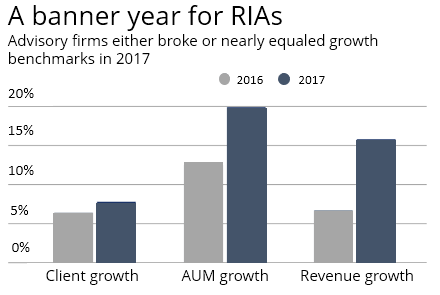

Rapid Growth in the Number of RIAs Means these Financial Advisory Firms Should Focus More on Branding and Marketing

The growth in Registered Investment Advisors (RIAs) in recent years has been nothing short of stunning, as more investors, and the advisors that server them, move out of commission-based firms to those that charge a flat fee based on assets. What that means is that financial advisory firms – both fee-based and commission-based – will need to focus more time and efforts on improving their brand and increasing their marketing efforts to differentiate their services to attract and retain clients.

Source: TD Ameritrade 2018 FA Insight Study of Advisory Firms

The question for most firms is how do you differentiate your firm in a highly competitive RIA and financial advisory marketplace? “It doesn’t happen overnight,” says Matt Brunini, Founder of MBC Strategic, a financial and investment marketing and branding agency in Santa Monica. “It means taking the time to create your own unique brand and your own unique, well-developed story through consistent messaging and well-crafted design and materials. It also requires a clearly defined marketing budget and setting aside time and resources to get it done. Strategic marketing is an investment in the future of your firm and can have a measurable return on investment.”

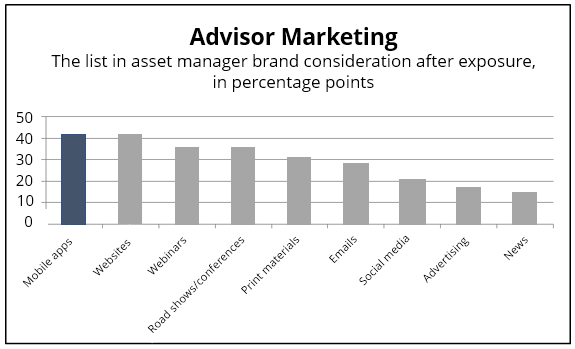

More than half of financial advisors who have revenue of more than $1 million in annual sales spend at least 4% of their revenue on marketing, according to The Oechsli Institute.1 For younger financial advisory firms who are just starting out or those who are making a name for themselves and growing their firm more aggressively will want to spend relatively more, as much as 10% of annual revenue, says Brunini.

Source: Market Strategies International, Cogent Reports Advisor Touchpoints, Q1 2015

Strategic Marketing Plans for Financial Advisory Firms

Creating a marketing plan is multi-step process and should involve the relevant visionaries and stakeholders of your firm. It involves answering these key questions:

1. Assess your firm’s current marketing efforts. How much time and resources do you spend on marketing and branding initiatives, both internally and externally. What is working and what isn’t and why? Can some of your internal resources be better spent on hiring specialized financial and investment marketing agencies?

2. Define your target markets. What are your niche markets and practice specialties? What is your ideal client and why? Where do your assets come from? Where does your new business come from? What percentage comes from existing clients?

3. Create a marketing strategy. Define what your objective is. Is your objective specialized (focused on more high-touch activities) or systematic (creating broad exposure, credibility and recognition)? Should creating a brand come first? Or can other marketing efforts take place simultaneously?

4. Decide what your marketing tactics should be. Should your marketing efforts be all about building a website or creating effective content? Or would an email campaign be sufficient and more effective? This is an important tactical step in RIA marketing plan generation.

5. Implement your strategy and tactics and measure them. Make sure all of the strategies and tactics are assigned to the right people or agency. Also, be sure to regularly review your marketing plan and make any necessary adjustments. Follow up by measuring all your marketing efforts. Some of these can be automatized with online tools and metrics, but some of them may require your firm to figure a way to measure growth in AUM or sales lead generation.

Common marketing mistakes for RIAs

From our perspective, the most common marketing mistakes can be put into three buckets: the firms who don’t have time for marketing, the firms who take on too much in terms of marketing, and those who try to portray themselves as being all things to all people—not focusing on the right branding message.

The firms who believe they don’t have time for marketing are just making it harder on themselves by not being able to rely on that carefully created messaging and branding that sets them apart from the pack. In essence, these RIA firms are cannibalizing their own future by not spending time and resources on marketing.

Financial advisory firms are just that: financial advisors. They should not be spending their time on marketing when hiring someone else to create and build their marketing and branding would be more efficient and effective. A true marketer takes what the financial advisory firm has already done and builds a brand and story around it, creating the messaging and design to go with it.

Finally, too many firms try to be all things to all people. From our experience, the best firms are those that cater to specific strategies, target markets, and have practices that emphasize what they do best. Figuring out what those niches and practices are can be the start of a marketing and branding plan.

Your RIA branding efforts are, in many ways, how your target audience perceives you. Therefore, your brand must attract new clients through clear and differentiated messaging and secure a positive perception to the masses by building and maintaining trust. And that can be tailored that to the culture of your firm.

Likewise, a well-crafted RIA branding message should communicate what sets your firm apart. Successful financial advisory branding requires understanding the emotional and rational drivers of your audience and then connecting that to your differentiated advice and investment offerings.

Learn how MBC Strategic’s award-winning expertise can enhance your RIA branding and financial advisory marketing efforts. View our award-winning investment marketing projects here.

1. The Oechsli Institute, “Elite Advisory Fiirms,” 2017.

Published:

Tags: marketing for financial firm, Financial Advisory firm marketing, Financial Advisor marketing, RIA Marketing, financial marketing millennial, investment brand marketing, insurance marketing, award winning investment marketing agency, award winning investment marketing and branding, financial services branding, investment branding and marketing strategies, investment web design, investment website design, MBC Strategic