The 3 Strategic Foundations of a Modern Digital Presence for Investment Firms

At a GlancE

-

-

Digital Architectures are the modern equivalent of early due diligence for allocators

-

Visibility Systems determine who finds you and what you learn when they do

-

Engagement Engines guide investor evaluation and advance firms towards investment shortlists

-

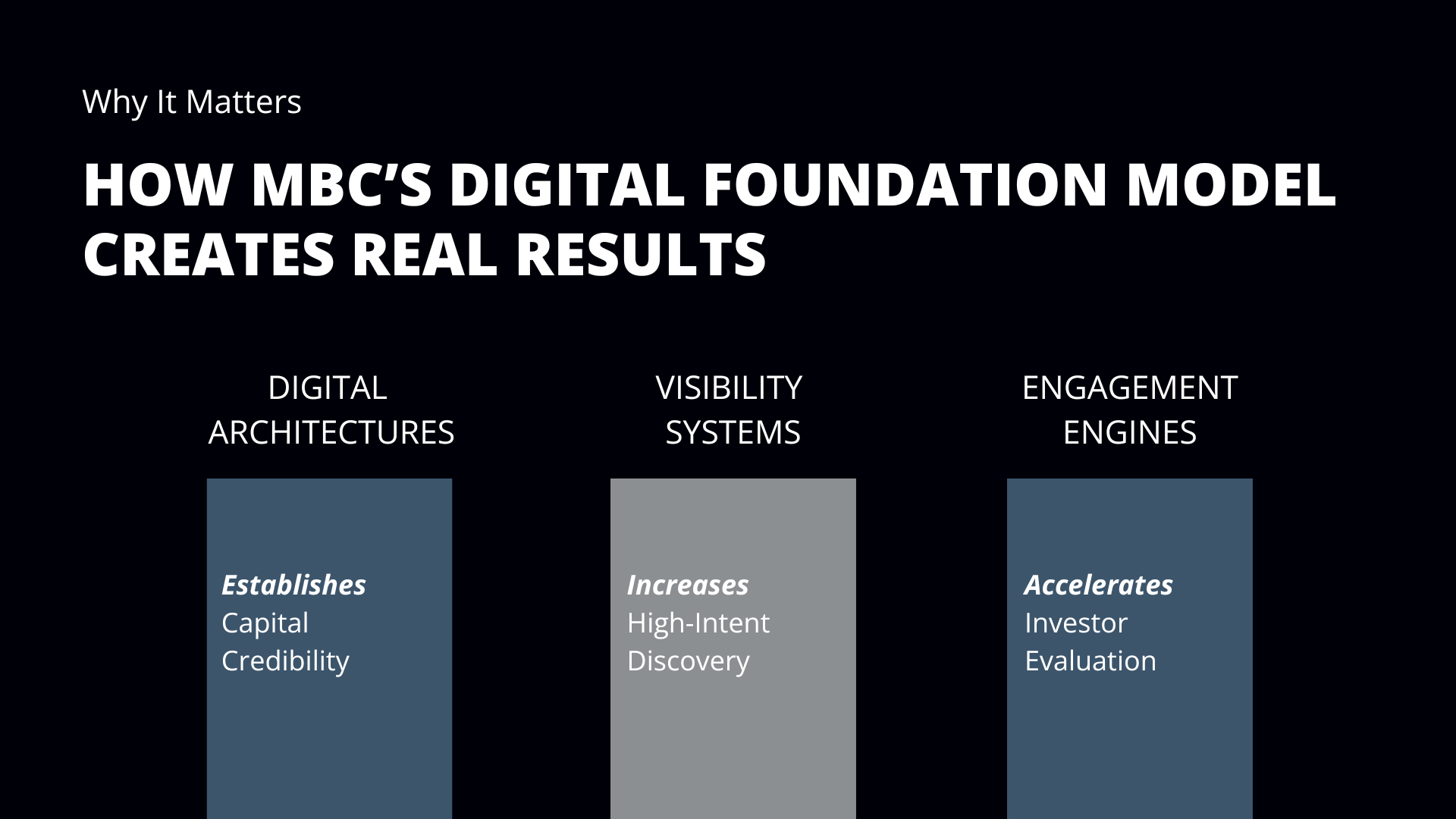

The MBC Strategic Digital Foundation Model is an integrated approach to optimizing digital presence for investment firms

-

Digital presence has become the first stage of allocator due diligence, long before a manager conversation or material review. Allocators evaluate website clarity, UX flow, data presentation, and structured narratives as signals of operational strength and strategic maturity. That shift has raised the stakes for website design and digital presence across asset management, investment advisory, venture capital, and private markets.

To help firms understand what truly matters, the MBC Strategic Digital Foundation Model organizes digital presence for investment firms into three foundational components that shape how investors interpret your organization:

→ Digital Architectures

→ Visibility Systems

→ Engagement Engines

Together, they clarify how digital performance impacts credibility, comprehension, and the path to investor evaluation.

1. Digital Architectures

The systems that shape first impressions and establish credibility

The first foundational component reflects the base structures investors encounter immediately—how your website organizes information, presents strategy detail, and communicates process clarity. Strong foundations create an intuitive environment that mirrors how allocators think:

Identity → Strategy → Evidence → Rationale

This component of the digital marketing model encompasses:

- Website clarity and structural hierarchy

- Visual discipline and design maturity

- Navigation that mirrors allocator logic

- Product or fund & strategy pages that provide immediate orientation

- Transparent performance and process presentation

Investment website design that is visually outdated, structurally cluttered, or dependent on PDFs risks being interpreted as disorganized or operationally light. Conversely, a disciplined, modern interface signals control, maturity, and readiness for institutional capital.

“Allocators spend an average of 90 seconds or less forming first impressions. Design is your fastest differentiator”

Allocator Scan Pattern

A quick way to view how Digital Architectures impact investor perception and allocator digital due diligence:

|

ALLOCATOR Q |

FIRST STOP |

RISK IF ABSENT |

|---|---|---|

|

Who are you? |

Homepage, About |

Unclear mandate or focus |

|

What do you invest in? |

Strategy/Fund Overview |

Perceived complexity, low fit |

|

Why does it work? |

Process & rationale |

Doubts about repeatability |

|

How consistent is it? |

Data summaries, disclosures |

Assumptions of weak reporting rigor |

Cost–Benefit for Investment Firms

Firms with strong Digital Architectures build trust faster and reduce back-and-forth clarification. Weak foundations carry measurable costs: investor drop-off, misunderstandings about strategy, and slower movement into meaningful diligence.

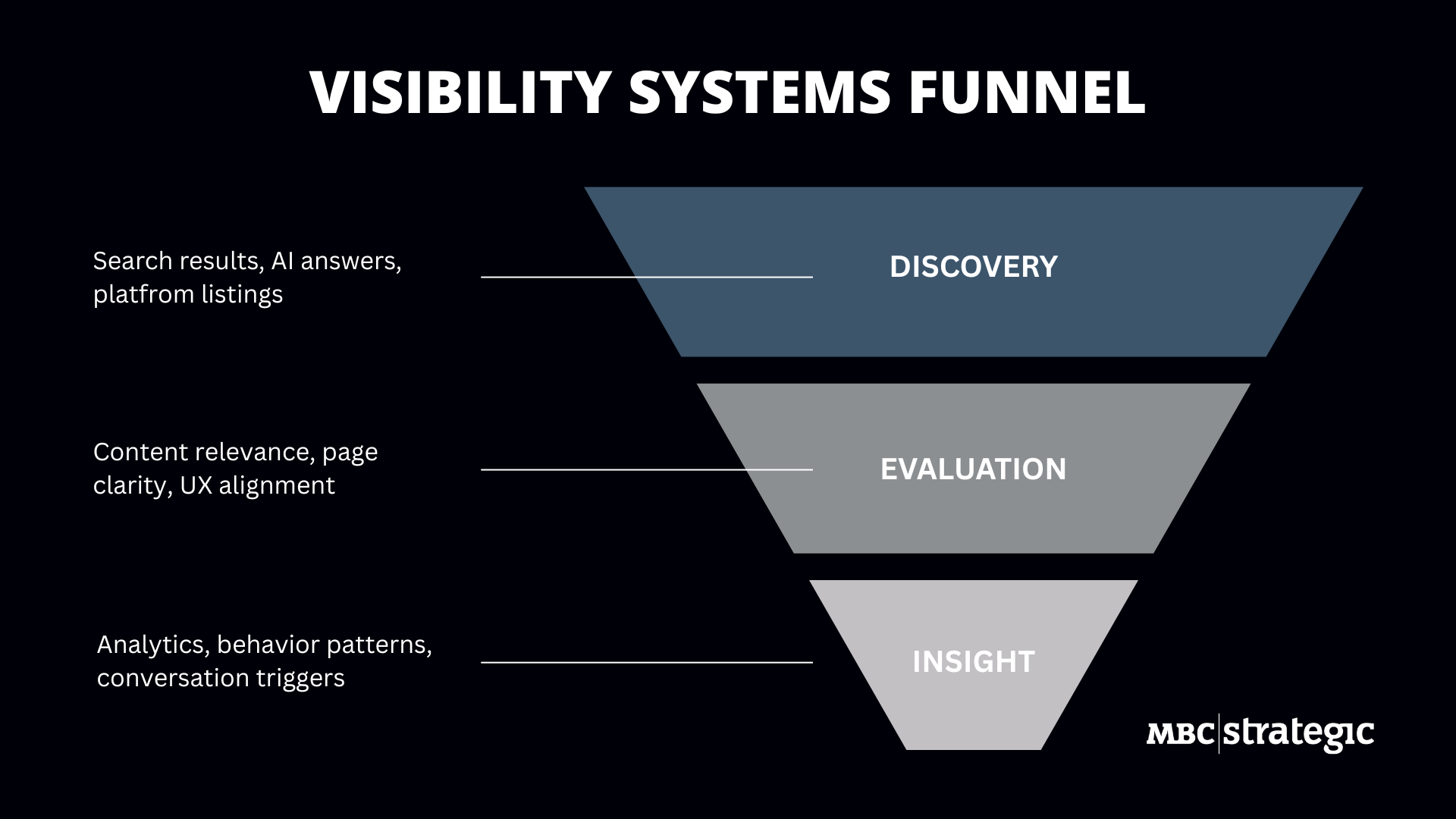

2. Visibility Systems

The systems that improve discovery and illuminate investor behavior

Even the strongest website will underperform if investors can’t discover it. The second component—Visibility Systems—include the search, structural, and analytical systems that improve your presence across:

- Search readiness across category-defining terms

- AI-friendly and AEO optimized structure & content clarity

- Signals that improve discovery across advisor platforms and research tools

- Behavioral analytics that reveal engagement patterns

- Data-driven campaign iteration and reporting

This also includes user analytics, such as heat maps, click-paths, drop-off points, that reveal where investors hesitate or accelerate. Targeted SEO, structured data, AI-ready content formats, and clean technical performance all contribute to this layer.

Cost–Benefit for Investment Firms

High visibility through SEO & digital optimization increases early exposure to LPs, advisors, and consultants searching within your asset class. A strong intelligence infrastructure shows how investors engage with your story and site, which enables continuous focused refinement. When this layer is weak, firms lose positioning, misread investor interest, and operate with limited insight.

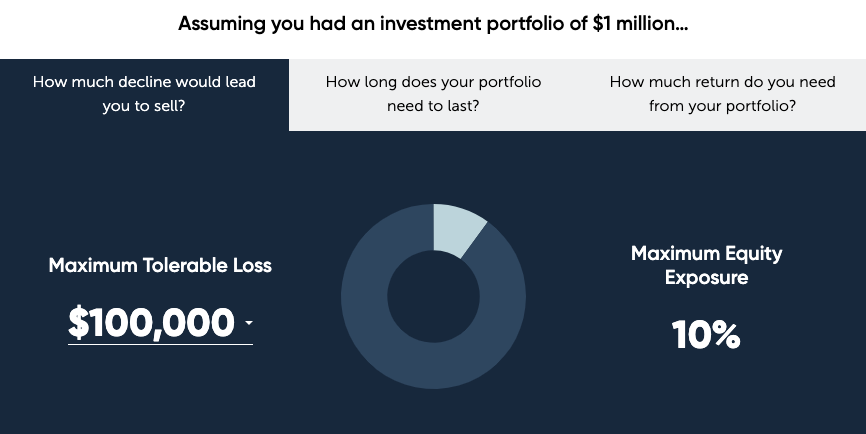

3. Engagement Engines

The experiences that move investors from understanding to evaluation

Once an allocator has oriented themselves, the next question becomes: How easily can I evaluate this manager further?

This is where the third component, Engagement Engines, prove immense value. These components extend attention, clarify complex data, and provide deeper visibility into investment philosophy, product set, portfolio construction, and long-term performance.

Examples of engagement engine elements include:

- Interactive data presentations and frameworks

- Dynamic modules that clarify exposures, risk or themes

- Focused landing page & microsites (campaign environments, thematic narratives)

- Scenario or allocation visuals that give investors agency

- Multi-path investment website audience segmentation

These elements create structured environments for investors to explore strategy mechanics and test their assumptions—all without needing a call or deep-dive deck.

“Pages with interactive, structured exploration capture 2X more engagement than passive content”

Cost–Benefit for Investment Firms

Firms that provide interactive and focused digital pathways see longer time-on-page, stronger comprehension, and smoother transitions to actual conversations. The cost of omitting this layer is higher dependency on PDFs and missed opportunities to shape how prospects interpret your edge.

The Importance of the Three-Component Digital Model

Collectively, these systems determine:

-

- How investors perceive your discipline and readiness

- Whether you appear in key search and AI-driven discovery moments

- How effectively investors understand your strategy and differentiation

- Where digital presence accelerates—or impedes—the path to actual diligence

The model isn’t focused on simply adding more technology, but rather on aligning digital systems and financial services UX with how today’s investment buyers evaluate managers.

Firms doing this well see stronger inbound quality, fewer early-stage misalignments, and faster movement from general curiosity to raising capital.

How MBC Can Help

For firms looking to improve clarity, engagement, or visibility, the MBC Strategic Digital Foundation Model highlights where small adjustments can create meaningful gains in how investors understand and evaluate a strategy.

With 25+ years focused exclusively on financial and investment brands, MBC Strategic brings sector fluency and design discipline together to help managers present their website design & digital presence with greater precision and impact.

If you want a clearer view of where your digital presence can improve, you can request a proposal or schedule a digital-presence review to identify high-value opportunities.

Frequently Asked Questions

Q. Why is website design & digital presence so critical for investment firms?

Investor attention spans are short—less than 15 seconds per page view on average. UX clarity ensures key information (team, strategy, results) is surfaced instantly.

Q. How does SEO help with allocator visibility?

Optimized sites appear in more relevant searches (fund type, sector focus, ESG). It’s one of the most cost-effective ways to improve awareness and inbound lead quality.

Q. What’s the ideal website update cycle for investment managers?

A design refresh every 3–4 years, with quarterly content and compliance reviews. Analytics data should guide ongoing updates to align with engagement patterns.

Q. How do investment fund and strategy pages influence due-diligence outcomes?

Clear, up-to-date strategy pages help allocators evaluate process, risk, performance consistency, and operational maturity. Well-structured data reduces friction and keeps firms in the diligence funnel longer.

Q. What investment digital presence signals matter most to institutional allocators?

Consistency of data, clarity of narrative, speed, mobile responsiveness, and transparent disclosures. These signals help allocators quickly assess whether a manager is organized, credible, and ready for institutional review.

Q. What makes hedge fund website design and UX for financial services unique?

They must balance discretion with clarity. Strong hedge fund website design and UX for financial services surface strategy, risk, and performance quickly, giving allocators fast comprehension with minimal friction.