Marketing Through Uncertainty

How Brands Grow Strongest in the Storm

Financial firms sensing marketing uncertainty or economic headwinds often slash marketing budgets early on. While this approach seems prudent at first, it is commonly counterproductive, with extensive historical data proving that reactionary decisions can severely undermine long-term growth and market position.

The reality is that companies who continue to invest in their brand across all market environments are the ones who maintain positions of strength and competitive advantage.

In fact, those maintaining or even increasing their marketing investment during downturns have consistently outperformed their competitors when markets stabilize.

This article will go over key insights and evidence regarding marketing spend during market volatility, followed by the strategic actions investment managers and financial firms can take to ensure they are stronger than ever when the dust settles.

Insight: Investing During Downturns Drives Growth

History has repeatedly shown that economic downturns create unique opportunities for forward-thinking firms. While competitors retreat and reduce their market presence, those who maintain visibility gain disproportionate advantages in market share, client trust, and long-term growth.

This data goes all the way back to the Great Depression, where Kellogg’s famously doubled its advertising budget (while its competitor, Post, cut back), and gained a 30% increase in markets share, along with decades of sector dominance thereafter.

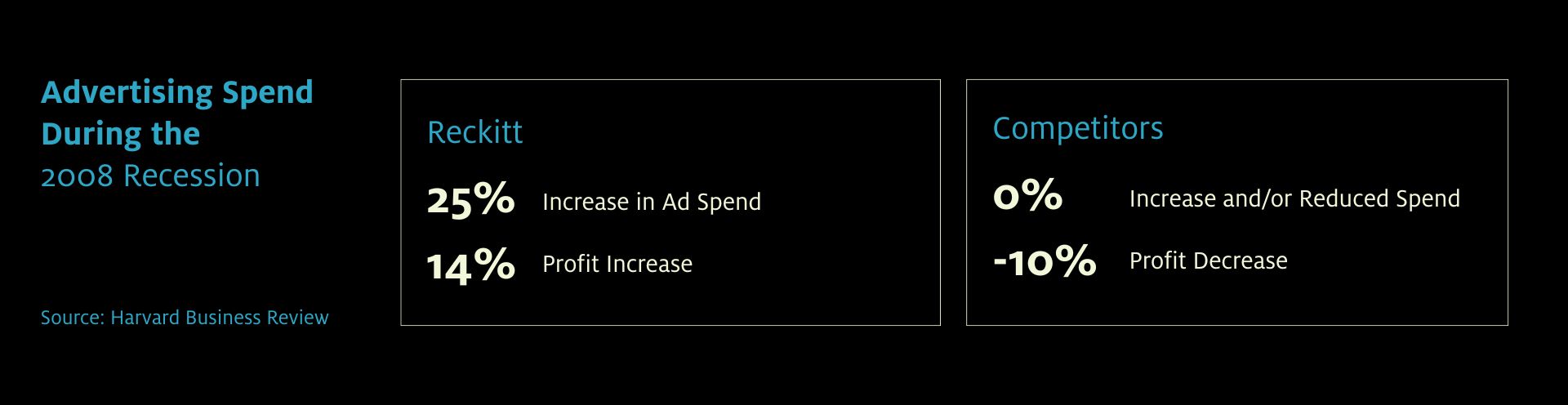

Also consider this compelling case from the 2008 recession: While many companies slashed marketing budgets, Reckitt Benckiser (The company behind Lysol and Clearasil) took the opposite approach. They increased their advertising spend by 25% and subsequently enjoyed 8% revenue growth and 14% profit growth while competitors suffered profit declines averaging 10% or more, according to Harvard Business Review¹.

Insight: Maintaining Visibility Strengthens Market Position

The fundamental principle at work here is what marketing strategists call share of voice. When your competitors reduce their marketing presence, maintaining your own marketing efforts automatically increases your relative visibility and influence in the marketplace.

This amplification effect creates several tangible benefits:

- Enhanced market position: As competitors fade from view, your brand gains prominence

- Lower acquisition costs: Media and advertising costs often decrease during downturns

- Long-term brand equity: Consistent presence builds trust during uncertain eras

- Competitive advantage: The groundwork laid during downturns typically translates to accelerated growth during recovery.

While these insights clearly demonstrate the value of sustained marketing during economic uncertainty, the question remains: How exactly should financial firms adapt their approach to maximize returns during these challenging periods? The answer lies in strategic adaptation rather than reduction.

Action: Adapting Strategy Instead of Reducing Spend

The key is not simply maintaining marketing spend but adapting your approach to align with the changing environment. During economic uncertainty, successful organizations engage in strategic shifts that capture new opportunities versus being reactive to fear and uncertainty. Here are transformational approaches that prove exceptionally powerful when the going gets tough:

Refine Messaging to Build Trust and Relevance

According to McKinsey research, the most effective marketing during downturns focuses on building genuine connections of trust.

A clear example of this strategy could be seen during the 2008 recession when Sainsbury’s launched its “Feed Your Family for a Fiver” campaign. They acknowledged consumers’ financial constraints while positioning the brand as a helpful partner. This approach not only increased customer loyalty but drove measurable revenue growth even as consumer spending declined broadly.

So, rather than pushing products, top-performing financial companies pivot to messages emphasizing stability, trust, and value.

Prioritize Client Retention to Maximize Long-Term Value

Economic uncertainty presents an ideal opportunity to solidify relationships with existing clients. Research from the International Journal of Innovation in the Digital Economy found that firms that protected their core customers during downturns emerged significantly stronger when economic conditions improved.

The logic is intuitive: during uncertainty, clients prioritize stability and attention.

Marketing initiatives focused on client education, support, and demonstrating added value can significantly enhance retention rates, while also attracting clients dissatisfied with competitors who have reduced their service levels.

Reframe Marketing as a Measurable Business Investment

For investment professionals, it’s particularly valuable to reframe marketing not as an expense but as an investment with quantifiable returns. During the last major recession, while competitors struggled, General Mills increased its marketing investment by 16%, yielding an 8% revenue increase2.

Amazon’s strategy during the 2009 recession provides another instructive example. By continuing to innovate and promote Kindle products rather than pulling back, the company achieved a remarkable 28% increase in sales2.

Action: Implementing TActical marketing adjustments

Now that we’ve seen the value of marketing in volatility and how successful firms have approached these critical moments, let’s examine specific tactical changes financial firms can implement immediately to adjust to uncertainty and position themselves favorably:

1. Strengthen Value Proposition Communication

During uncertain times, clients are particularly focused on value and return on investment. Revise your marketing materials to explicitly articulate how your services deliver tangible financial benefits, enhanced risk management, or other concrete advantages. Replace abstract claims with specific outcomes that directly address current market concerns.

2. Recalibrate Messaging Tone and Content

Develop a communication framework that balances reassurance with realistic market assessment. Successful financial firms during downturns adjust their content to reflect consumer sentiment without appearing overly optimistic or unnecessarily pessimistic. This calibrated approach builds credibility while maintaining confidence in your firm’s capabilities.

3. Implement Data-Driven Decision Systems

McKinsey research indicates that companies leveraging marketing technology to make data-driven decisions during downturns significantly outperform those making cuts based on intuition. Establish enhanced analytics frameworks to track engagement, lead quality, and conversion metrics across all channels, allowing for real-time optimization of marketing resources.

4. Strategically Reallocate Marketing Resources

Rather than implementing across-the-board cuts, conduct a comprehensive channel performance analysis and redistribute budget to your highest-performing touchpoints. This might mean shifting from traditional advertising to digital content that demonstrates thought leadership, or from broad campaigns to targeted outreach focused on ideal clients with immediate needs.

Common Questions About Marketing During Economic Uncertainty

Q: How can we justify increased marketing spend to stakeholders during cost-cutting initiatives?

A: Frame marketing as an investment rather than an expense by presenting historical data on companies that gained market share during downturns. Calculate the potential cost of lost visibility and market share against the investment required to maintain presence. Finally, emphasize the higher cost of rebuilding awareness and trust after it’s been lost versus maintaining it consistently.

Q: Should we focus more on acquisition or retention marketing during downturns?

A: While both remain important, research suggests that retention marketing often delivers higher ROI during economic uncertainty. Existing clients represent your most valuable asset, and strengthening these relationships through targeted communication can prevent attrition while potentially uncovering additional service opportunities. However, acquisition shouldn’t be neglected, as competitors’ clients may be more receptive to alternatives as their current providers reduce service levels.

Q: How quickly should we expect to see results from maintaining marketing during a downturn?

A: Marketing during downturns typically yields both short and long-term benefits. Some metrics, like engagement and share of voice, may improve relatively quickly. However, the most significant advantages often materialize during recovery phases, when firms that maintained visibility experience accelerated growth compared to those who cut back. The key is establishing consistent measurement frameworks that track both immediate impacts and longer-term market position improvements.

Q: How should we adjust our messaging during economic uncertainty?

A: Successful messaging during downturns acknowledges market realities while emphasizing stability, expertise, and value. Avoid appearing tone-deaf by recognizing clients’ concerns, but balance this with confident expertise that provides reassurance. Focus on how your services help clients navigate uncertainty rather than making promises that might seem unrealistic given market conditions.

How MBC Strategic Helps Investment Firms Thrive During Uncertainty

At MBC Strategic, we specialize in helping investment and financial services firms navigate challenging market conditions through strategic marketing approaches. Our deep industry experience enables us to develop campaigns that resonate with investors and financial professionals even during economic uncertainty.

Our services include:

- Strategic Marketing Consulting: We analyze your current positioning, competitive landscape, and market opportunities to develop customized marketing strategies that align with changing economic conditions.

- Brand Development and Refinement: Economic shifts often require adjusting how your brand communicates value and stability. Our branding experts help ensure your messaging resonates with current client concerns.

- Digital Marketing Optimization: We help financial firms maximize ROI from digital marketing initiatives, focusing resources on channels and approaches delivering measurable results.

- Content Strategy and Development: Our team creates sophisticated, value-driven content that establishes thought leadership and addresses clients’ evolving concerns during uncertain times.

- Marketing Analytics and Measurement: We implement robust tracking systems to quantify marketing ROI and continuously optimize performance based on real-time data.

Conclusion: Marketing as a Competitive Advantage

Economic uncertainty doesn’t change the fundamental importance of marketing—it amplifies it. While competitors retreat from view, forward-thinking financial firms recognize the opportunity to strengthen their market position, deepen client relationships, and lay the groundwork for accelerated growth when markets recover.

At MBC Strategic, we’re committed to helping investment and financial services firms transform economic challenges into competitive advantages through strategic, thoughtful marketing approaches. The firms that maintain their marketing presence during uncertain times don’t just survive downturns—they emerge from them stronger, more visible, and better positioned for long-term success.

Contact us today to discuss how we can help your firm develop a marketing strategy that turns economic uncertainty into your competitive advantage.

References

1 Harvard Business Review. (2009). “Don’t Cut Your Marketing Budget in a Recession.” Harvard Business Review.

2 Forbes. (2019). “When A Recession Comes, Don’t Stop Advertising.” Forbes.

3 McKinsey & Company. (2022). “Beyond belt-tightening: How marketing can drive resiliency during uncertain times.” McKinsey & Company.

4 International Journal of Innovation in the Digital Economy. (2021). “Economic Downturn and Implications: Marketing Challenges and Opportunities.” International Journal of Innovation in the Digital Economy.