The Investment Branding Premium

How Brand Credibility Wins Capital

As allocators and consultants weigh transparency and discipline alongside performance, credible financial and investment branding has become one of the clearest indicators of operational quality — and a decisive factor in capital allocation.

At a Glance

-

Branding precision can signal operational rigor, an indirect cue investors often view as a proxy for performance discipline.

-

Firms with well-defined, consistent brands move faster through due diligence and raise capital more efficiently.

-

The investment branding premium is a market reward for managers who communicate with focus and integrity across every touchpoint.

The Rise of the Investment Branding Premium

Markets move fast, information moves faster, and investor expectations are always evolving. Performance still drives selection, but perception increasingly drives opportunity.

Allocators and consultants are flooded with manager materials that blur together. The investment firms that stand out and win capital are the ones who communicate their philosophy, process, structure, and story with high precision and professionalism.

Why? That precision and professionalism signals control.

Why Investment Brand Credibility Now Shapes Capital Decisions

Institutional allocators have little patience for marketing spin. They evaluate the underlying substance, and they look for evidence of alignment, governance, and process discipline. The problem is that those qualities are hard to observe directly.

Instead, investors infer them from what they can see: how a firm defines itself, how consistent its materials are, and how confidently it communicates.

A credible brand demonstrates:

Operational Alignment – coherence across teams and products

Process Visibility – willingness to communicate approach clearly

Executional Rigor – consistency in presentation, design, and tone

Each of these traits functions as a non-financial signal of performance. The clearer and more credible the investment branding strategy, the stronger the investor’s perception of reliability.

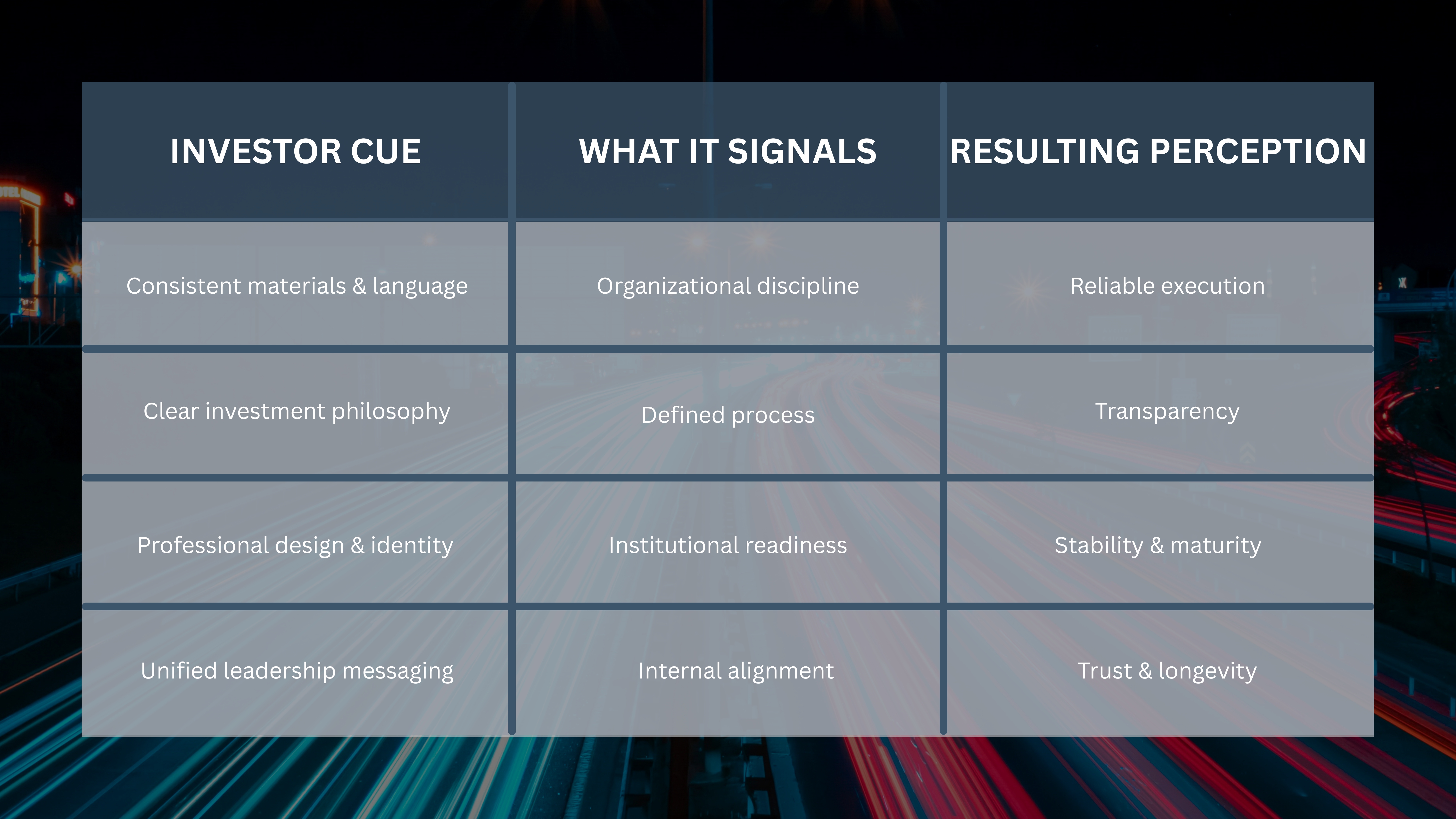

How the Investment Branding Premium Works

The branding premium is the practical way allocators interpret communication quality as evidence of organizational discipline. It operates through three simple dynamics that shape how investors evaluate managers long before performance enters the conversation.

-

Investors judge what they can see.

Clarity of message, consistency across materials, and maturity of design become the visible cues allocators use to understand a firm’s structure, philosophy, and process. When these elements are crisp and well-aligned, investors can quickly grasp what makes the manager distinct.

-

Those cues signal underlying discipline.

When communication is coordinated and coherent, it implies governance, process rigor, and internal alignment. Inconsistency has the opposite effect; it raises questions about oversight, coordination, and operational control.

-

Those signals influence capital flow.

Credible communication reduces friction in due diligence, accelerates understanding, and strengthens trust during periods of performance variability. The result is faster fundraising, higher consultant confidence, and more resilient client retention.

Investment branding as a performance indicator

When financial branding is scattered or inconsistent, investors naturally question what else inside the organization may lack coordination or discipline. When communication is clear and consistent, investors naturally read that as evidence of discipline inside the organization.

Brand credibility becomes a performance signal because it reflects the structure that produces results. Clarity, consistency, and definition aren’t cosmetic; they symbolize institutional discipline. Branding isn’t a veneer over results; it’s evidence of the rigor that produces them.

The Credibility Equation

This is how credibility compounds: every detail communicates process strength.

The Impact on Investment Fundraising and Client Retention

In a market where allocators must rapidly evaluate dozens of managers, credibility becomes an efficiency filter. A well-defined brand reduces friction in due diligence, accelerates understanding, and reinforces trust over the full client lifecycle. The result is often stronger fundraising momentum and greater retention resilience.

Firms that invest in financial branding services consistently report:

-

Faster RFP turnaround and smoother consultant approval

-

Fewer clarification requests during due diligence

-

Increased investor confidence during underperformance

-

Higher client retention through market volatility

How to Build Investment Brand Credibility That Lasts

A credible investment brand isn’t built on aesthetics alone. It emerges from alignment, definition, and discipline across every layer of communication.

- Define your narrative through research.

Use financial brand research to understand how investors perceive your firm today and where credibility gaps exist. -

Establish positioning with precision.

Develop an investment firm branding strategy that articulates your philosophy, differentiators, and voice with consistency across all materials. -

Design for credibility, not decoration.

Create a cohesive investment firm identity design — typography, color, data visuals — that reinforces maturity and control. -

Message with discipline.

Ensure that all teams—from investment to client service—speak with messaging & voice that projects a unified purpose. Consistency is what transforms information into trust. -

Audit and evolve.

Just as you review portfolios, regularly assess how your brand performs under scrutiny through marketing analytics. Perception, like performance, must be managed over time.

Earning the Branding Premium

A strong investment brand is now operational proof point. Brand credibility is capital credibility, and the firms who articulate their value in a focused manner are easier to understand, and easier to trust. And in a marketplace defined by a mix of due diligence and perception, trust is a prime driver of capital flows.

How can MBC Strategic Help?

For over two decades, MBC Strategic has guided investment and financial firms in aligning brand definition with investor expectations. For branding projects completed since 2019, clients have seen an average 144% growth in assets under management after their rebrand and repositioning efforts.

Ready to strengthen how your firm communicates its value?

Request a proposal or explore how our financial branding services can help align your brand, messaging, and investor confidence.

Frequently Asked Questions

1. How does financial branding influence capital raising for investment firms?

Strong financial branding helps investors quickly grasp a firm’s focus and discipline. When messaging and materials are consistent, investors read that as operational control—a signal that builds trust and accelerates capital commitments.

2. What’s the difference between brand awareness and brand credibility in investment marketing?

Awareness gets your firm noticed; credibility gets it chosen. Brand credibility reflects clarity, consistency, and transparency. These are traits that investors associate with professionalism and reliability.

3. How can investment firms measure the success of their branding efforts?

Look for tangible outcomes: faster RFP cycles, better consultant engagement, higher retention, and stronger confidence during downturns. Those are signs your brand is earning investor trust.

4. When is the right time for an investment firm to rebrand?

Key moments for financial branding services include firm growth, product expansion, or inconsistent messaging. If investors seem unclear about your story or differentiators, it’s time to revisit your investment firm branding strategy.

5. Why use a specialized financial branding agency instead of a generalist firm?

Specialized agencies understand investor behavior, compliance nuance, and institutional communication. They translate complex strategies into confident narratives that build trust, not just visibility.