What The New SEC Rule Means for Advisor and Asset Management Marketing

On November 4th, 2022, the U.S. Securities and Exchange Commission will officially begin enforcing compliance with its new “marketing rule” related to the advertising legal framework for registered investment advisors. This new SEC marketing rule affects both financial adviser and asset manager marketing practices, and replaces the current broadly drawn advertising and solicitation rules with modernized, principle-based provisions, which serve to do the following:

-

- Expand on the Definition of Advertising

- Permit the use of Testimonials and Endorsements (granted certain rules are followed and documents maintained)

- Grant the use of certain Ratings from Third Parties

- Shape and accommodate rules for Performance Information

Additionally, the Commission is also adopting other related amendments, including:

-

- Books and Records Rule updates – impacting recordkeeping

- Form ADV changes – calling for additional info regarding marketing practices.

In short, these provisions are designed to accommodate the continual evolution and interplay of technology and advice, as well as support financial advisor and asset management firm marketing efforts in reaching prospects and greater audiences ethically, through contemporary media channels.

The following areas of the Marketing Rule have been simplified for clarity. If you would like to view the SEC’s new Marketing Rule guideline, or Rule 206(4)-1 itself, click here.

Advertisements

The first change reflected by the new marketing rule is in the definition of “advertisement.” Streamlined to account for current and future media evolutions (e.g., social media), advertising is now described through a “two-pronged” approach. At a high-level, this approach expands the definition of advertising to reflect any direct or indirect communication an investment advisor makes that:

- Offers the advisor’s services regarding securities to current and prospective clients and private fund investors; or

- Includes any endorsement or testimonial for which compensation is provided by the adviser.

With few exclusions, advertising now encompasses a much broader range of communication from advisers. Accounting for digital platforms such as social media, websites and email, the SEC is enacting guidelines that provide greater clarity on how modern-day investment advertising needs to be handled.

For advisers that choose to advertise their services, the updated investment Advertising Rule also contains seven general prohibitions related to untrue, misleading, unbalanced or omitted information. These prohibitions play their part in maintaining a fair and balanced marketing environment and must be well respected for advertisements to be fully SEC compliant.

Testimonials & Endorsements

Although fiercely regulated in the past, the SEC’s new rule provides greater flexibility around the use of testimonials and endorsements. This is granted, however, if the advisor discloses specific information in a “clear” and “prominent” manner, including:

-

- Whether the person providing the statement (“the promoter”) is an investor, current client, or other person,

- A description of, and whether, any cash or non-cash compensation was given in exchange for the endorsement or testimonial, or

- Any conflicts of interest, and details of, that may exist between the promoter and the firm.

The Opportunity

These regulations open new doors for advisors and asset managers hoping to leverage past and current client experiences in marketing material. Certain guidelines should be adhered to when using these marketing tactics, such as entering into written agreements with any non-affiliate/de minimis promoters or prohibiting certain “bad actors” from promoting.

In practice, however, testimonials and endorsements can be a helpful way to showcase the value of an advisor or asset manager. Examples of such in-use under the new rule include:

- Featured reviews on a website home or sub-page

- Comments on a social media post dedicated to a client’s past experience

- Online articles detailing updates for an adviser’s practice

- Videos explaining the outcomes of working with the adviser

Third Party Ratings

With the new rule, advisors are permitted to use third-party ratings within RIA marketing and advertisements, provided certain disclosures and criteria pertaining to the preparation of the rating are met. Third-party ratings under the new Marketing Rule are acceptable within advertisements as long as they follow these guidelines:

- The adviser’s questionnaires and surveys used to collect third party ratings make it easy for participants to provide favorable and unfavorable responses, not producing predetermined results

- The third-party rating prominently discloses:

-

- The date which the rating was given

- The period of time that the rating is based on

- The identity of the third party that arranged or created the rating

- Any compensation, if applicable, that has been provided by the adviser (directly or indirectly) in connection with the rating

The Opportunity

In-practice, with the proper disclosures, advisors now have more opportunity to use rating platforms to ask for, and display, reviews and client experiences.1 This is especially notable in an industry where word-of-mouth is relied upon heavily for soliciting new clients and will likely gain more focus as new ratings-platforms appear.

That said, advisors should note that all reviews must be treated equally under SEC compliance. This prohibits deleting or sorting reviews that may not be in the adviser’s best interest or favor or omitting required disclosures. To avoid difficulty, advisers should ensure that any third-party ratings used in ads are unbiased, credible and fair as well as accompanied by the appropriate required disclosures.

Performance Information

Advertisements that include performance information or data are also receiving amended updates. When using performance information, it must include:

-

- Net performance if gross performance is presented (subject to certain conditions),

- Specific time periods for any performance results (in most cases),

- No statement of “approval” or “review” by the Commission,

- Performance results from all portfolios with substantially similar investment policies, strategies and objectives as those within the advertisement (with few exceptions),

- Performance results from the entire portfolio, available promptly if results of a certain subset of investments of that same portfolio are provided,

- Relevant performance to the financial situation and objectives of the intended audience, in the case of hypothetical performance, adopted and maintained reasonably by the adviser (not including performance generated by interactive analysis tools),

- Appropriate similarities in the case of predecessor performance, with respect to personnel and accounts at the predecessor adviser and the advertising adviser.

The Opportunity

For each of these cases the advertisement must display all relevant disclosures clearly and prominently. Meeting these conditions, among other things, will allow firms greater freedom to include performance history within their advertisements, and can benefit marketing material such as landing pages, banner-ads, and video or email promotions. Some prior marketing materials may need to be reviewed and their compliance and efficacy may need to be evaluated if they include anything that could be construed as hypothetical performance.

Books and Records & Form ADV

In affiliation with the updated Marketing Rule, recordkeeping and registration have also received significant SEC changes. These changes are noteworthy for internet-based advisers with websites or accounts on social media platforms and should be considered in regular day-to-day business.

As part of the new Books and Records rule, RIAs must make and keep copies of:

-

- All advertisements they directly or indirectly distribute (For third party ratings, performance information, testimonials and endorsements, the amended rule also includes specific requirements for making and keeping rules)

- Any oral advertisements, oral testimonies and oral endorsements

Examples of advertisements that are impacted under this rule include:

-

- Certain internal working papers

- Website communication (including new versions and changes, spanning five years)

- Certain social media posts & discussions

- Online videos of any related advertisements

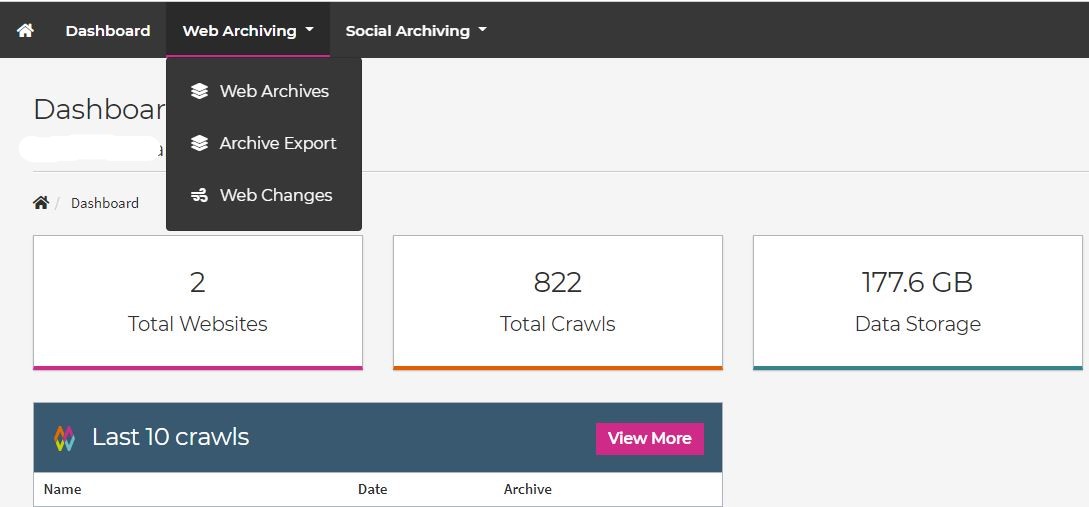

The good thing is that there are plenty of cost-efficient marketing material and investment website archiving systems that can help advisors and asset managers comply with these new regulations. Investment advisers are also required to file an updated Form ADV at the time of the advisers normal annual filing schedule. The updated form requires advisors to provide additional information regarding their marketing practices, use of testimonials, endorsements, ratings, and certain performance information.

Taking Next Steps

For large or mid-sized firms, tracking and maintaining these records can prove most challenging when changes to your site are frequent. Maintaining a robust and diligent system is a priority but should not distract from ongoing firm operations as well as servicing clients and investors. In leveraging and successfully implementing the SEC’s recent changes, working with a specialized firm can aid in ensuring a streamlined and compliant process.

If your firm is interested in taking a step further with your marketing plan, get in touch with MBC Strategic and discover how your website can both lead and react to the legal environment.

- Please see FINRAs rules surrounding entanglement and “linking to third-party websites” here.