Mutual Fund Marketing: Prioritizing the Right Tactics in 2019

When it comes to marketing mutual funds, every mutual fund is different and demands its own strategy. Sure, there are only so many fund objectives – growth, capital appreciation, monthly income—depending on what the lawyers put in the prospectus, but how does the portfolio manager execute on that strategy? What differentiates the fund and the fund family from the rest of the pack? When it comes to effective mutual fund marketing, success does not happen overnight. In the 20-year history of helping to market mutual funds at MBC Strategic, we have found the best results come from supporting sales teams with thoughtful, consistent, relevant and differentiated marketing and messaging across channels. This includes a strategic content marketing plan, email marketing to a growing list of intermediaries and investors, social (yes, social) campaigns—all supported with effective digital PR in a way that will build brand recognition and help drive asset growth. Consistency is key.

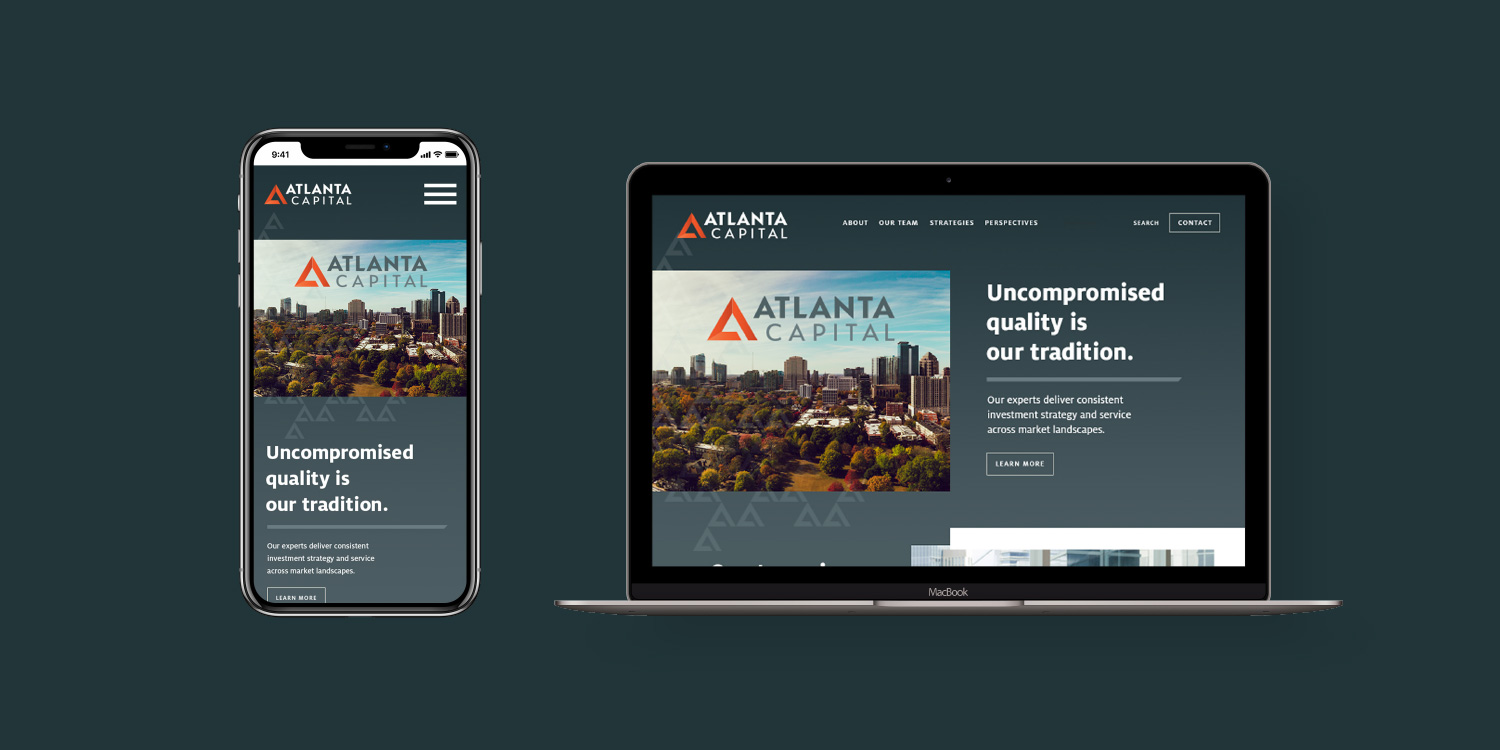

In order to see the return you are targeting on your marketing investment, you may ask yourself, is it really necessary to create full marketing campaigns and go through the process of supporting it with PR coverage? Are the returns of your funds good enough to get your message out? After working in the investment space for two decades, we stand by a foundational approach based on a cohesive messaging strategy. Have you spent the time to really key in on what differentiates your fund and your company? Have you taken the time to position that unique value in the way that your investors want to see it? This, coupled with a consistent presence in the market are paramount to the success of mutual fund managers. By creating this consistency and delivering valuable insights to your audience, whether it be HNW investors, institutional clients, or financial advisors, you will more likely a name in the market that people can trust. Furthermore, a modern, mobile-friendly website and a suite of fund-specific marketing materials and collateral will allow you to convey the quality of your firm and create further consistency across client touchpoints.

Seeking Consistent Mutual Fund Growth Over the Long-Term

Whether your strategy is sector rotation, value, indexing or emerging markets, any mutual fund will have periods of variance relative to peer group performance. Strong marketing communications and campaigns will help stem outflows and explain reasons for periodic underperformance. If you establish trust with investors, they are more likely to weather market turbulence because they will believe in the long-term viability of your strategy. If your investors believe in the uniqueness of your investment strategy, they will be more understanding if your return profile deviates a little from the benchmark. These are mostly emotional decisions which is why we feel it is critically important that you are providing potential investors with consistency and transparency. If investors feel disconnected from your brand story and investment philosophy, then they will be less loyal and more likely to seek other mutual funds. You don’t need to be grandiose and omni-channel with all of your marketing but you must be authentic and consistent.

Measuring the Success of Your Mutual Fund Marketing Initiatives

Setting off down this path can often be a daunting task and exceed the bandwidth of your marketing department – and that is where an agency with mutual fund marketing expertise can help. They can support your efforts with experienced professionals with mutual fund knowledge across the spectrum of B2C (investor), B2B (advisor) and B2I (institutional) investment marketing and can handle anything from website design and digital marketing strategies to sales materials and thought capital. This offers mutual fund families flexibility and bandwidth when tackling big projects. We’ve spent 20 years understanding the mindset and emotional needs of retail investors, financial advisors and institutional investors, and can provide an extra strategic layer on top of your existing marketing efforts. From growing assets to building your public presence, we understand how to leverage effective communication to make projects like this successful.

Measuring simple analytics such as clicks and time on page are not enough to make educated decisions moving forward. That’s why it’s important to dig deep to uncover the journey your potential customers are experiencing. How are they exposed to your brand and through which avenues are they are able to access content—public or gated—as they move through this journey? Are you delivering quality content to the channels when and where your ideal client is ready to consume that content? Are potential partners and investors able to find your firm when looking for your key investment differentiators? This is all part of an effective content marketing program—especially important in the crowded mutual fund space. And don’t worry, there are quite a few viable marketing automation platforms – ranging in cost and quality – that can make these efforts a little less daunting.

In short, our advice to companies looking to more effectively position and market their mutual funds:

5 Key Tactics in Mutual Fund Marketing

1. Analyze the type of investors and advisors that your have the most success with — what about their psychology drives those results

2. Spend the time to create a strategic messaging approach across mutual funds and for your brand

3. Make sure your message is told consistently across your sales team to your website and sales materials

4. Leverage marketing automation in your mutual fund marketing efforts

5. Take advantage of digital PR to add credibility to your mutual fund marketing strategy

Support Mutual Fund Marketing Efforts with Digital PR

PR for every industry is unique and having a dedicated publicist who knows the ins and outs of your targeted media outlets, an eye for the most relevant financial writers and understanding of your firm’s brand will give you an edge as you approach the market. It does often take time to build momentum, but once writers learn about your brand, niche offerings or asset class expertise, a well-rounded PR strategy will pay off by adding credibility and support of your message to industry trades or third-party sources. Securing media placement, features or interviews on anything topical will help build your brand as well as reinforcing the trust in your existing investor relationships.

Looking for help in your mutual fund marketing efforts? Contact MBC Strategic today and let’s talk about your goals.

Published:

Tags: investment industry marketing, financial services industry marketing, los angeles investment marketing, mutual fund marketing, mutual fund advertising, advertising a mutual fund, mutual fund strategy, marketing a mutual fund, award winning advertising agency, award winning financial service marketing, branding agency with investment experience, branding for investment industry, investment brand strategy, MBC Strategic, MBC Strategic investment marketing, mutual fund marketing services