Alternative Investment Marketing

Specialized Strategies for Private Equity, Hedge Funds & Alternatives

Marketing alternative assets and private markets requires a unique, compliance-aware approach tailored to institutional investors and sophisticated allocators. MBC Strategic creates campaigns that highlight specialization, expertise, and performance hedge funds, private equity, private credit, and other alternative strategies.

What We Deliver

- Hedge fund and alternative asset marketing strategies

- Private equity and venture capital campaign development

- Compliant messaging and investor communications

- Fundraising materials, pitchbooks, and presentations

Why It Matters for Investment Firms

Tailored outreach helps alternative investment firms connect with institutional and high-net-worth investors through clear, strategic communication. Professional marketing and presentation materials strengthen fundraising efforts, while strong positioning builds allocator confidence and reinforces perceived expertise. An effective alternative investment brand and campaign strategy aligns with the sophistication of the offering—creating a lasting, credible impression that enhances visibility and long-term trust.

Alternative Investment Marketing Service Set

- > Hedge Fund & Alternative Asset Marketing Collateral

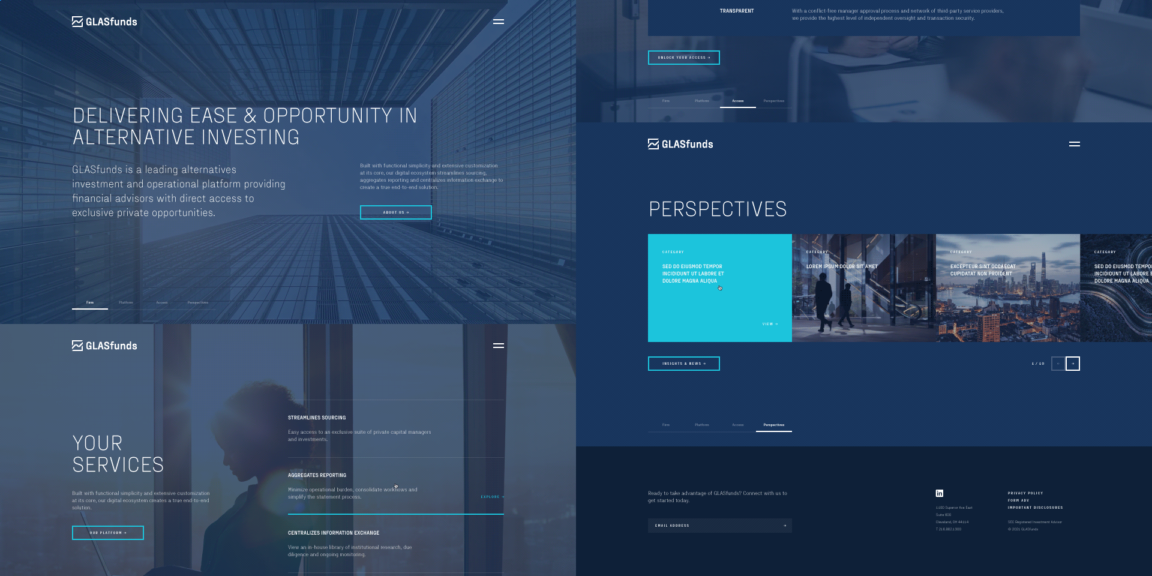

- > Alternative Investment Websites & Landing Pages

- > Fund Launch Marketing & Brand Awareness Campaigns

- > Private Equity & Venture Capital Fund Campaigns

- > Investor Decks & Capital Introduction Materials

- > Industry Thought Leadership

Additional investment marketing services

- Advertising

Run targeted, immediately compelling campaigns that raise awareness among investors, clients and stakeholders - Public Relations

Build credibility and stand out amongst peers with strategic financial media coverage and investment industry visibility - Campaign Analytics & Reporting

Continue growing by tracking campaign performance, measuring engagement, and optimizing ROI - Social Media Strategy & Management

Drive investor engagement and establish trust across key social platforms - Content Marketing

Share a unique and differentiated point of view through articles, whitepapers, and reports that showcase firm value - Email Marketing

Deliver timely, compliant email campaigns that nurture investor and partner relationships at their inbox - Investor Communications

Provide transparent updates and trustworthy reports that strengthen stakeholder confidence - Event Marketing

Maximize in-person impact at conferences and roadshows with tailored campaigns and physical materials

Frequently Asked Questions

1. How is alternative investment marketing different?

A: Alternative investment marketing highlights performance and expertise for hedge funds, private equity, and venture capital.

2. What types of alternatives need marketing support?

A: Hedge funds, private equity, venture capital, and other alternative strategies.

3. What materials support alternative investment marketing?

A: Investor decks, fund websites, pitchbooks, and thought leadership content.

4. How do you reach institutional investors with marketing?

A: Through targeted content, PR placements, and professional channels like LinkedIn.

5. Why is transparency important in alternative investment marketing?

A: Clear communication builds credibility and reassures sophisticated audiences.

6. What materials support hedge fund marketing?

A: Hedge fund marketing materials include investor decks, websites, and thought leadership content.