Establishing and Maintaining a 360˚ Brand Identity in Financial Services

The new rules for brand identities dictate that your brand interacts with your target audiences on four levels: verbal, visual, sensory and interactive. It’s no longer good enough to put together guidelines that cover just the words, images, colors and fonts associated with your financial services brand.

A brand logo is not the be-all-end-all of its identity. It is an important, even central, aspect of a brand’s identity, but today there are more expectations, and fewer rules, when it comes to brand identity. This is especially true in financial services, among the increasingly discerning universe of investor audiences.

The all-encompassing financial services brand identity

Your brand should be used as a platform to not only sustain and drive growth but create confidence and trust with clients and prospects as well. When investors trust you, they will be more willing to stick with you in down markets and more likely to refer assets your way.

A critical component for any successful investment management business is a deep comprehension of how their client demographics change over the long-term. This depth of understanding allows for evolving investment marketing strategies that adapt to, and prepare for, as many different target markets and client audiences as possible. In the current investment marketing landscape, it is not just trends and future developments – things that one cannot control – that help investment companies secure new business and stay positioned for future growth. Investment marketing must take into account changes in technology and investor desires as well.

A term that has come to describe this new rule of brand identity is 360˚ degree brand identity. It can serve financial services brand managers and marketers well to think of their brands as a circle divided into four equal parts:

- Visual Qualities — photography, typography, logo, color palette

- Verbal Qualities — company name, tone of voice and messaging

- Sensory Qualities — sounds, light, illumination, touch, texture

- Interactive Qualities — navigation icons, social content

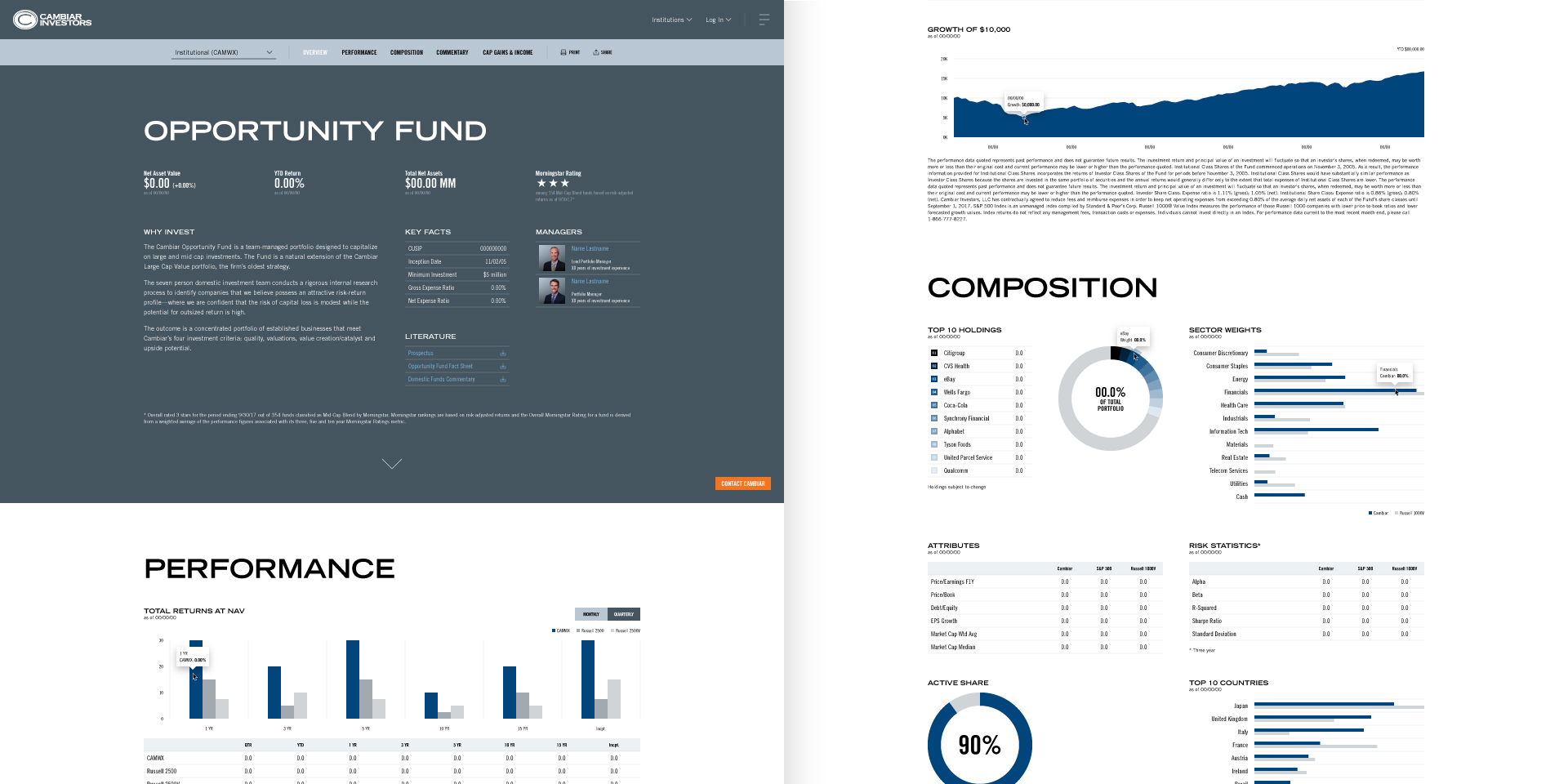

See how Cambiar Investors institutional investment website helped the firm establish its 360˚ brand identity

Conveying the Right Strategy and Messaging

To begin the investment branding process, it is important to do the strategic work first. It is the brand strategy that sets a blueprint of how to approach every step of the process, from determining the look, feel and functionality of the visual aspects of your firm. Careful consideration and honest assessment your brand will ultimately provide a solution that not only makes your firm stand-out, but also clearly communicates what makes you unique. The brand strategy will help you pinpoint:

- Your mission

- Your values

- Your brand personality

- Your unique differentiators

- Your brand voice

How to Articulate your Marketing Strategy and Brand Identity

In a world where money managers often tout ‘higher risk adjusted returns’, investors’ needs can be overlooked. By communicating with your audience and correctly addressing their true needs, you can lay the foundation for building confidence and trust. As you begin creating imagery and messaging that stands out from sea of investment firms and managers, your brand will begin to evolve. The better your brand interacts and resonates with your target audience, the more trust you will cultivate.

Trust contributes to whether a client will refer others or expand the relationship with additional assets, mandates or allocations. It is essential to set the tone with your clientele in terms of how you communicate with them, as well as to succinctly convey your investment style and process. This may seem obvious, but in a world where money managers overemphasize returns to the detriment of client-first messaging, investors largely don’t know what to expect. By connecting to and communicating with potential investors on what sets your firm apart and how you create value for them, you can set the stage for their expectations in how you behave through changing market cycles and unique scenarios. The process of branding helps you develop confidence and trust with your existing investors while engaging new potential clients.

Here are a few additional strategies to consider when developing your brand:

- Consider your prospect’s perspective – It’s important to factor their needs into everything you do. Put yourself in their shoes or think about current investors and what they say they want or need. Even if you work strictly with institutions, the decision makers there are humans, with human needs and emotions.

- Stay true to yourself – While it’s unlikely they will audit your story piece by piece, it’s important to be genuine. This will become part of your brand, something that you will have to interact with on a daily basis, so it must be a story that you actually believe in and can live and breathe.

- Don’t follow the crowd – Look at your competitors and how they tell their stories. Good financial services marketing and branding means that you don’t want to be saying the same thing as the other firms you are up against.

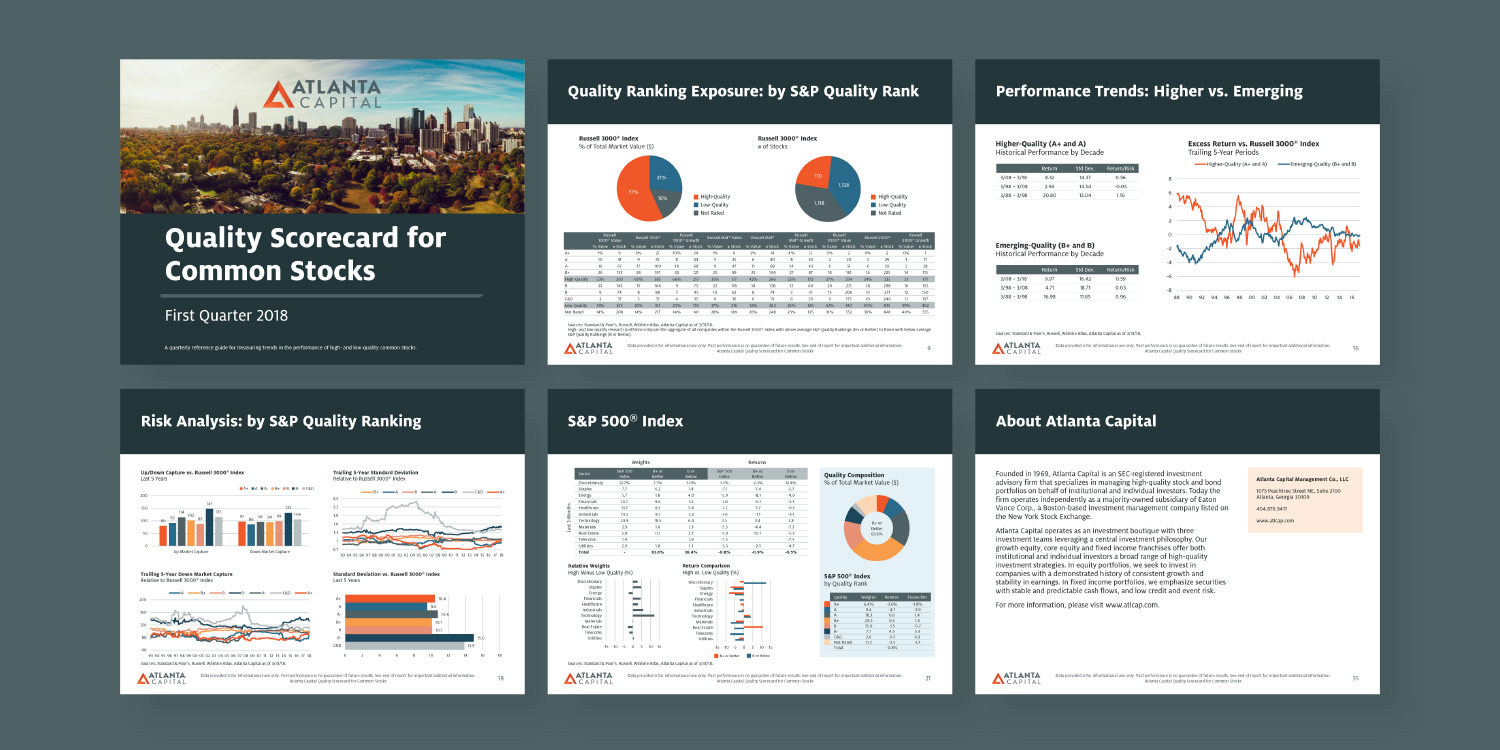

See how a 360˚ rebranding exercise for an established institutional equity manager helped them achieve differentiation in what can be a crowded market.

Keeping up with your Competition and Marketing to Millennials through Brand Supportive Social Media

Using platforms such as Twitter and LinkedIn, you’re cutting out the third party and offering direct access and insight into your brand. It’s a much quicker, more direct form of communication to a very targeted audience who have chosen to engage with your brand on social media in the first place. You can actually become the direct source of news about your company or brand by writing a blog and posting articles or media releases on your website. This can help raise your profile and increase your credibility as an expert in your field and boost your SEO efforts—even in the heavily-regulated world of investment and asset management.

Social media accounts such as LinkedIn, Twitter and Harvest are not only crucial in developing your public image but also great resources to scope out journalists, engage with clients and monitor your competitors’ activity. Even in the investment industry, social media is sending conversational messages with the aim to influence awareness and eventually sales. Firms should use these accounts and be consistent with a particular tone when engaging with their audience. Investment firms and asset managers can do this by using relevant hashtags, links and images, and tagging journalists they want to reach out to and re-post topical news. This is the voice of the firm and keeping that voice consistent is part of a comprehensive branding process.

Whether your clients are retail investors, advisors, or institutions, we can help develop effective branding tools and materials to target and reach them – as we’ve been doing for the past twenty years. We have helped firms build their identity, target the right audience, and effectively deliver their message, all with a keen eye on how to help them grow their business. Serving clients from alternative investments and mutual funds, to financial service providers and institutional investors, we deliver branding, marketing, and public relations solutions, bringing the necessary research, technology and strategies that will help streamline a complex process and produce strong results.

To learn more about how 360˚ investment branding can help transform your firm, get in touch with our team.

Published:

Tags: investment industry marketing, financial services industry marketing, 360 degree financial services marketing, los angeles investment marketing, 360 degree approach to marketing, Financial service brand identity, Brand identity, financial brand marketing, financial marketing initiatives, award winning advertising agency, award winning financial service marketing, branding agency with investment experience, branding for investment industry, investment brand strategy, investment marketing and branding, MBC Strategic, MBC Strategic investment marketing