Branding the Value of Impact Investing

Rebranding an Institutional Impact Investment Firm

Challenge

TriLinc Global is an impact investing manager that creates positive social impacts and market-rate returns through private debt investments in emerging markets. The firm’s founder and CEO left a major Wall Street firm to create an investment company with an impact-minded purpose. TriLinc serves advisors and institutional clients, many of whom which care more about funding liabilities rather than creating positive impacts and they sought the help of MBC Strategic to help create a brand and message that stayed true to the firm’s core beliefs but also addressed the unique needs of the institutional investor audiences.

Strategy

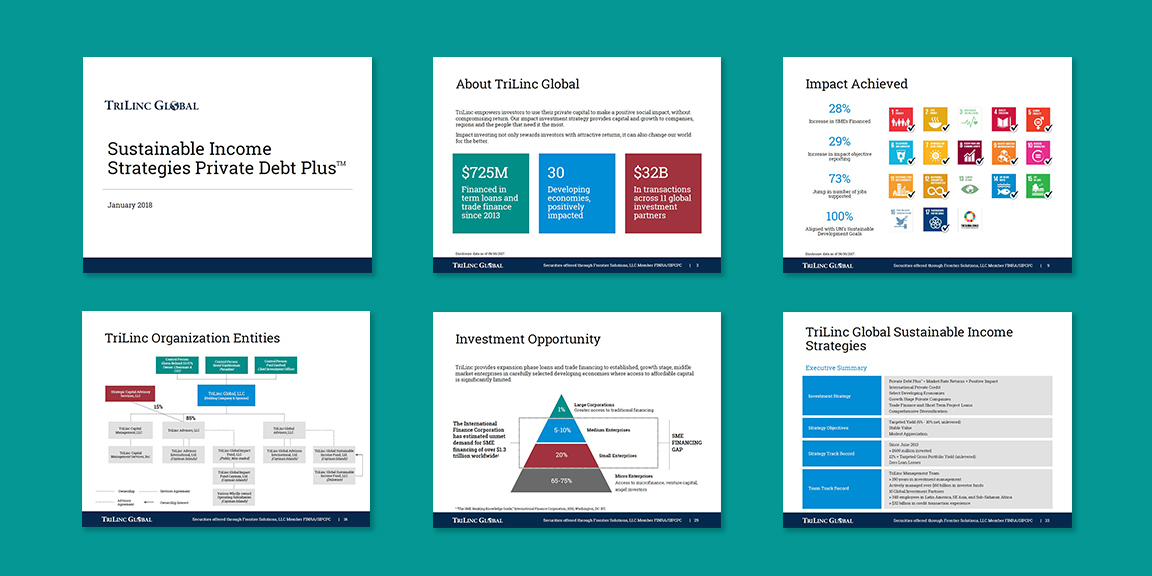

After an extensive stakeholder interviews, competitive research and brand analysis exercise, we took a very deep dive into the rational and emotional needs of the various institutional audiences and where impact investing might tie in. We came to recommend a platform that directly addresses the industry-wide misconception that impact investing means concessionary returns. Their belief in creating powerful impact and meaningful returns was able to get to the heart of what their investors wanted to hear but also provided a differentiating element through their unique, impact investing strategy. This new messaging and brand positioning was then brought across their digital and printed materials, followed by a newly developed website that reflected their professional and institutional brand.

Results

With a powerful and concise message to go out to the institutional market with, TriLinc has been able to both raise its brand awareness in this competitive investor segment and also become a recognized thought leader in the impact investing space. Their new website and materials have become an important resource in terms of reinforcing brand reputation and producing useful and actionable content. With this new brand and digital platform, they have been able to continue their mission of creating real impact in developing economies, contributing to the Sustainable Development Goals (SDGs) and growing their assets—with AUM growth of 245% in less than two years.