Why ESG Investment Marketing Is More Important Than Ever

5 Ways to Communicate Your ESG Approach

The importance and value of authentic ESG investment marketing has grown in recent years, yet many firms have failed to hit the mark. Feel-good messaging without solid positioning and real-world context or a receptive audience can create more confusion than confidence. However, recent events have changed the narrative, with investors having learned two important lessons during the pandemic: We are all connected, and resiliency is paramount to profits.

Both statements are key to the concept of marketing and branding an ESG investment approach or sustainable investment strategy. Primary audiences are now seeing that companies implementing substantial environmental, social and governance policies are inherently better connected and more resilient than their peers. Moreover, these organizations are consistently winning the ESG branding battle with a natural advantage over their peers who simply cannot make similar assertions.

With popular sentiment on your side, if you utilize ESG in any number of various ways, now is the time for your investment firm to bring environmental, social and governance messaging to the forefront. Regardless of the depth of sustainability or ESG in your investment approach, asset managers and investment funds need to better articulate its value in their messaging. Different types of asset management integration of ESG include:

-

- Pure play impact investors with a primary focus on doing good in the ESG investment approach

- Asset management firms that want to get the word out relative to their ESG adherence as part of their firm culture

- Investment management firms that want to market their ESG fund or sustainability-focused funds, or the availability of an ESG screen on a particular investment strategy

Effectively illustrating strong vision and understanding of the power of investment in global sustainability or ESG through content will not only help reliably engage target audiences, it will also help you maintain marketing and business competitive advantage over the long-term.

Why ESG Investment Marketing Now?

Your Audience is Ready

ESG is now becoming a true part of company culture, not just a mission statement. It is also becoming a great investment opportunity, where firm ESG ratings can translate to better financial returns. In short, ESG policies and benefits are now built-in, not just bolted on. And investors are taking notice, with numbers and data to back that up.

A recent JP Morgan report noted that COVID-19 could prove to be a “major turning point for ESG. And that sustainability-focused funds attracted a record amount of capital in the first quarter of this year, even as the pandemic rattled worldwide markets. Global sustainable funds saw inflows of $45.7 billion, while the broader fund universe had an outflow of $384.7 billion.”1

In the world of investment marketing, ESG is now built-in, not bolted on.

Furthermore, BlackRock was another firm confirming the value of ESG in their research by stating, “Overall, this period of market turbulence and economic uncertainty has further reinforced our conviction that ESG characteristics indicate resilience during market downturns.”2

With now being the perfect time to focus on ESG investment marketing, your firm needs ways to capitalize, and we are here to show you how.

5 Ways to Position Your ESG Investment Branding and Marketing for Maximum Impact:

1. Know (And Speak Directly To) Your Audience

Investment firms are no longer marketing to a generally monolithic audience, especially when it comes to marketing their ESG investments. Modern audiences, especially the emerging millennial investor class, have concerns beyond the bottom-line and require nuanced, holistic narratives. Position your ESG messaging by getting to know your audience and pinpointing their decision-making criteria.

Whether it be an increased focus on values-based investing metrics, or getting a more complete picture of risk, there are powerful ways to structure your ESG investment strategy, as long as it is informed by the needs of your target audience.

2. Take A Solutions-Driven Messaging Approach

Much of ESG is about finding solutions to various inefficiencies, so ensuring that your messaging mirrors this focus helps motivate potential investors, especially during times of uncertainty. Present your ESG approach in a macroeconomic context as well as positioning it as a key to effective diversification.

Investors are still willing to add risk, but they also want to see the light at the end of the tunnel. Strong long-term messaging that turns ESG marketing into a solution to risk/reward concerns will give your audience incentives to invest when fear is a driving emotion.

3. Clearly Articulate Strategic Competitive Advantage in Content

As ESG finds its footing in the investment space, it is critical to develop a two-sided approach to marketing ESG investment strategies for investors seeking multi-dimensional impact in terms of both social and environmental benefits and bottom-line financials.

Conveying how these underlying principles, and the investment strategies used to capture their value, create expanding advantage can attract long-term, loyal clients. While emotional appeal can go a long way in ESG investment branding and marketing, it needs to be coupled with why business decisions, like sustainable policies, lead to long-term portfolio growth. In short, strategic value should always accompany mission-driven philosophies to ensure investor interest.

4. Show Your Commitment & Demonstrate Your Understanding

Talk is cheap when it comes to ESG. Greenwashing has burned investors in the past, so one of the most important things to convey in messaging is true commitment. This can be done by showcasing built-in ESG investment strategies in visual form, be it through integrating ESG Scores within fund overviews or infographics that list out key sustainability drivers within the portfolios themselves.

Giving the audience simple insight into how and why you invest will not only effectively convey strategy, it will also show that you understand what you are investing in, a critical step in the marketing process when investors need proof of your expertise and vision in the space.

5. Quantify Impact In ESG and Sustainable Investment Messaging

One of the most effective ways to showcase ESG investing principles and values is to quantify impact. Many firms now have access to data around positive environmental impact of both their portfolio companies and their own firm-wide operations. This can include simple but helpful metrics such as trees saved, water conserved, and CO2 reduced.

This reporting can be done in-house or through third party assessors. Being able to showcase quantifiable results is even more powerful than visualizing initiatives, especially for a crowd used to attributing value to a set of numbers. Potential investors are looking for investment managers who can walk the walk. If you have the numbers, put them front and center and you will be rewarded for the effort.

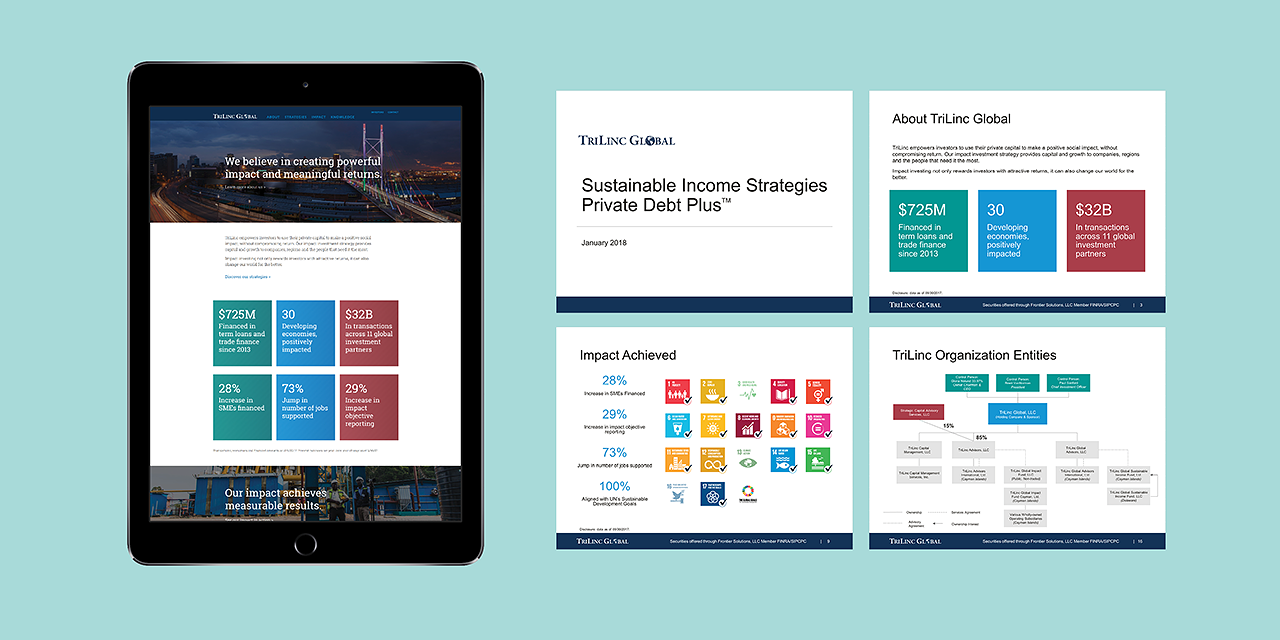

TriLinc Global is an impact investing manager that creates positive social impact and strong results through private debt investments in emerging markets. The firm worked with MBC Strategic to create a brand and message true to the firm’s core beliefs, yet one that addressed the unique needs of the institutional investor’s audience.

We are finally seeing not only strong environmental, social and governance initiatives in action, but also a substantial increase in the value of the respective underlying companies and investments. Now is the time to take your ESG investment marketing to the next level.

If you would like to better understand how to articulate your unique ESG investment marketing story and better navigate the shifting demands of investor audiences, our investment branding team has been helping investment managers do just that for the past 20 years. Check out some of our other work and reach out to us if you’d like to learn more about how we can help you craft a story that will grab your investors’ attention.

- JP Morgan, “Why COVID-19 Could Prove to Be a Major Turning Point for ESG Investing”

- BlackRock, “Sustainability Investing: Resilience Amid Uncertainty”

Published: