Basis Points /

Data-driven insights for investment professionals on the trends reshaping our industry

January 29th, 2026

WHAT TOP INVESTMENT FIRMS DO BETTER IN MARKETING TO WIN AND KEEP CAPITAL

- DEFINE CLEAR INVESTOR PERSONAS & VALUE PROP: Firms with a strategic marketing plan, ideal client persona, and distinctive value proposition can capture ~67% more new clients and ~68% more new assets.

- RUN INTEGRATED INVESTMENT MARKETING AND REFERRAL SYSTEMS: Firms with integrated marketing plans and documented referral strategies align content, outreach, and advisor activity, driving 85% more new clients and 2× median revenue growth.

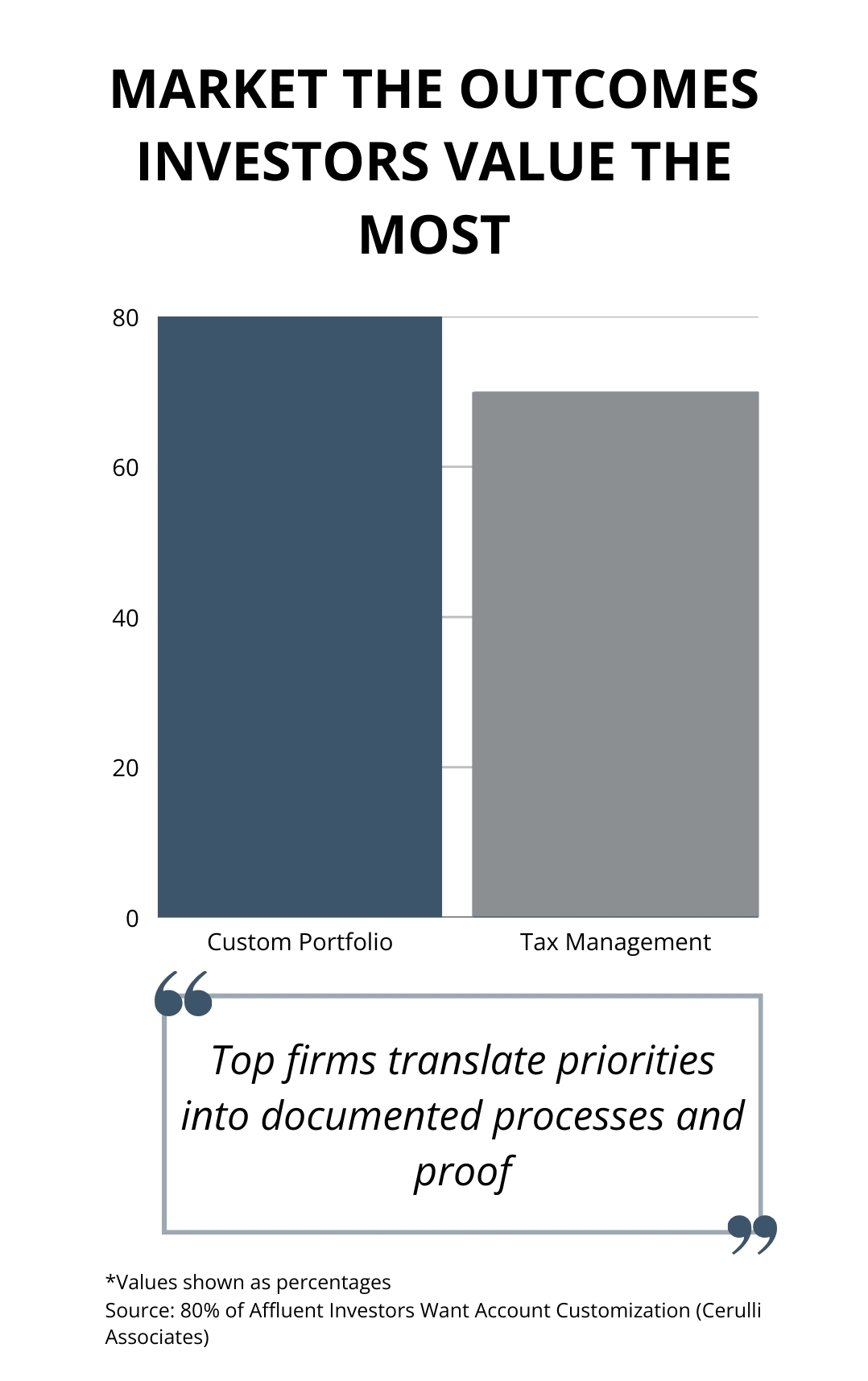

- MARKET THE OUTCOMES INVESTORS VALUE MOST: ~80% of affluent investors value custom portfolios and ~70% value tax management. Leaders translate these priorities into explicit processes, proof points, and examples.

- ENGINEER INSTITUTIONAL TRUST AND CREDIBILITY: 45% of $5M+ investors prefer established brands. High-performing independents build trust through consistent visibility, third-party validation, and controlled narrative.

- ACQUIRE NEXT-GEN RELATIONSHIPS BEFORE TRANSFERS OCCUR: 81% of inheritors plan to switch firms within 1–2 years. Leading firms build direct relationships with heirs through education, targeted content, and early inclusion in planning.

- MAKE THE CLIENT EXPERIENCE A RISK-REDUCTION SIGNAL: As retirement approaches, advisor reliance rises (~46%) and 45% prefer national affiliation. Leading firms clearly market their service model, team continuity, and support infrastructure.

December 30th, 2025

THE PROOF ERA: INVESTMENT MARKETING IS NOW AN EXERCISE IN EVIDENCE

- COMPLIANCE ENFORCEMENT IS ACTIVE: The SEC recently charged nine RIAs in a coordinated Marketing Rule sweep, issuing $1.24M in penalties tied primarily to unsubstantiated marketing claims and disclosure failures.

- WEBSITES ARE A PRIMARY RISK VECTOR: Recent SEC actions cite ordinary website language—capabilities, conflicts, experience—as advertising subject to substantiation and books-and-records requirements.

- TESTIMONIALS AND RATINGS ARE MISUSED: SEC exam priorities explicitly flag testimonials, endorsements, and third-party ratings as recurring areas of deficiency under the Marketing Rule.

- MARKETING AND FORM ADV MISALIGNMENT IS COMMON: Regulators have cited firms where marketing claims evolved faster than disclosures, creating compliance issues even when statements were directionally accurate.

- AI IS AMPLIFYING MARKETING RISK: 38% of advisory firms report using AI to generate marketing content, increasing exposure to unsupported, inconsistent, or non-archived claims.

- ALLOCATORS INCREASE PRE-MEETING DILIGENCE: Institutional allocators report heavier reliance on digital materials and online presence before engaging managers—raising the stakes for compliant, well-substantiated positioning.

- PROACTIVE FIRMS STANDARDIZE “MARKETING EVIDENCE”: Allocators expect consistent, repeatable data rooms and standardized marketing materials (DDQs, case studies), with managers citing faster closes with audit-ready materials.

- MARKETING CLAIMS MUST BE SUPPORTED ACROSS CHANNELS: 60%+ of institutional investors expect full consistency between marketing materials and DDQs—and flag inconsistencies as a negative diligence signal, even when performance is unchanged

Sources:

SEC.gov 1, 2, 3,

Charles Schwab

Fincity EM

AIMA

November 30th, 2025

HEDGE FUND MARKETING WILL MATTER MORE IN 2026

ALLOCATION BEHAVIOR IS SHIFTING, RAISING THE BAR FOR MANAGERS

Institutional allocators—pensions, endowments, family offices, and CIOs—are increasing exposure to hedge funds while tightening standards for manager selection.

- Allocator momentum is increasing: 46% of institutional allocators plan to increase hedge fund allocations over the next 12 months.

- Demand for new managers is expanding: 40% are seeking new hedge fund relationships rather than reinvesting solely with incumbents, increasing the importance of digital visibility during allocator-led discovery.

- Emerging managers face higher scrutiny: Only 46% of allocators are open to emerging managers, unless their positioning is sharp, aligned & communicative of a clear niche.

- Growth vision is now required: 63% require a credible scaling roadmap when assessing new managers, making strategic communication part of diligence.

- Operational credibility is decisive: Over 70% flag lack of independent administration as a red flag, and nearly 80% report higher ODD requirements—placing transparency at the center of manager evaluation.

WHAT ALLOCATORS NOW EXPECT FROM ALTERNATIVE MANAGERS

- Capital sources are broadening: ~75% anticipate flows from retail via semi-liquid vehicles, ~70% from family offices, and ~69% from private banks.

- Allocation decisions follow three drivers: outperformance potential (33%), access to niche strategies (33%), and favorable terms (22%).

- Governance failures are disqualifying: 87% of institutional allocators have rejected a manager due to governance concerns.

- Customization is becoming standard: 42% now routinely expect SMAs or tailored mandates to control exposure, risk, and reporting.

- Adaptability influences selection: Allocators favor managers demonstrating resilience and flexibility across market environments.

Sources:

AIMA

Hedgeweek

Marex

Carne

Pelaw Report

October 30th, 2025

INVESTING IN MARKETING STRATEGY DRIVES GROWTH

DEFINED PLANS CREATE RESULTS

- Strategic planning multiplies lead impact: Advisors with a defined marketing plan generate 168% more leads per month than those without one.

- Social media conversion improves with strategy: Advisors are 42% more likely to convert a social lead into a client when they follow a documented marketing plan.

- Client acquisition accelerates with a clear roadmap: Firms with defined strategies onboard 50% more clients per year compared to those operating reactively.

- End-to-end plans fuel confident growth: Advisors report being 34% more confident in their firm’s growth trajectory when guided by a clear plan.

BUILDING PLANS IS NOT EASY, BUT NECESSARY

- Marketing strategy remains underdeveloped across the industry: Fewer than 30% of advisors have a clear, documented marketing plan, even though it directly impacts growth.

- Time constraints limit progress: 85% of advisors cite lack of time as their biggest marketing challenge, spending just two hours per week on average.

- Solo advisors often go it alone: Over 60% of independent advisors handle marketing without external or outsourced support.

- Content personalization is a missed opportunity: Only 44% of advisors share tailored content with clients and prospects, while 53% of investors say they want more educational materials.

Source:

Broadridge – Financial Advisor Marketing Trends Report

September 30th, 2025

Thought Leadership Helps Raise Capital

Insightful Takes Win Mandates

- The C-Suite uses thought leadership for discovery: 75% of decision-makers saying strong insight prompted them to research products they hadn’t previously considered.

- Thought leadership is critical to growth with 91% of execs believing thought leadership that ‘connects’ can lead to improved client relationships and a potential 14x ROI.

- Global investors believe insights have impact with 66% reporting that thought leadership was influential on winning new mandates.

- Standing out & staying relevant is essential: 70% of executives saying much thought leadership ‘looks the same’ while citing credibility and relevance as key obstacles.

The Finfluencer Era is Here

- Young investors are turning to financial influencers on social media with 40% of Gen Z and 35% of Millennials getting investment information & advice there.

- Individuals over institutions: 52% of Millennials follow athletes over teams (vs 24% of Boomers), and fewer are seeking financial education directly from institutions.

- Perceived expertise has a measurable impact: A one-standard-deviation rise in perceived expertise translates to an ~18% lift in investor intention to act.

- Strategic Takeaway: Identify in-house individuals who are camera ready & confident and/or vet finfluencers who meet your standards while being aware of regulatory scrutiny.

Sources:

PR Daily

Harris Poll

Greenwich

Kantar

FIS

Academy of Marketing Studies

August 29th, 2025

Personalization and the Investment Client Experience

Closing The Personalization Gap

- Personalizing content is the biggest CX hurdle. 52% of firms say their top challenge is tailoring communications and experiences to individual clients.

- Consistency across channels is lacking. 35% of firms admit they cannot yet deliver seamless communications across email, digital, and print.

- Disconnected systems block progress. 59% report that siloed departments, data, and tech undermine marketing efforts and limit personalized engagement.

- Clients notice mismatched channels. 57% of firms still send print communications to clients who opted for digital, exposing gaps in integration

- Understanding client behavior remains difficult. 44% struggle to translate behavioral data into actionable insights for personalization.

Why Personalization in Investing Matters

- Revenue lift: Personalization can increase revenues by 10–15%, with firm-specific gains ranging from 5–25%.

- Cost savings: Tailored campaigns can cut customer acquisition costs by up to 50% and increase marketing ROI by 30%.

- Trust driver: 80% of investors say tailored guidance is a top factor in building trust with an advisor.

Sources:

Broadridge – Digital Transformation Study

McKinsey & Co – The Value of Getting Personalization Right

Mitel – The Power of Personalization

July 31st, 2025

The New Growth Formula for Advisors

LEAD GENERATION EVOLUTION

- Organic marketing overtakes referrals for the first time, with 28% of advisors now citing content and SEO as their primary lead source versus 24.5% for referrals.

- Content marketing delivers 2x the conversion effectiveness of paid social media and significantly outperforms all traditional marketing channels

CLIENT SERVICE CROSSROADS

- In a clear disconnect, 95% of advisors regard cross-selling specialized services as key to revenue growth, while the majority of actual clients are instead seeking “trust and excellence in core investment management.”

- Almost 90% of investors would be more likely to trust advisor recommendations if they shared advanced analytics to back up their guidance.

- Technology adoption creates a revenue opportunity, with 74% of investors willing to pay higher fees for advanced technology tools—yet most advisors report only “moderate” tech usage.

Source:

2025 Nitrogen Firm Growth Report

Published:

Tags: invetment management growth marketing, client marketing for investment firms, investment client marketing, Financial Advisor marketing, investment lead generation, lead generation marketing, advisory firm marketing, investment growth marketing, digital growth marketing, advisor growth marketing, investment advisor marketing, growth marketing, investment advisor growth marketing