3 Active ETF Marketing Strategies to Execute in 2025

Effective ETF Messaging for Investment Managers

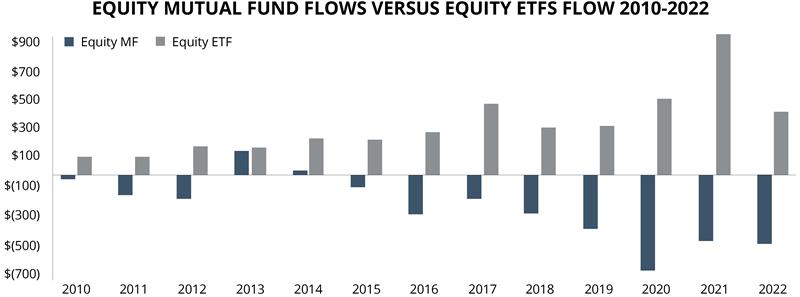

According to Bloomberg, active ETFs now outnumber passive ones for the first time, with roughly 51% of nearly 4,300 US-listed exchange-traded funds being actively managed. With a doubling of active ETFs, coupled with massive outflows of traditional Mutual Funds nearing $800B last year, we are seeing a clear-as-day trend of investor sentiment heavily favoring active products. This makes standout active ETF marketing essential as the space gets more crowded.

The asset managers, wealth managers and RIA’s who were able to read the tea leaves are now market leaders, but we are still in the early stages with plenty of room to grow. In fact, despite their rapid rise, active ETFs still only account for 10% of industry assets.

With this being the case, the first step is systematically repositioning your ETF marketing and product messaging to capture sophisticated, informed investors who demand more than the passive strategies that have dominated portfolios since the 1970s.

62% of firms are considering structuring their new product as an active ETF over the next year.2

A new era requires new ways of thinking. In this article, we will go over the following 3 essential marketing strategies:

- Change the Passive Narrative

- Hype up the Value Drivers

- Convey the Ancillary Benefits

Those who can lead the messaging wave will be seen as both a thought leader and an early adopter.

1. Change the Narrative

The Pitfalls of Passive Investing

Modern portfolio theory was a diversification theory in the 1970’s that has helped give rise to the popularity of passive investing. This has been quite successful up to this point, yet with technology creating opportunity, the virtue of staying passive is beginning to sound stale.

With user-friendly online brokerages offering low commissions and real-time data on every retail investors news feed giving them the latest financial information needed to execute on trade strategies, the smart money is looking for something more.

Managers offering active ETF products must capitalize on this disconnect between tradition and trend. Positioning these offerings as products that can maintain diversification yet can actively adjust to outmaneuver the inefficiency of staying passive in a volatile macro environment can ensure clients that their money is being put to good use, especially when they have the means and avenues to stay active themselves.

Messaging Strategy: Active ETFs provide the safety and opportunity of traditional funds without the inefficiency.

Source: ETF Trends

What About Direct Indexing?

This is also why adjacent strategies like Direct Indexing are seeing similar boosts in product offerings and marketing campaigns. Rather than holding the index, a direct indexing portfolio is essentially an SMA based on a benchmark, allowing investors to directly purchase every security for more control over their portfolio. Up until recently, this type of strategy was cost-prohibitive due to the trading fees, yet with technology barriers breaking down, it is now a realistic option for a wide range of investor types.

Messaging Strategy: Be it Active ETFs or Direct Indexing, promoting the enhancement of an already popular approach is a powerful marketing tool as investors are inevitably becoming more sophisticated…and less patient for passivity.

2. Hype up Value Drivers

The Value of Vigilance

Trading resources are everywhere, leading many retail and HNW investors toward questioning the value of the traditional investment manager. The line of thinking goes like this: I can just buy a Mutual Fund or ETF to track the index, so why do I need a manager when the work is being done for them?

In another era, these are the types that managers might have wanted to avoid, but with more and more taking this active tack, now is the time to ensure that you are speaking to the key concern your clients may have related if you are doing enough.

Fortunately, Active ETFs offer the exact remedy to this dealbreaker of an inquiry.

You can flip the script and tell them that with active ETFs, they can maintain their exact strategy and hold what they want, but being actively managed, you can pull even more value from these funds without putting assets at risk.

Not only will you be offering the potential for outperformance, you will be providing a path to sustaining these relationships by showing that your expertise is matched with the all-important vigilance of someone who truly cares for their clients and their assets.

Messaging Strategy: Use the concepts of staying active and diligent to give your clients the all-important confidence and peace of mind knowing you are doing all you can to ensure their funds are not only protected but positioned to actively grow.

2. Convey Ancillary Benefits

An Active Investment Advantage

Once the idea and process of the active ETF is firmly ingrained in the investors mind, we can move towards conveying the personal client benefits that can be derived from, and that pay off, the innovative foundational thinking of the product itself. Here are some of the most notable ancillary benefits of the Active ETF:

Personalization – A portfolio full of boiler plate mutual funds can make any investor feel distant from their investments, while executing on Active ETFs strategies means you can truly personalize portfolios through the implementation multiple overlays and values-based investment decisions for a tailor the experience.

“Active Personalization is the new active investing. It blends traditional approaches with more modern ones to create a new way to help you serve your clients in a personalized, scalable fashion.” – Kunal Kapoor, Morningstar CEO

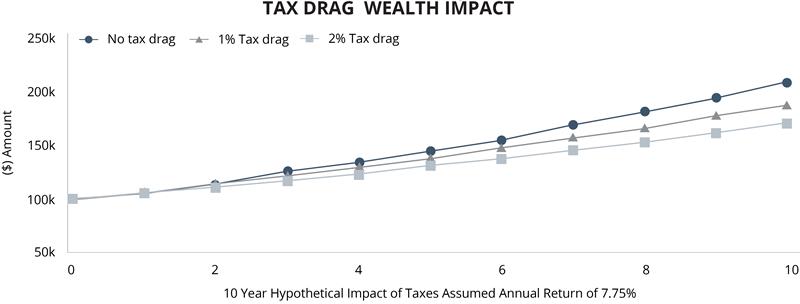

Tax Benefits – The effect of taxation on investment accounts has long been underrepresented from a marketing and product standpoint. This is changing rapidly as more investors consider tax implications and more managers are offering products and services related to active tax management. Naturally, this places active ETFs in a strong messaging position as they can help reduce liability and potentially produce tax alpha for your clients.

Source: Russell Investments

Flexibility – The rigid, inflexible nature of passive products stifles the ability of investors to take advantage of volatility, whereas an active approach can keep you nimble and capable of adjusting where necessary.

Values – Index funds and mutual funds tend to be one size fits all, yet Active ETFS allow you to have more freedom to invest on values and preferences, such as eliminating fossil fuels or customizing around social or ethical themes.

Messaging Strategy: Emphasize the value of individualizing investment portfolios via Active Personalization, a blended approach that targets the needs and desires of the client. This is especially important as you court younger (and more discerning) investors who will power your practice for the next 10-20 years.

Stay Active, Win Clients

While active ETFs themselves are compelling products, the messaging for such an offering has just as much to do with the concept of staying active in a professional sense as it does with the specific actions taken. Clients who know their investment managers are going out of their way to improve the investment experience will reward their partners with greater confidence, which translates into better relationships.

MBC Strategic is uniquely positioned to help, having worked with a long line of active investment managers over two decades of investment marketing and branding history. If you are considering future active product offerings or would like to explore messaging strategies, contact us today.