User Experience Trends in 2020 for Financial Services Marketers

New technologies and user experience (UX) trends in the financial services industry continue to drive change and disrupt notions of traditional banking and investment services. Processes are continually evolving, and it is critical to understand how to leverage innovative web-based technologies and design to engage a customer base perpetually in search of better online experiences.

Financial service marketing strategies capable of leveraging trends and offering a more sophisticated, convenient and streamlined user experience to their target audience will outpace the competition.

According to Gartner, “Customer experience drives more than two-thirds of customer loyalty, outperforming brand and price combined — but over 70% of CX leaders struggle to design products that increase customer loyalty and achieve results.” 1

With this in mind, let’s take a look at a couple of the trends that are important for financial services marketers to understand in order to craft the modern experience their customers desire.

Consumer Driven Fintech

One of the largest ongoing trends within the financial services industry on the application level of the technology stack is the relentless growth of consumer driven fintech. Traditional banking and lending organizations continue to be disrupted (despite regulation, privacy and fraud challenges) with digital alternatives that provide fast and seamless online and mobile payments, like longtime players Venmo and PayPal. The success of these platforms is inextricably linked to the seamless user experience that comes alongside the idea.

There is also new crop of alternative banking platforms specifically targeting the Millennial experience, like goodly, which gives employers the ability to pay down student loan debt, an attractive benefit for young consumers and job-seekers fresh out of college. Another example is Flyhomes, a lending company which uses the cash on its balance sheet to purchase homes on behalf of the applicants. The applicants then select a mortgage company and the terms to purchase the home back from Flyhomes, ultimately forgoing the need for a large initial down payment.

These are two examples that demonstrate how advancing technology and user experience-driven design is allowing nimble financial services providers to move from a “one-size-fits-all” scenario, to a highly personalized offering that places the needs of the target audience front and center. From a UX standpoint these solutions solve a specific challenge through innovation for which there is a continuous demand.

Personalization

Going beyond apps and into the realm of web and marketing material design, one of the keys to an exceptional user experience for financial companies is personalization.

According to Nielsen Norman Group, “In order to achieve high-quality user experience in a company’s offerings there must be a seamless merging of the services of multiple disciplines, including engineering, marketing, graphical and industrial design, and interface design.”

Taking a multi-lateral approach to website and marketing material design that allows users to feel like they are navigating an individualized experience can be a huge conversion driver. One such example is Wasmer Schroeder & Company.

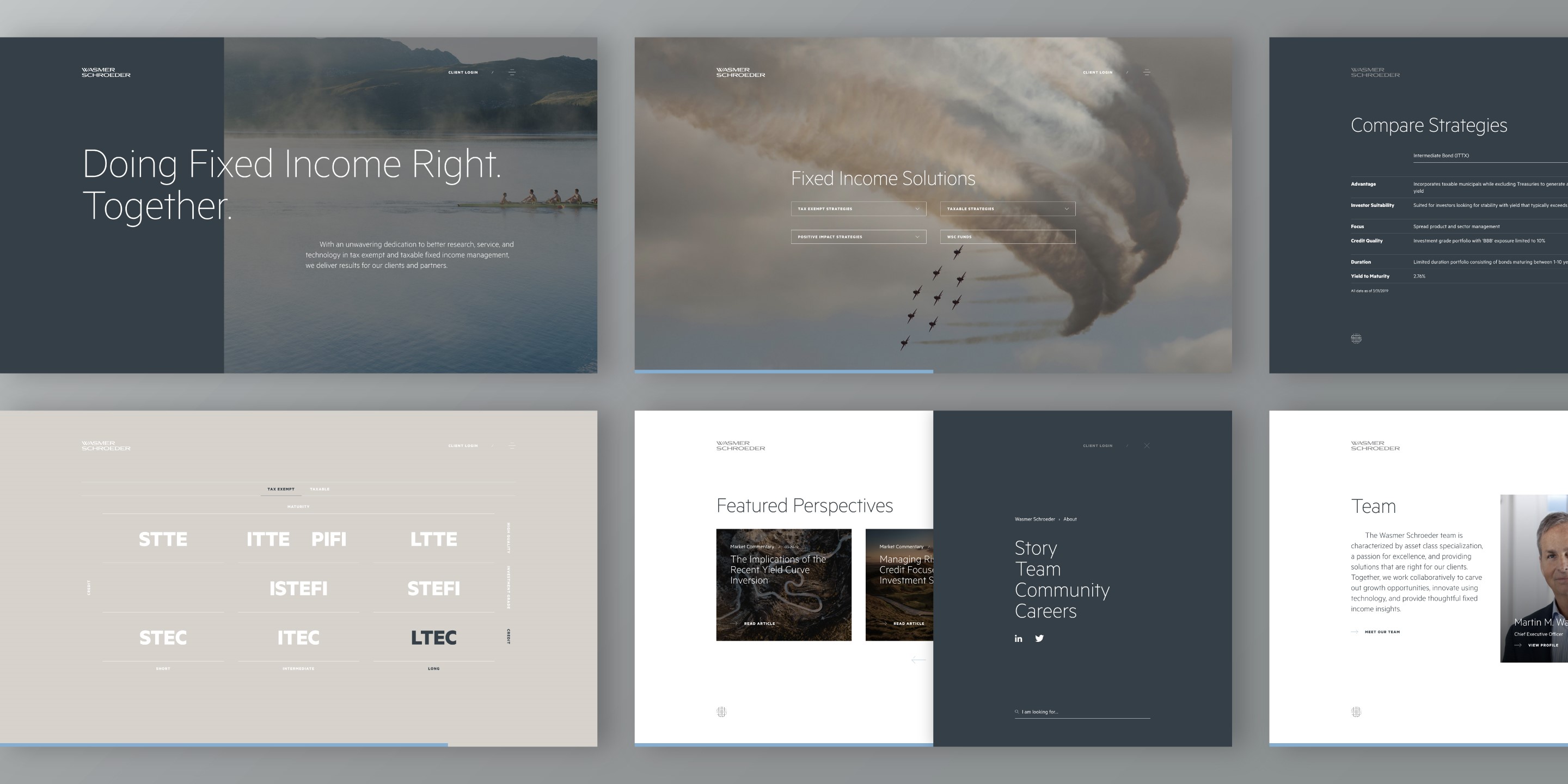

After 25+ years of successful fixed income management, Wasmer Schroeder & Company approached MBC Strategic for help with a comprehensive institutional asset management rebrand. The sleek updated design scheme showcased the firm’s position within the institutional fixed income landscape, with a modern and elegant color palette and identity.

In addition to the new identity materials, the project included factsheets, firm and institutional decks, a corporate brochure, a new asset management website, and a separate site for the firm’s mutual fund.

The branding assets display Wasmer Schroeder’s insightful, human and collaborative approach and provide users with a uniquely personalized experience that identifies what they are looking for and intuitively serves them the most relevant information.

For example, to provide Wasmer Schroeder’s clients with a user-friendly, yet customizable method of viewing investment products, MBC Strategic’s designers developed an interactive “fund selector” that allows users to identify the right fund for their personal situation. Once the vehicle class of interest is selected, the viewer can then learn more with a direct route to the factsheet, ultimately enabling streamlined personalization within the user experience.

Within financial services marketing, customized experiences as a core aspect of online engagement and personalization is paramount. The quest for more tailoring of a product to meet the audience’s needs, much like responsive design, reflects the growing desire for more control over interactions with the technology we utilize daily.

The ability for consumers to customize how they see information and control what they want to see, when they want to see it is more sophisticated than ever and should thus be viewed as an actionable trend that has become foundational to UX best practices. And with AI-based tech, this trend is only going to increase in velocity.

Adding Data & Insights to the Personalization Mix

As financial and investment marketers, we strive to deliver the best customer experience possible working within brand design. Not only is our approach driven by research and best practices, but also by leveraging data.

According to Gartner, there is a fine line between connecting with customers based on data and crossing the line into invasive territory depending on the depth of personal information being leveraged. They suggest three principals to developing effective personalization: identifying barriers to the success of personalization, going slowly with implementation, and believe it or not, people.

To help our clients with this challenge, at MBC Strategic we utilize the deep insights we gather from extensive research and in-depth interviews of stakeholders and their clients, into competitor messaging and design elements.

As part of our process, we develop a profile of the target audience that includes their functional and emotional needs. These insights are applied across messaging and digital design to ensure we capture how to best communicate them and develop digital experiences to satisfy those needs without crossing the line. We’re not alone in being aware of consumer sensitivities. With enhanced privacy standards and different geographic consumer privacy laws – by both state and region – there are distinct challenges that must be addressed and navigated when considering personalization strategies.

Marketing and design teams bring a wealth of their own knowledge from their experiences with financial services user experience which can be a great source to inform and understand the right balance personalization opportunities 2—especially in financial services and investment branding and marketing.

A prime example of utilizing this data and derived insights can be seen with the revamped Gamble Jones web site. Our firm was brought on in 2018 to complete the RIA rebranding project for Gamble Jones while staying true to the firm’s roots, traditions and clientele.

Prior to launching the new user experience, we held a company-wide branding workshop to help communicate both the purpose of the rebrand and pull insights from stakeholders about how to best speak to their clientele.

MBC helped Gamble Jones connect with their diverse target audience by modernizing their website with modern imagery, story-based insights and responsive design. The new website stands out in the RIA space, providing a uniquely personalized emotional connection that is true to the way the firm operates.

Are you interested in learning how to create a more personalized brand and a superior user-experience? MBC has been helping financial institutions and investment firms grow for over twenty years. To better understand the importance of mobile web design for your financial institution or investment firm and see how MBC Strategic can help, please contact us here today.

1. https://www.forbes.com/sites/forbesfinancecouncil/2019/09/09/five-trends-shaping-fintech-into-2020/#202e4ee2f13b 2. https://www.gartner.com/en/marketing/insights/articles/3-personalization-principles-for-marketers

2. https://www.gartner.com/en/marketing/insights/articles/3-personalization-principles-for-marketers

Published:

Tags: UX, investment design, financial storytelling, investment industry marketing, financial services design trends, marketing design trends, minimalism design, financial services website, UXtrends, UX Trends 2020, UX Financial services, Financial services user experience, award winning advertising agency, award winning financial service marketing, branding for investment industry, investment brand strategy, MBC Strategic, MBC Strategic investment marketing