How to Position Your Financial Brand in the New Normal

The early stages of a new era is an opportunity to focus on design, content and PR.

Two of the most profound effects of COVID-19 lockdowns on the business world has been its complete disruption of normalcy in terms of both interactions and timing. Zoom meetings have replaced face-to-face, while the pace of “business-as-usual” has altered substantially.

The new normal we find ourselves in is at such an early stage, that brands who identify what is temporary and what is permanent, and act on those insights, have the opportunity to position themselves favorably in the marketplace.

Seeing that remote work is likely to remain permanent for many, the lockdown environment gives us some time and space to consider revamping digital presence. RIA’s, asset managers, venture capital firms, real estate Investment companies and so many others in the financial community can come out of this shift with a recalibrated and refreshed look that catches eyes, establishes trust, and converts leads in a new digital-first environment.

Taking advantage of this time to audit your brand presence, create value-added thought leadership content, and analyze how to make more of publicity opportunities will allow you to adapt and prove yourself as an industry leader known to act confidently and decisively when others are fearful.

Audit Your Web Presence: Preparing for a brand overhaul

Everyone is remote, and as a result, everyone is interacting in the digital space. This means that not only you have the opportunity and bandwidth to asses your own site, everyone else does as well. While the investment community has relied on physical interfacing, conferences, cocktail hours, and roundtables, much of this focus has gone digital, which means your site and presence is likely getting a closer look than ever before.

So, what should you be looking for during a high-level audit?

User Experience & Messaging

Your site’s user journey should be fast, informative, and seamless. If your goal is email capture, make sure the experience naturally leads to that CTA, giving the user every reason to click on that button and log their information.

Likewise, confident, eye-catching and strong messaging needs to immediately grab the attention of the website visitor, providing the most compelling financial services of your firm along with optimizing a site’s speed and design to critically stand-out from competitors.

Also check out your brands web responsiveness and particularly how your site performs on mobile. With the shift from desktop to phone viewing, the seamless conversion of design and layout for mobile visits is now even more important to utilize to provide an efficient and concise lasting impact. This will only increase post-COVID, likely the first experience investors will have, and one of the few opportunities to make a strong initial digital impression.

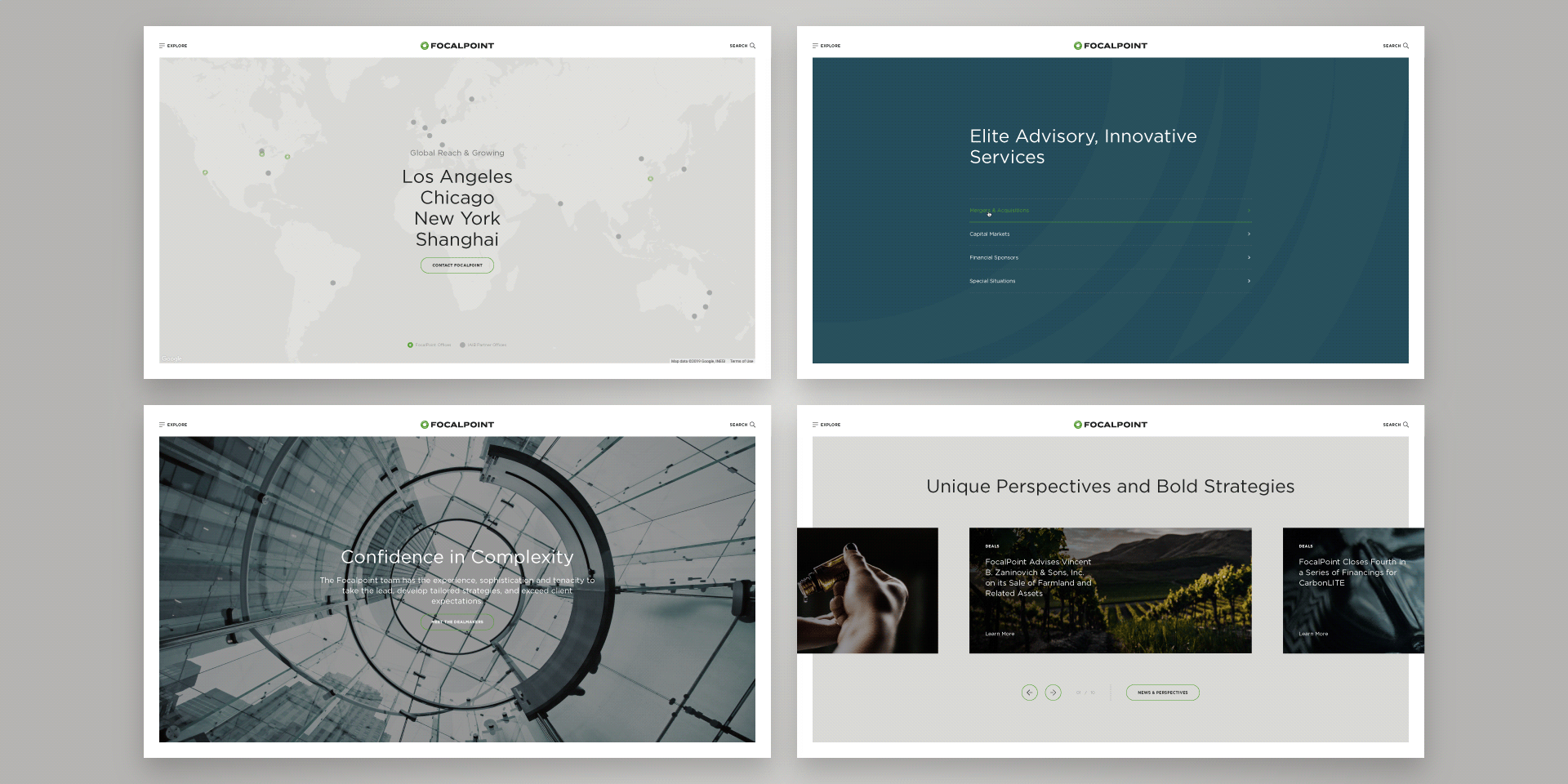

As an example, this commitment to responsiveness and design flexibility can be seen on Los Angeles Investment Bank, Focalpoint Partners, who worked with MBC to develop a website works seamlessly across all devices, providing visitors with a clean design and exceptional user experience, while also demonstrating FocalPoint’s brand and value proposition through an elegant display of messaging.

Content is King: Be a thought leader

Following an audit, you can take a more proactive stance and figure out the information your current and potential clients want to see. Investment professionals, retail investors, and business owners are all looking for an advanced perspective. Uncertainty creates a focus on finding information that paints a better picture of an opaque situation. Not only is this the case during difficult times, it is also a critical resource for ongoing engagement in the new normal.

When providing investment marketing services across hedge funds, alternative investment managers, mutual funds, and asset managers, our very first question posed prior to developing a white paper or targeted newsletter is:

What are we providing, and to whom?

A properly executed thought leadership strategy helps financial managers understand clients on a deeper level and distill their unique value proposition into something that will resonate strongly with their audiences, creating memorable financial services content that keeps audiences coming for more, all while solidifying trust.

This focus on keeping your digital audience informed and confident can be seen in the STRATA Trust Companies thought leadership strategy. MBC worked with STRATA to create and populate a quarterly newsletter of topical blogs and content.

By including exclusive insights such as whitepapers and blog posts that showcase your knowledge and differentiate your services, you are showing clients that you are an expert in your field, which in turn can greatly impact their interest in your services and attract investors.

PR: A necessary strategy

While thought leadership, client communication and brand messaging allows your voice to be heard, and public relations allows your firm to be seen

Worthwhile marketing and PR metrics include website referrals, media mentions, influential content, and word of mouth. The goal of a public relations campaign is to steer brand influence of by using key offerings, personality and value-added content to elevate the brand into an influential and sought-after business.

The public relations game is heavily reliant on the lasting relationships built between firms and high-visibility reporters deeply interested in the subject matter that they’re writing about. Influential platforms will engage the most relevant readers and those readers in turn will give a much higher likelihood to generating future business or advancing name recognition within industries, where reputation is key.

Stay Ahead of The Curve

How firms come out of this post-COVID world and maintain their persona will be an important consideration in establishing a strong connection with clients. Unpredictable times need strong leadership, and those who can demonstrate proactive confidence and authenticity will be rewarded. Your new normal brand should convey thoughtful authenticity and a commitment to providing valuable information, while establishing an engaging online presence. This window of opportunity to invest in a rebrand could be just the thing to propel your firm.

If you want help better understanding how to articulate your own unique story and better navigate the shifting demands of investor audiences, our investment branding team has been helping investment managers do just that for the past 20 years. Check out some of our other work and reach out to us if you’d like to learn more about how we can help you craft a story that will grab your investors’ attention here.

Published:

Tags: investment industry marketing, financial services industry marketing, financial brand marketing, financial firm content writing, Award winning marketing agency, investment firm lead generation, Financial services post pandemic, financial services covid 19, award winning advertising agency, award winning financial service marketing, branding agency with investment experience, branding for investment industry, investment brand strategy, investment marketing and branding