The Power of Branding and Investment Industry Storytelling

Think of any brand in world of finance and investments and chances are there is a good story behind it.

Humans are social creatures and a critical reason for our success as a species lies within our language, and our ability to transmit information and emotions to one another. We are hard-wired for storytelling. Ever since we were huddled around a fire thousands of years ago, stories were the medium for communicating everything from moral values to historic events.

From a scientific level, what we as humans are trying to do with storytelling is to create a neurochemical hormonal signal in the brain.1 That neurochemical is called oxytocin and is key in the “it’s safe to approach others” signal in our brains and is crucial in our ability to form relationships outside our immediate family.2

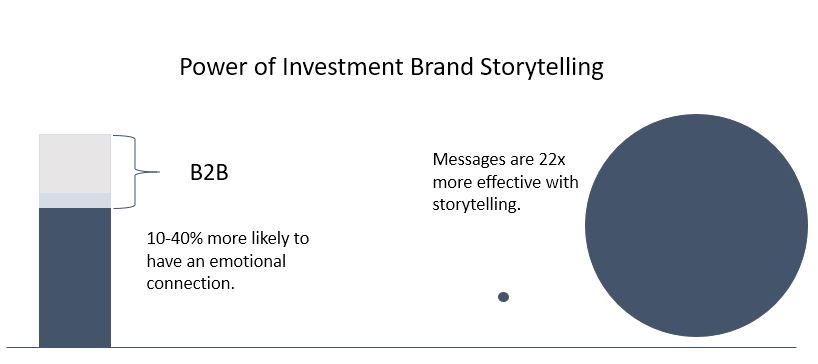

When we look across industries and brands, storytelling is everywhere. It’s why you cry during the Super Bowl commercial with the dog following the Clydesdale horses, or why you might place implicit trust in what Warren Buffet thinks about financial markets. It is about creating that emotional connection with your audience—being authentic, honest, and telling a differentiating story. This is a marketing tenet that goes across industries. Some might say that the finance and investment industry is all about numbers—that it is the industry that lacks emotion. Yet, we firmly disagree. Think of the emotion involved with managing the livelihoods of thousands of employees of a pension or 401k. What could be more emotional than that? A study by Google and CEB found that compared to B2C brand, B2B brands were 10-40% more likely to have emotional connections.3 As evidenced by the equity markets on a daily basis, investors do not always act rationally—both individuals and institutions. The industry stories come through the news, influencers, investor reports and other channels, and each resonates with different audiences. This is just one reason that there always seems to be diverging opinions of the state of the market—doom and gloom of the bear looming around the corner or the roaring bull to continue.

Jermone Bruner, a pioneer in the field of cognitive psychology, found that messages delivered as stories can be up to 22x more effective at being memorable than those delivered just as facts. And this makes sense, think of all the information that you see on any given day, Americans consume on average 100,000 digital words per day4, and how much of that sticks with you. As McKinsey states, “Storytelling has always been important in business, of course, but in today’s environment, with executive and investor attention stretched thin by information overload, the softer stuff is ever more important for getting ideas noticed.”5 So if you want to grab someone’s attention and be memorable, telling a story is a much more effective way to do so.

We believe there is a powerful opportunity within the investment industry for better brand storytelling. Most investment marketing materials and pitches are just a pile of data and charts thrown together, often lacking that critical element that we subconsciously crave. Yes, it might be important that your Sharpe ratio is over 3.0 or that you have five PhDs on staff, but you also need to think of how that comes together into a bigger picture. Not every company has a Warren Buffet or Larry Fink behind them, but every investment firm was launched for a reason. There is a greater reason, passion and purpose to continue doing what we do every day, and it is important to weave that part of the story and purpose into your investment marketing.

And this is already a concern that the industry should be aware of. CFA Institute recently performed a robust survey across investors and found that since 2016, the importance of a brand has increased from 33% to 46% in 2018.6 According to their survey, branding is becoming an important factor that investors are using to establish trust with managers and it is increasingly becoming a proxy for trust itself.

When investors are interested, they will dive into your numbers in their due diligence process, but you need to get them interested enough to be willing to take that next step. So, before you flood a potential investor with 10 slides of past performance and stock selection process, give them a story to latch on to and connect with.

Creating a story isn’t as easy as it sounds, but a few key take-aways can help the process:

1. Consider your prospect’s perspective – It’s important to factor their needs into your story. Put yourself in their shoes or think about current investors and what they say they want or need. These are humans, with human needs and emotions.

2. Stay true to yourself – While it’s unlikely they will audit your story piece by piece, it’s important to be genuine. This will become part of your brand, something that you will have to interact with every day, so it must be a story that you actually believe.

3. Don’t follow the crowd – Look at your competitors and how they tell their stories. Often, they don’t have a cohesive brand story. Financial services marketing and branding really lags in this part of the innovation curve, but you don’t want to be saying the same thing as the other firms you are up against.

One interesting investment branding and storytelling examples was for a long-term client, Angel Oak Capital. They had CMBS/RMBS backgrounds and came out of the 2008 mortgage crisis knowing that they could do it better than how it had been done before the crisis. They were leading the way into a better model for mortgage origination, securitization and the management of structured credit assets, and that unique specialization and coordination across the brand architecture needed to reverberate throughout their messaging and marketing. Whether it be through their sales teams across both private funds and mutual funds sold through wirehouses, their websites or their materials, it needed to be clear as to why they were providing their services and products, and why it would be better for their broad range of clients. With a cohesive story and a whole suite of rebranded marketing elements, they have more than quadrupled their AUM from five years ago—now approaching the $10 billion mark.

Another example of investment storytelling that has been coming up quite a bit is around how to communicate, market, or even brand an investment firm’s focus on ESG and impact investing. Is your firm’s DNA centered on doing good so that its impact is first in the brand messaging hierarchy or is it a supportive part of the story that is a key point into what makes you unique? We recently worked with both types of investment firms and help them create their brand stories to genuinely and authentically reflect the importance of impact and socially responsible investing in their overall brand stories. TriLinc Global is private debt, trade finance firm with impact investing woven into every chapter of their story and at the top of their brand’s message.

If you want help better understanding how to articulate your own unique story and better navigate the shifting demands of investor audiences, our investment branding team has been helping investment managers do just that for the past 20 years. Check out some of our other work and reach out to us if you’d like to learn more about how we can help you craft a story that will grab your investors’ attention here.

- https://greatergood.berkeley.edu/article/item/how_stories_change_brain

- https://hbr.org/2014/10/why-your-brain-loves-good-storytelling

- https://www.thinkwithgoogle.com/marketing-resources/promotion-emotion-b2b/

- https://www.adweek.com/digital/the-future-of-brand-storytelling-and-the-role-that-data-plays/

- https://www.mckinsey.com/featured-insights/innovation-and-growth/telling-a-good-innovation-story

- https://nextgentrust.cfainstitute.org/infographic/