ESG and Socially Responsible Investment Marketing Trends for High-Net-Worth and Millennial Investors

Opportunities for Institutions to Do the Right Thing while Raising Assets

At MBC Strategic, we know that one of the keys to marketing success for asset management firms is to highlight differentiators in a meaningful way. This means finding out what your target investor audience truly cares about and talking directly to those needs in your communications. This needs and wants-based approach can be an effective marketing tactic that enables real connections that will help weather turbulence in the financial markets.

One of today’s powerful opportunities in financial marketing is centered around Environmental, Social and Governance (ESG) and socially responsible investment analysis and subsequent communication strategies. By adding these ESG dimensions of financial analysis to your investment process, asset managers can uncover correlation with other assets and factors and better understand underlying risks. In the past, ESG has been thought of as a ‘good-to-do’ strategy that was more about saving the planet than generating returns, but it is becoming increasingly apparent that better ESG ratings can mean better financial performance. Research like the recent MSCI report, Foundations of ESG Investing, has been able to show positive correlations between ESG characteristics and financial performance.

Aligning Investment Marketing and Communications with HNW Investor Demand

Beyond the outperformance aspect is the fact these types of responsible investment strategies are also in high demand, especially in the high-net-worth (HNW) investor space. US Trust published a recent report which found that across every age group, gender category and wealth level ($3 million minimum), over 70% of investors agree that companies should seek growth through profit, but they must also be responsible for their impact. Furthermore, over 53% of respondents agreed that a company’s track record in ESG is important in their decision to invest. These are powerful numbers that should not be ignored as asset management firms consider ESG investment and marketing strategies and tactics.

Although the demand is already present for these types of investments, the trend will almost certainly increase. Between 2014 and 2016, sustainable, responsible and impact investing grew by 33%, increasing from $6.57 trillion in 2014 to $8.72 trillion in 2016, according to the US SIF Foundation. What is also interesting from an investment marketing perspective, is that relative to any other investor segment, ESG and sustainable investments are most aligned with the values of the millennial generation.

An ESG Investment Marketing Approach Can Also Connect with Millennials

This new generation of investors is expressing their values through investment dollars, and with an expected wealth transfer of $30T dollars to millennials, it is something that must not be overlooked. While ESG investing is well-aligned with this investor demographic, there are some misperceptions about ESG investing with millennial investors. A Wells Fargo study on millennial investing habits found that 70% said they would better cope with market fluctuations if they knew their investments were having a positive impact. The same study also found that 60% of millennials believe that investing in trends like ESG means they are giving up potentially higher returns.

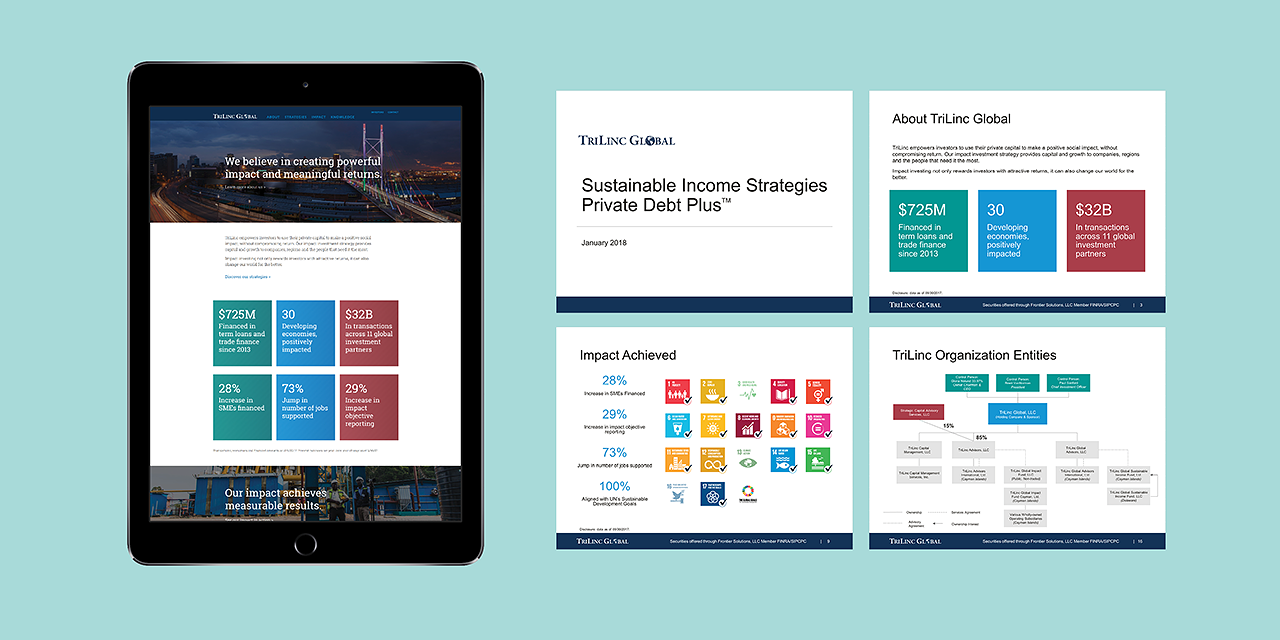

For investment managers, this provides a great marketing opportunity. Not only can asset management firms provide the millennial target audience with the types of investments that want and are more willing to invest in, but impact-related investment industry marketing campaigns and strategies also have the opportunity to be more effective. The right messaging to the right target markets can build long-term trust with investors and can demonstrate greater value than their clients initially perceived.

Regardless of the HNW demographic that investment managers are looking to attract, it is important to build up a clear and differentiated value proposition. That begins with knowing your own strengths, understanding your competitive set and how they are positioning in the market, and most importantly, grasping the wants and needs of your investor audiences. Whether they are seeking ESG strategies for their risk mitigation and out-performance potential, or because they are hoping to make a positive impact through their investments, your investment marketing and communications must address what your investors want, not what you want to sell.

To view the complete page click here

How to Approach Impact, Sustainable and ESG in Your Investment Marketing

Managing a financial marketing strategy for diverse investor audiences can be a tricky task, especially when it can run the gamut between HNW, institutional and intermediary channels. At MBC Strategic, we have fine-tuned investment branding, marketing material and strategy for our clients for more than two decades. Give our team a call if you are interested in learning more about how we can help drive your asset growth and broaden your ESG, sustainable and impact investment marketing strategy. And, if you’d like to learn more about how to build a brand that inspires trust, regardless of investment type or investor audiences, please read our white paper, The Brandability of Trust.

Learn how MBC Strategic’s award-winning expertise can enhance your insurance branding and annuity marketing. View our award-winning investment marketing projects here.

Published:

Tags: esg investment brand marketing, investment brand marketing, insurance marketing, award winning investment marketing agency, award winning investment marketing and branding, ESG investment marketing, financial services branding, investment branding and marketing strategies, investment web design, investment website design, MBC Strategic, socially responsible investment marketing, website design financial services