Financial Industry CMOs – Building Trust with Your C-Suite and Getting Marketing Initiatives Done

While we might be biased as a financial and investment branding and marketing agency, we’re not the only ones to believe that CMOs have one of the hardest jobs out there—especially true across the investment and asset management industry. They are expected to bring important changes to the company’s efforts, and often times are not given the resources or latitude to make those expectations a reality. A Harvard Business Review survey found that 74% of CMOs “believe their jobs don’t allow them to maximize their impact on the business.”[1] We often deal with marketing leaders in the financial industry who are held to similar standards, but some are not given the tools and budgets to make substantial shifts in company strategy that they’re expected to. After 20 years of helping financial service marketers and CMOs to maximize the fruits of their efforts, we have some insight into a few strategies that can help bring about effective growth from marketing and branding efforts and better align goals with the realities of the industry.

First, we believe it’s important to define goals. CEOs and CFOs often want financial marketers to work on tactical things – updating decks and fact sheets, keeping the website running, organizing the booth at a conference – but the goals laid upon investment industry CMOs really dictate the need for strategic work. Better positioning yourself against competitors, creating new digital experiences to drive growth, finding ways to build trust with partners and investors – all of this is takes creative and strategic analysis.

So, ask your firmwide leadership about what they expect and need from marketing, and what are the goals for your role. In the end, interests are aligned, you all want overall firm success and growth, but there are different paths to get there. Some CMOs focus on strategy, some focus on commercialization and are more product/service focused and others have a broad range across both strategy and commercialization. Begin by clearly defining the outcomes you’re expected to produce, the responsibilities that you will have and the long-term strategy of the firm that you need to work under. Financial marketers and CMOs need to align expectations and job responsibilities. We believe it is necessary to prove the value of your marketing skills to then earn the trust necessary to make the big changes in how you develop relationships and attract new investors.

In asset management branding and marketing, the divide between resources dedicated towards sales versus marketing is heavily weighted towards the former. We believe that these two divisions of investment companies need to work in synergy to maximize results, but often marketing gets the shorter end of the budget stick. Surprisingly enough, it is not that CFOs don’t want to allocate money to marketing, but it is that they often don’t understand how marketing is affecting the bottom line. A survey by Censuswide found that 38% of CFOs believe marketing was a cost center, meaning that it cost money to run and didn’t directly add profits. On the bright side, it also found that 94% of CFOs would increase digital marketing budgets if there was clear evidence of return on marketing investment. [1]

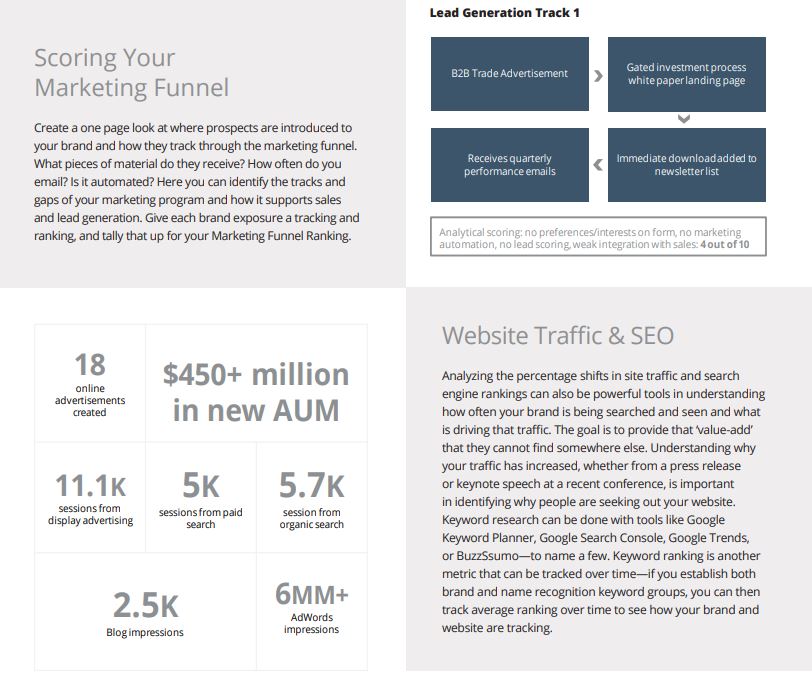

The most important thing you can do here is to agree on metrics. If you set metrics that they believe will help drive profits, then you have a much simpler path to substantiating the worth of marketing. CFOs care about dollars and cents, so when presenting your case, you need to be able to tie things more directly into sales and profits. Inbound leads generated by the website or more advanced marketing funnel tracking are some good examples of metrics tied closer into business development, and ultimately profits. By more clearly demonstrating the value of your marketing efforts, you can help allocate the right resources and get the budget you need.

Many financial firms lack good branding strategies, and not because the CMOs don’t know what they’re doing but because the company’s management doesn’t understand the importance of branding. We understand that in investment management this can often be an uphill battle, but we’ve found that by demonstrating ROI of your financial marketing activities you can reinforce the value of your role and make a stronger argument for larger projects. These strategic projects in the investment management space might include rebranding, revising messaging strategy, redesigning websites, updating your investor-facing marketing collateral or preparing for a content marketing and thought capital campaign.

We find another good way for CMOs to reinforce the importance of their role is to create financial marketing benchmarks and metrics. Our recent whitepaper goes into depth about how you can create tangible benchmarks through both qualitative and quantitative means and provide more ammunition for your arguments on the importance of larger strategic marketing initiatives. Making benchmarks will create another concrete basis from which to prove the value of your financial marketing.

Integrating technology into your marketing department will help facilitate much of the tracking and data points necessary to more clearly show value. While this can be a big spend upfront, finding the right technology partners can both make your job more efficient, potentially saving money in the long run but will also be able to help you make your case for increasing budgets when you can point to the sales and profits that you’ve been able to help generate.

We understand how hard a chief marketer’s role is, especially within the financial services industry and we have been helping these individuals for 20 years now to help communicate the importance of marketing to internal leadership and executing on a full range of projects, from investment rebranding and messaging strategy, to websites and digital advertising and a full suite of marketing materials. We understand the differences in investor audiences and the need to balance emotional appeal with rational sensibility, even with B2B audiences.

[1] https://hbr.org/2017/07/the-trouble-with-cmos#why-cmos-never-last

[1] Viant, Closing the CFO-CMO Digital Divide, 2018

If you are having trouble quantifying the results of your investment marketing or just have a specific project in mind that needs to succeed, we’d love to have a discussion about how we can help. To learn more about how MBC Strategic can improve your financial and investment marketing and branding solutions, please give us a call and contact us today.

Published:

Tags: financial marketing initiatives, investment industry marketing, financial services industry marketing, Financial industry CMO, los angeles investment marketing, chief marketing officer strategy, building trust in marketing, award winning advertising agency, award winning financial service marketing, branding agency with investment experience, branding for investment industry, investment brand strategy, investment marketing and branding, MBC Strategic, MBC Strategic investment marketing