Steps for Financial Institutions to Better Identify and Reach Their Target Market and Audiences

Knowing your target market is one thing. Creating an effective plan to reach those individuals or groups can be much more complicated. Understanding where your target audience spends their online and offline time is essential – whether they are retail investors, advisors and intermediaries, investment consultants or CFOs at institutions.

In today’s competitive financial services marketing environment, it is more important than ever to understand your consumers. It takes time and effort to analyze the behavior and needs of target audiences to better understand how you can get your product into the hands of the right people. Whether you sell something tangible like a car or your end product is an investment fund or service, many of the steps to grasping your target market are the same. In this piece, we will cover how to define your target market and what you can do to keep their attention once you identify who they are and where they consume content.

How to Identify and Define Your Target Market

Current Customers. In order to identify and define your target market, you’ll need to look at your current customers. Who are they and why do they buy from you? Look for similarities or common interests, and which characteristics bring in the most business to your firm. If you are a new company, there is an easy solution: look at your top three direct competitors and follow similar steps.

Do a Deep Dive. Break down your company with an in-depth analysis of each one of your products and/or services. For example, in the world of alternative investment custody, a trusted self-directed IRA custodian provides deep educational content for both investors and their advisors on how and when to use different products and the potential tax implications for each. Because they are both B2B and B2C, they provide each market with the tools they might need for a range of products and services. Ask your clients or internally analyze when and how in the provider selection process does each group seek expertise and counsel and how can you provide the right amount of information to truly fill that need?

Gather Data. Gathering key metrics and objective data can help answer questions of who your target market is. Conduct surveys from stakeholders and/or online surveys from market research firms is one way to approach this. Another solution to gathering key data for demographics on target markets for your financial firm may be to reach out to a third-party financial marketing and branding agency. A marketing agency will be able to access data that your firm would not have access to alone and leverage their experience and insights across dozens of similar projects. The deeper and better your data is, the better insights your marketing team can compile. In addition to the basic demographic trends such as age, income, location, title, gender, marital status, etc., you can also gather and analyze what the rational and emotional needs of your customer base might be as they look for a new investment product or service provider.

Targeting retail investors (B2C), advisors (B2B) or an institutional investment audience (B2I): All three audiences have different characteristics that define them and their needs. Some may differ when it comes to distribution. For example, you’ll want a mass-distribution platform to reach the retail public, whereas an institutional audience you’ll want to be more direct in terms of distribution. Identity the trades, publications, sites or conferences where your audience will best engage with your brand or products. Also, if you do cater to multiple audiences, your language and design might change when addressing retail, advisors and institutional investor audiences. Make sure you take all of this into account when determining who your audience is and what they’re expecting. Sometimes it may be necessary to craft a different message for all three, if you plan to market your product or service across the spectrum.

Sharpen Your Focus. Once you are able to identify the demographics of your target market you will find it much easier than you ever thought to reach these people. Identifying these characteristics of your target market upfront will allow you to significantly reduce cost in advertising and ideally see a healthy increase in investment marketing ROI. Think of target market selection as a funnel. For example, the top of the funnel may be gender. If your product or service is gender-specific, your target audience is immediately cut in half. Your second filter may be location. If you’re selling scuba diving gear, you’ll probably have little success marketing your product to those living in South Dakota. Your third, and final, part of the funnel could be income level. A college student looking for a new car probably has a different budget than a high-net-worth individual.

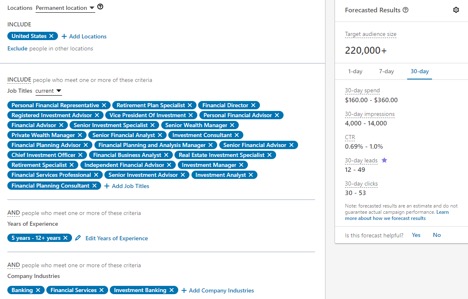

Social platforms such as LinkedIn have made reaching your target audience easy with one-click filters allowing you to, after you identify them, filter out any unwanted marketing expenses by honing in on your target market. For example, setting up a B2B investment advertising campaign on LinkedIn can be quite easy with these tools.

Example of Linkedin Target Marketing. Targeted by location, job title, years of experience and company industries.

By identifying the demographics, you’ll have a much better understanding of who your core audience should be. Therefore, you’ll be able to dive even deeper into the psychographics of your target market to better understand personality, attitude, interest, lifestyles, habits and values.

Ask yourself Questions. Your business can have more than one niche market so make sure you ask yourself qualifying questions as you move through this process. For example, marketing for an investment manager or product provider such as a mutual fund or ETF often targets both retail investors and advisors and intermediaries. Different firms have better success with marketing and advertising depending on the complexity and use of the products. If that is the case for your financial institution, you will likely have to do this process twice and create targeted marketing strategies for each. Some questions to think about:

· Is my target audience large enough?

· Can they afford my product/service?

· Is my message being heard by my target market?

· Is this the right platform and content for engagement?

· What makes my target market ‘click’ emotionally and drives them to make decisions?

Once the hard part of identifying your target market is behind you, the biggest mistake you can make is assuming that it is really actually over. Consumer habits are always changing and so should your marketing strategy and efforts to obtain and keep them interested in your investment product or service.

Final Steps

The end goal for identifying your target market is to turn this batch of potential consumers into profitable business for your financial firm—whether your goal is brand recognition or product distribution. The more you understand their habits, where they come from, their decision-making triggers, amongst other criteria, the more effective your marketing efforts will be –improving your bottom line and increasing your ROI.

If you’re interested in utilizing the resources of a third party marketing agency that specializes in the financial industry and has been crafting similar marketing strategies for the past two decades, our team would love to hear from you.

Published:

Tags: investment industry marketing, financial services industry marketing, finding your target market, los angeles investment marketing, financial target market, Financial service brand identity, Brand identity, financial brand marketing, financial marketing initiatives, award winning advertising agency, award winning financial service marketing, branding agency with investment experience, branding for investment industry, investment brand strategy, investment marketing and branding, MBC Strategic, MBC Strategic investment marketing