Private Equity Branding Needs to Shine through its Golden Age

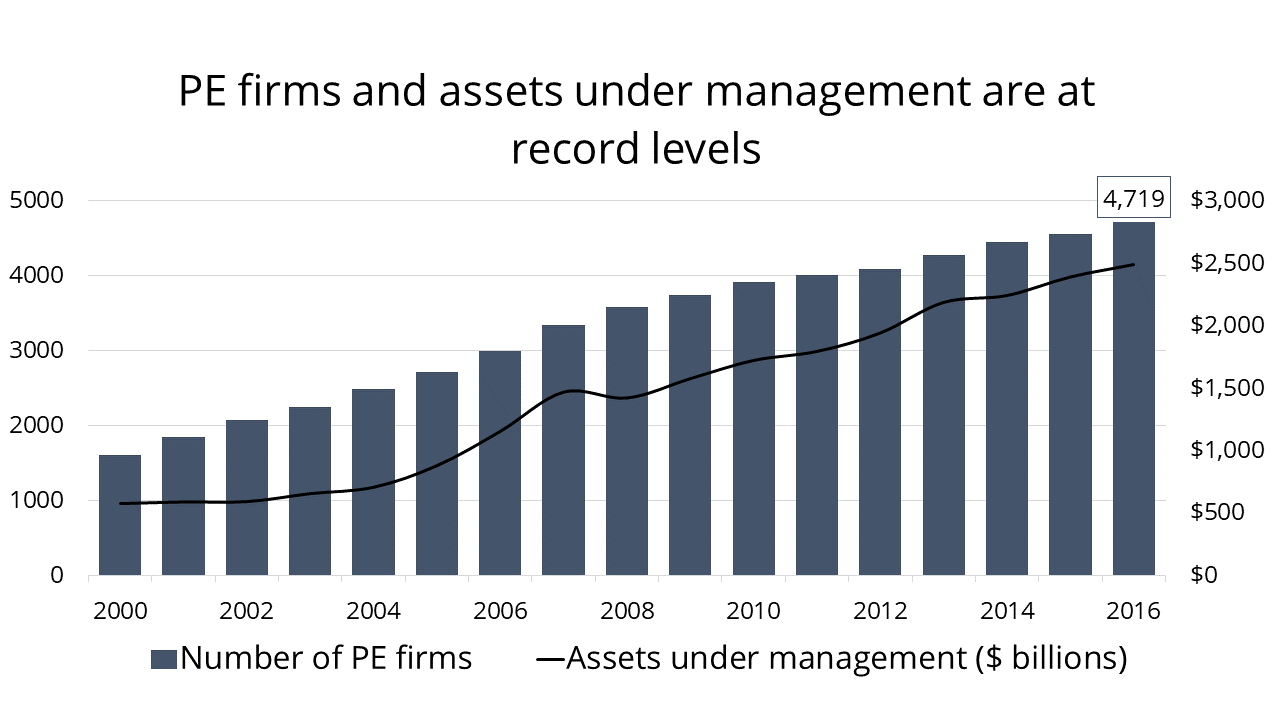

Many asset classes, including tulips and technology, have undergone Golden Ages, or periods where their craft and industries grew tremendously and quickly captured the public limelight. The spotlight has been shining on private equity for some time now and only seems to be getting brighter as the hunt for returns and yields in the public markets becomes more challenging. The private equity industry is today reporting record numbers of global assets under management, showing strong investor interest, powerful performance opportunities, and a bullish outlook by many investment commentators. At the beginning of last year, private equity had steadily grown to $4.7 trillion in AUM,[1] with over 4700 firms in competition—an all-time high. Investors are continuing to inquire about access to the once exclusive club of private equity, and the industry’s growth is likely to continue.

Source: Preqin, 2017 Global Private Equity & Venture Capital Report

In 2017, the industry grew even more – to $5.23 trillion in assets.[2] But private equity industry growth does presents new challenges for many private equity funds. Amid mounting assets and increasing competition, private equity marketing, asset managers and partners will need to differentiate themselves to better attract investors. Competition continues to build in the private equity arena as firms also stock up an arsenal of dry powder—uninvested capital—which has surged 26% in 2016 to nearly $869 billion across the industry.[3]

In this fiercely competitive landscape, PE firms have a few unique opportunities to add additional luster to their individual private equity brands, especially as the spotlight sines upon private equity as a whole. An obvious direction would be to offer industry topping performance numbers. Even this however may not be enough. Performance does a wonderful job of attracting investors, but unfortunately cannot keep investors during downturns or periods of underperformance. Only with the right private equity investment branding can private equity firms can truly establish a foothold within the industry, servicing their investors with authentic promises and securing staying power when market cycles change. By telling the overarching brand story of what a private equity firm has to offer and how it protects its investors through different environments, differentiated PE firms will be better positioned to attract and engage new customers, engendering brand loyalty among current and prospective investors alike. Authentic and effective branding for private equity firms can make a difference. Read our whitepaper, The Brandability of Trust, for more detail on how a strong brand can impact asset raise.

Private Equity Clients Are Thrilled as The Sector Thrives

Private equity as a sector is currently performing exceptionally well, especially as valuation anxiety plagues traditional public equity and real estate markets and while the hedge fund industry struggles. As a result, investors are in a good place. According to the recent Preqin Global Private Equity Capital Report, 95% of PE investors are satisfied with performance, and 94% plan to commit at least an equal investment into PE– numbers, showing much more certainty than many other investment categories.

Of course, a thriving PE sector benefits private equity firms of all size—from small to large—helping each firm accumulate investor assets on a broad scale. Should the market shift, however, and excess returns become harder to obtain, which private equity investment firms might prevail?

Private Equity Branding in Action

It would be the private equity firms which have developed a strong private equity brand presence through dedicated investment branding and marketing efforts across both retail and institutional target markets that see measurable asset staying power even during downturns. In this way, small and mid-sized asset managers have an opportunity, during the industry’s golden age, to elevate their private equity branding efforts and gain a foothold as a recognized firm in the industry.

Private equity is in a league of its own. The best branding strategies in the financial services industry tend to inspire investors to look beyond returns, finding confidence in other aspects of their investments and helping their end investors understand their private equity asset manager’s total value proposition.

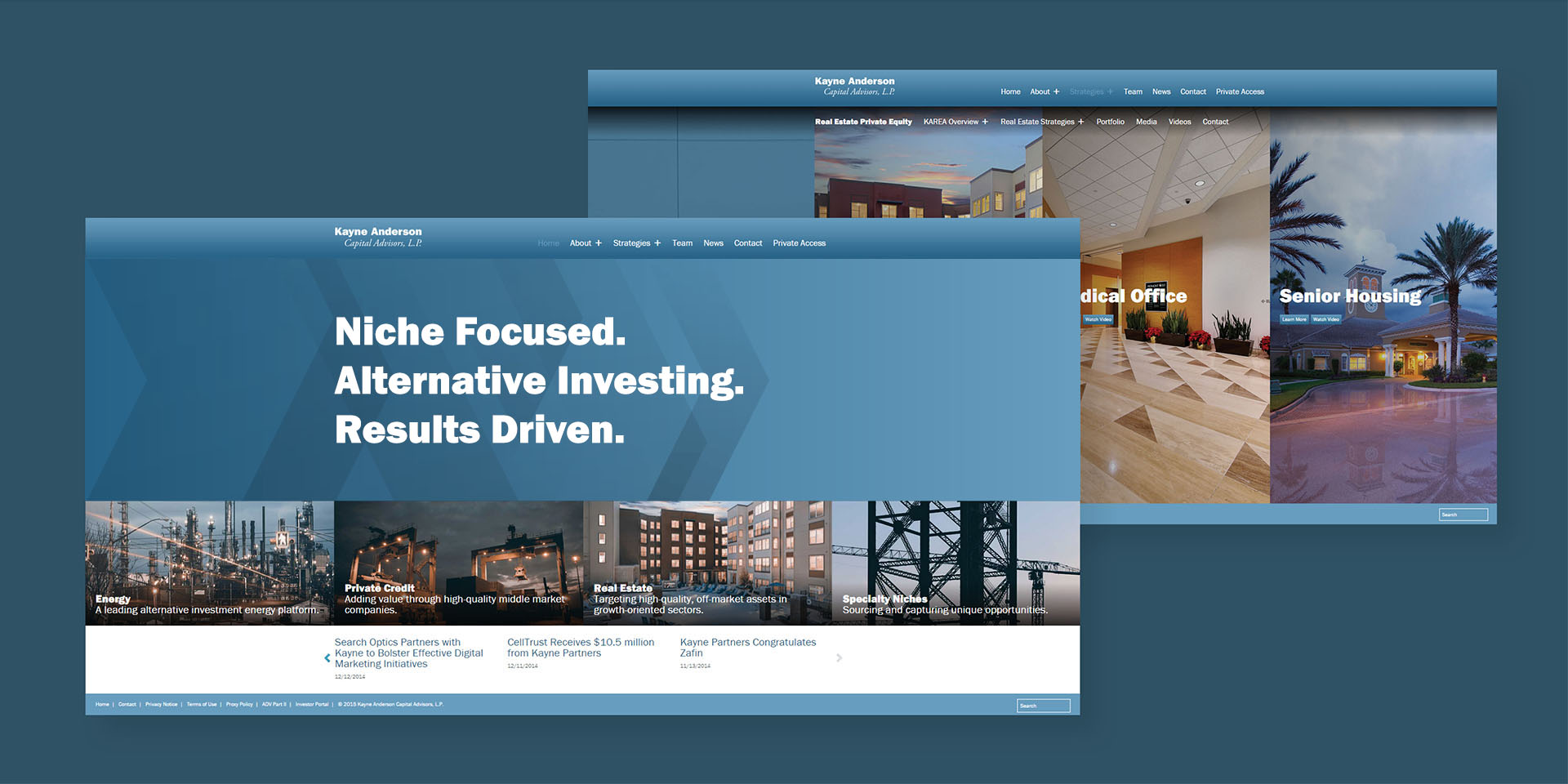

For example, to better convey its value and access points across a range of niche investment categories, Kayne Anderson Capital Advisors enlisted MBC Strategic to complete a comprehensive website redesign and to tell their distinctive story to prospective investors and partners. Kayne manages $26 billion (as of 12/31/2017). The redeveloped private equity website design project focused on a clear communication of the firm’s wide-ranging investment services to investors while creating a comprehensive and unifying messaging platform to unite investors in their search for alternative investment options.

See more of our development process for Kayne Anderson’s website redesign in our private equity branding case study.

Does your brand need a refresher? Consider a marketing agency with a specialty in financial services to articulate your story. Contact MBC Strategic.

- McKinsey and Co., A Routinely Exceptional Year For Private Equity, February 2017

- McKinsey and Co., The Rise and Rise of Private Markets, February 2018

- Institutional Investor, McKinsey: Dry Powder is Nothing to Worry About, February 2017