Annuity Rebranding: Insurance Carriers Big Problem & Big Opportunity

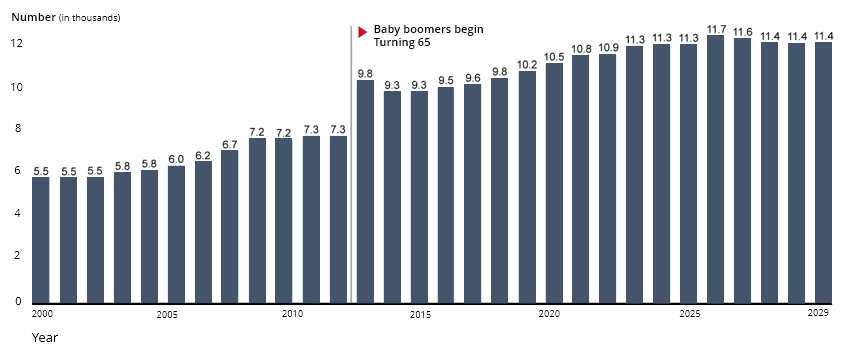

It’s time to start rebuilding the tarnished reputation that annuity brands have faced over the past several years, and to stem the outflow of assets. Complex products and insurance branding gaps are causing some insurance companies to miss a golden marketing opportunity to position and sell annuities to the estimated 10,000 Baby Boomers turning 65 every day. The insurance industry is partially to blame from slowing the sale of variable annuities because of historically low rates, as many have been pivoting to other insurance products, to reduce risk—scared off by the now-defunct fiduciary changes. It’s time for a change. America is in dire need of a new retirement system, and if insurance companies market and package variable annuities properly, they can fill that gap.

1. Source: GAO Analysis of U.S. Census Bureau information. | GAO-17-579T

Marketing the future of America’s investment options for retirement

- Over the next 12 years, roughly 10,000 Baby Boomers will turn 65 each day. That’s roughly 18% of the population hitting 65 by the end of 2029.1

- Social Security and Medicare will be strained by the onslaught of Baby Boomers facing retirement, who are financially unable to care for themselves.

- The current 401(k) system is woefully incapable of funding America’s retirement, in that participants are not contributing enough, making withdrawals, and not repaying 401(k) loans. Unfortunately, some treat their 401(k)s like checking accounts, and unknowingly cripple their retirement savings. Many American workers are unfamiliar with retirement accounts and traditional investment vehicles like mutual funds, let alone annuities and long-term insurance products.

- Behind Baby Boomers are Generation X and Millennials. These demographics likely haven’t been approached as prospective buyers for annuities, though all of them will face the same retirement hurdles as Baby Boomers.

The opportunity for annuity branding and marketing

It’s up to the insurance industry itself to fill the void left 45 years ago when ERISA was passed and essentially got rid of pensions in the private sector. It can’t rely on the government to do it for them. Insurance companies and annuity providers need to go head-to-head with the 401(k) industry to win over retirement planners and retirement savers.

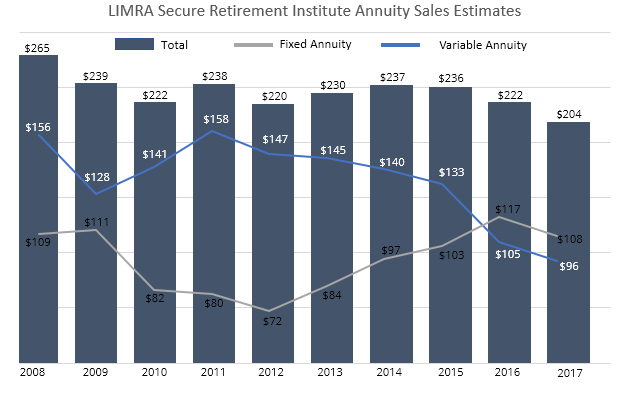

One critical step is to focus on better messaging and insurance company marketing and positioning—essentially it is an insurance branding issue. One of the biggest problems American consumers face is inadequate retirement savings, and by rethinking annuity branding, insurance companies can generate new assets under management while providing real solutions to savers. We will briefly touch on the problems with annuities before moving on to solutions. Variable annuities have lost more than $60 billion in assets over the past six years, from a peak of $158 billion in 2011 to a low of $96 billion in 2017.

1. Source: LIMRA Secure Retirement Institute, U.S. Individual Annuities survey Sales values in billions.

Annuity marketing must solve 4 major problems

1. Annuities are unpopular. There have been too many cases over the years where insurance companies were accused of selling annuities to elderly clients who didn’t need them. What’s more, there is still widespread unfamiliarity with the value of annuities and how they work, even among many who have already purchased one.3 Both of these have worked against the insurance industry and has eroded America’s confidence in annuities. Better marketing for annuities is vital to solving this problem.

2. Low rates in recent years have decreased the margins that insurance companies typically charge on annuities to profitably cover their guaranteed income commitments. Insurers have tried unsuccessfully to pass on those costs to customers, but as a result some have intentionally scaled back their annuity writing.

3. The fiduciary rule. For more than two years, the looming Department of Labor’s fiduciary rule requiring financial advisors and insurance agents to act in the client’s best interests was like a dead weight that hung over the insurance industry. This prompted many insurers to scale back their annuities business and to cut back on staff.

4. Dialing down risk. Given the low rates and unpopularity of annuities, many insurers have been reducing risk by pivoting to other insurance products, and by tweaking the conditions, terms and optional riders on annuities. One new insurance product to hit the market has been indexed annuities, but some analysts suggest that they only bleed investment income from higher fees and higher risk.

Why are things different for insurance carriers now?

After six years of declining sales, variable annuities gained 2% in the second quarter of 2018, prompting LIMRA to forecast growth of variable annuity sales of 5% by 2020.4 On top of that, interest rates have continued to climb as the Fed embarks on a new tighter monetary policy. The DOL fiduciary rule is now officially dead, and the Trump administration has vowed it will remain dead. This is good news for the insurance industry, but less so for consumers.

Annuities are beginning to be seen as complements to retirement plans, especially as the government grapples with yet another legislative mess of how to fix America’s retirement problem. The market volatility in early 2018 was enough to spook investors about the precariousness of their own retirement savings.

There is also hope that the government will take some positive steps toward educating investors about the importance of having guaranteed income and not to rely on their 401(k). In a letter to Congress this summer, the Lifetime Income Risk Joint Task Force of the American Academy of Actuaries, had a number of valuable suggestions that would elevate annuities to a status on the same level as 401(k)s: “The requirement in the (proposed) Lifetime Income Disclosure Act that plan participants regularly be provided information regarding the lifetime income value that can be expected from their retirement saving account is an important step in that direction. Lifetime income is an area of concern for all Americans.”

Insurance marketing tips and rebranding annuities

Fixing the product mix of the insurance industry and America’s overall retirement system is still a heavily debated topic. But, insurance companies can rebrand their annuities business, and use the current growth in annuities to get started. Timing is important, and it’s best to jump in now. Here are some insurance and annuity branding and rebranding tips:

- Annuity marketing for the future: You know what has happened to the reputation and branding of annuities in the past. To avoid repeating these mistakes, craft a message that is uniquely designed for your firm. Insurance branding must clearly communicate value to savers, and annuities are essential to their retirement savings.

- Engage retirement savers with new annuities messaging: Be ready with an entirely new message that promotes annuities as the key to retirement savings not just as a means of converting a 401(k) or IRA to an immediate annuity when they are 65. Communicate how annuities are a complement or even a replacement for their 401(k).

- Embrace the sentiment of fiduciary rule: Yes, the fiduciary rule is dead, but that doesn’t mean you shouldn’t abide by it. Wear the label “Fiduciary” across your chest, and if applicable, use it on web messaging and printed material. Letting customers know that you have their best interests in mind is a win-win and can encourage your clients to give annuities a second look.

- Target the right audience with your annuity branding: Don’t Limit yourself to Baby Boomers. If you want to reach retirement savers, look to people as young as 30 for prospective buyers of deferred variable annuities. Use social media, and if possible, target your message differently for younger prospects. Be careful to avoid the word “retirement.” In your product messaging, use words like “wealth building”, “life savings goals” or something along those lines because retirement is a long way off to many young savers. At 75 million individuals, millennials are now the biggest generation in America, and likely the most in need of retirement help as social security becomes increasingly strained. Insurance marketing for millennials is a must-have in your marketing mix.

- Combine annuities with other products: Combine annuities with whole life or term life insurance. If your coverage allows for discounts or combination options with variable annuities, by all means do so. And if your firm also offers health insurance or long-term care, consider offering that as well. Add these features to your annuity branding and messaging.

- The right insurance and annuity brand: Branding will make or break the insurance business. Your brand is, in many ways, how your audience perceives you. Therefore, annuity branding must attract new clients through clear and differentiated messaging and secure a positive perception to the masses by building and maintaining trust. By law, you still have to refer to them as annuities, but you can create names, logos, materials, websites, etc. that can be tailored that use your own brand.

- Find your own brand voice: Let some of those big insurance companies advertise annuities their way and maintain the status quo of current annuity marketing. Not only can these messages fail to engage and differentiate, they fail to communicate how their products can secure a family’s retirement future. Whether you’re a supplier of life insurance, an underwriter or the owner of a life insurance agency, your insurance product message should communicate what sets your firm apart. Successful insurance branding requires understanding the emotional and rational drivers of your audience and then connecting that to your differentiated annuity offerings.

- Keep it simple: In a world where confusion about annuities is rampant, having a clear, simple, consistent message can help your annuity brand shine and drive future growth. By staying true to what makes you different and communicating this to customers, your brand will become more recognizable and trusted, attracting the insurance clients you desire and can best serve.

Learn how MBC Strategic’s award-winning expertise can enhance your insurance branding and annuity marketing. View our award-winning investment marketing projects here.

- Pew Research Center, “Baby Boomers retire,” December 29, 2017

- LIMRA Secure Retirement Institute, 2018

- Deloitte Insights, “Voice of the Annuities Consumer, May 2015

- LIMRA Secure Retirement Institute, August 2018.

Published:

Tags: award winning annuity marketing, how to rebrand an annuity, investment brand marketing, annuities messaging, insurance marketing, Annuity Rebranding, award winning investment marketing agency, award winning investment marketing and branding, financial services branding, investment branding and marketing strategies, investment web design, investment website design, MBC Strategic, website design financial services