates twice as high as standard Google search for institutions that adapt their content strategies.

In short, in investment marketing, visibility equals credibility — and AEO ensures your firm’s expertise is present in AI-generated answers where investors make decisions.

Mastering AEO to Stay Visible in Generative Search

To stay visible in this new query-based landscape, firms must embrace Answer Engine Optimization. Instead of focusing on search rankings and keywords, success now depends on creating AI-ready content that can be surfaced, referenced, and trusted when investors ask questions through chatbots.

How Do Generative Engines Prioritize and Present Information?

Generative AI models prioritize credible sources and structured content when delivering answers.

Generative engines and large language models (LLMs) are trained on billions of web pages. These models learn patterns from historical data to generate outputs, but the data they absorb is not evenly distributed. Some brands and topics have a much larger presence than others. As a result, LLMs naturally develop bias toward established sources.

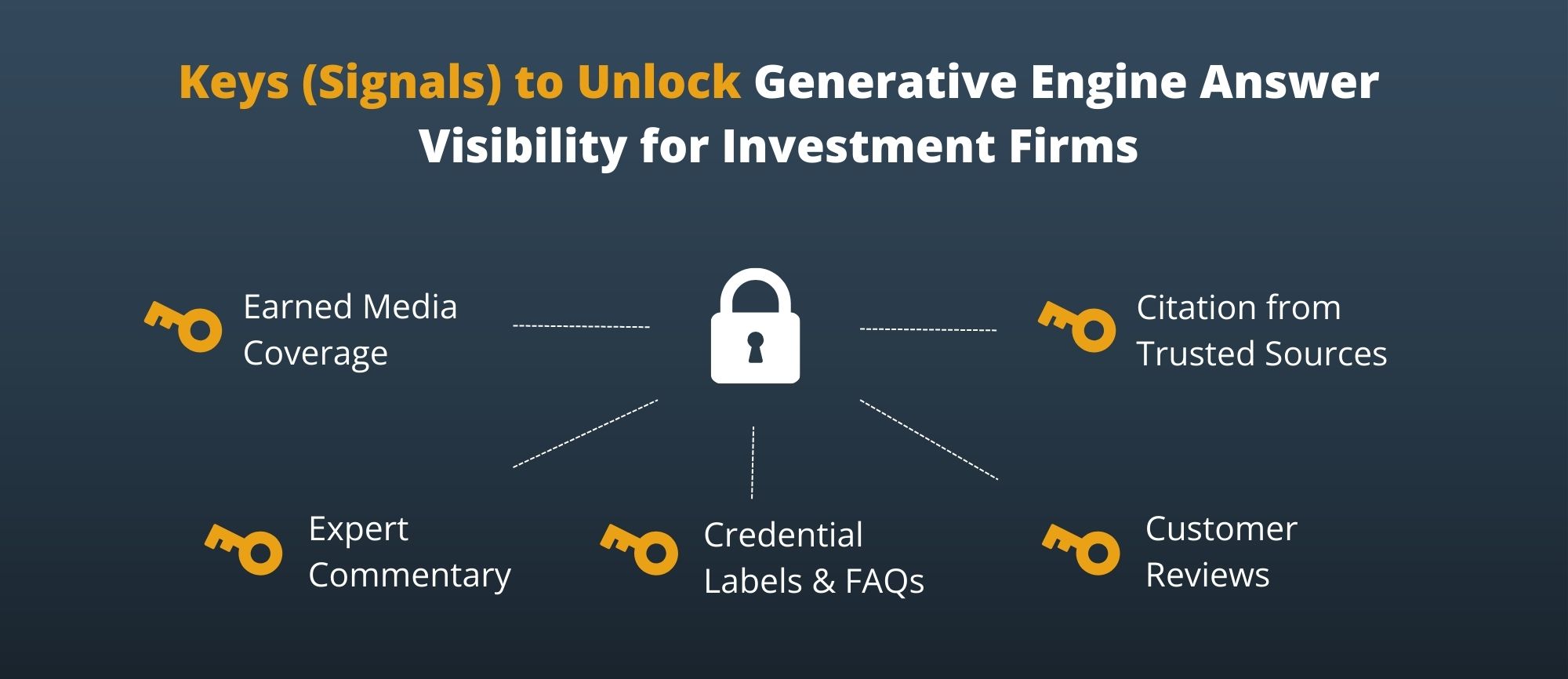

Therefore, when an investor asks a chatbot a question, the model does not select answers at random. It synthesizes patterns to source and weight information that appears credible, often with media coverage, expert commentary, citations from trusted sources, and customer reviews.

This is why firms with strong reputations and consistent digital signals are more likely to be surfaced and referred to in generative responses.

How Do You Make Your Content Stand Out to AI?

AI favors content that is authoritative, structured, and validated by external signals. Financial institutions can increase their visibility and references in generative answers by aligning content with the signals LLMs prioritize.

The following practices strengthen answer presence and help regain lost traffic from search engines:

Earned Media and Authority

Recognition in respected financial publications and citations from trusted outlets act as credibility signals AI engines prioritize.

Media coverage, expert commentary, and third-party validation all serve as non-branded proof points that elevate a firm’s authority.

Highlight Earned Customer Conversations

Independent reviews, testimonials, and third-party discussions carry more weight than branded content.

These external signals create backlinks, reinforce authenticity, and demonstrate investor trust — all factors AI models recognize as reliable.

Build Owned Credibility

Authoritative content that highlights advisor credentials, firm track records, and measurable results establishes trust with both investors and AI.

An evidence-based tone, backed by data and outcomes, consistently outperforms vague claims or marketing buzzwords.

Converge Questions for AI

Anticipating investor questions and publishing direct, structured FAQs improves the chances of your firm being quoted by AI engines.

Examples: Who are the best wealth managers in the New England area? Why are mid-cap stocks a good investment?

Optimize Website Structure for AI Readability

A clear website hierarchy with headers, lists, and definitions makes content easier for AI and search engines to parse.

Organize pages with logical H1–H6 headers, bullet points, and structured guides so models can efficiently summarize your expertise.

Advanced: Develop AI-Specific Content

Specialized resources such as API feeds and use-case libraries can position your firm as a go-to source for AI-driven answers.

Creating technical documentation and structured datasets ensures that generative models can easily reference your firm in real time.

What is the Future of AI in Investment Marketing?

Generative AI is becoming the new discovery layer for investors, making AEO the natural evolution of SEO.

AI is not a passing trend. While some competitors see disruption, forward-looking firms recognize AI as a force multiplier, enabling scale, investor personalization, and deeper trust with clients.

Regulation will eventually address intellectual property concerns, but financial institutions cannot afford to wait. Generative engines are already shaping investor decisions today, and firms that adapt now will be the ones that surface when investors ask their most critical questions.

Think of generative AI as a launch pad: investors may start with a chatbot for education, but they will seek a provider to execute their goals. If your insights are structured for AI, your firm’s name becomes part of that decision-making journey.

Firms that embrace this dual approach — human trust + AI readability — will not just stay visible but thrive in the intelligence age.

MBC Strategic leads in AI adoption for financial firms, enabling innovation in investment marketing while safeguarding the human connection and trust the industry relies on.

Contact us to audit your digital presence and ensure your expertise is visible in AI-driven investor searches.

Frequently Asked Questions

1. What is Answer Engine Optimization (AEO)?

AEO is the practice of structuring content so that generative AI models can read, understand, and surface it in their answers.

2. How is AEO different from SEO?

SEO focuses on ranking in search results. AEO focuses on being present in AI generated answers where investors increasingly seek information.

3. Why is AEO important for financial institutions?

Investors now turn to AI tools for insights on wealth management, market outlooks, and retirement planning. Firms that adapt their content for AI remain visible in these critical conversations.

4. How do large language models choose what content to show?

Models synthesize patterns from billions of web pages. They prioritize content that is credible, well structured, and validated by external signals such as media coverage and customer reviews.

5. What types of content do generative engines value most?

Clear, authoritative, and structured content. FAQs, guides, definitions, and cited expert commentary are easier for AI to parse and summarize.

6. Can AEO improve conversions?

Yes. AI powered search can produce conversion rates up to twice as high as standard Google search when brands adapt their strategies.

7. What is the risk of ignoring AEO?

If a firm does not adapt, its insights may still educate investors through AI, but without attribution. The firm loses visibility, data, and conversion opportunities after doing the work.

8. How can firms measure AEO success?

By tracking brand mentions across GPT, Claude, and Gemini, and assessing both sentiment and accuracy, since traditional web analytics cannot capture AI presence.