Start with the benefits when introducing and marketing innovative financial products or services

As the financial industry continues to mature, introducing innovative products and services is becoming harder to do. Whether it’s an unconventional way of investing, a new type of account, a unique approach to financial advice or an innovative new financial technology product or service, you need to build an intelligent marketing and branding campaign around it to ensure its success and lasting competitive edge.

To do that, start with the benefits of the product or service. Innovation in the financial industry thrives when it creates a better solution for the user or end investor. That product or service could be a new strategy of investing, an alternative investing ETF, a streamlined way to access investors online or a new slice of the fixed-income market. Regardless, the innovation should include upfront messaging that touts benefits, be it addressing a pain-point, saving costs, boosting efficiency, providing a new market or distribution method, or anything else that explicitly or implicitly provides resulting value to the customer.

The process for creating a marketing campaign is simple, and one that most businesses launching innovative products can follow, but actually carrying out a campaign tends to be difficult and cumbersome. That is why at MBC Strategic, we have developed our own five-point process for introducing an innovative product or service, which we’ve outlined below.

1. Understand and demonstrate the benefits

Understanding the benefits of a product or service is a crucial starting point in creating an investment marketing and branding campaign. If it’s a pain point, the underlying innovation must solve it. Who has the problem that the innovation is trying resolve? How many people or organizations have the issue? How much is it worth to them? Is there initial skepticism about the product or service?

Working with the media can help. The media can turn skeptics into supporters by explaining the product’s effectiveness and turn public opinion into praise.

2. Campaign as if it’s something they can’t live without

In the mind of the consumer, if they believe that a new product or service is something they can’t live without, they will buy it. Your goal as a marketer should be to establish a purpose in your customer’s life, and tell them why that purpose depends on your product’s functionality or service.

Of course, it must be sold at a reasonable price to make it economically viable to the client.

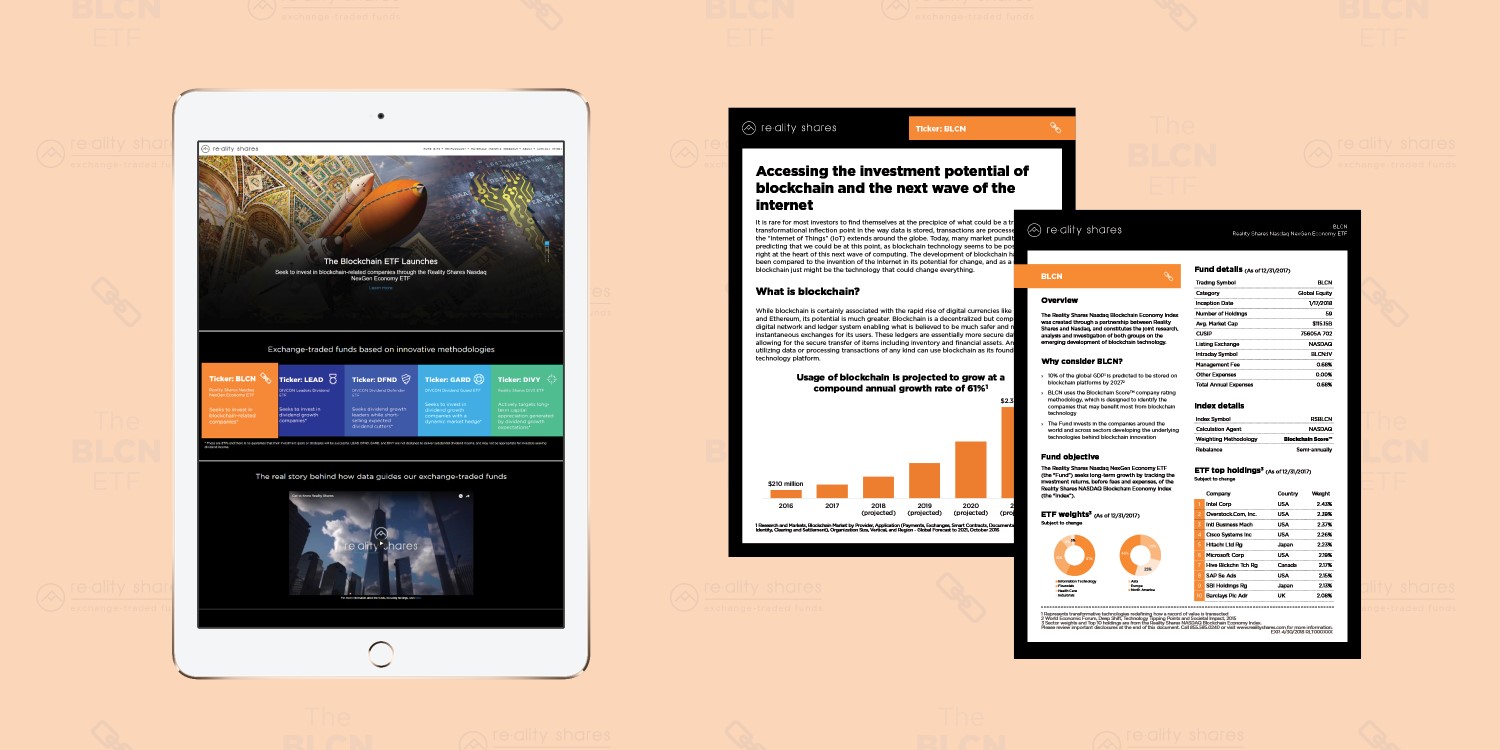

For example, an ETF client of ours, is focused on innovative investment strategies, and has made a business of creating and marketing ETFs that invest in the latest and most promising areas of finance. This includes funds that invest in areas like blockchain technology, multi-factor investing and dividend futures. So, we helped them create an ETF messaging, marketing and advertising campaign that is built on the same promise as the areas they were investing in, in addition to ensuring that message is visible throughout their materials and in broader media.

3. Focus on the descriptors

Once you have a product and you’ve figured out the precise role it would play in a consumer’s life, you’ll need to figure out what message to send your audience. Branding is key, and identifying which words best describe your product and the innovation behind it is important. Create a messaging platform that any one of your employees could recite from heart: simple words are best, but they should also create an emotional attachment.

Find the best words to describe your product or service, create a brand story around them, and then cascade that throughout your messaging platform by integrating sales support and marketing materials—it may make sense to combine video or more traditional forms of branding. This can take time, but you’ll want to get it right.

4. Personalize it

Perhaps the biggest mistake that creators of innovative financial products and services make in their marketing, is thinking that, because their invention is so new and so invaluable, they don’t need to put the customer first. Especially during this nascent stage, putting the customer first is essential, and personalizing the investment product or service marketing campaign is probably the best way to do that.

Whether it’s an investment product or a new financial technology tool, conveying that it has been designed specifically for them is important. One area where this is particularly important is in the area of financial advice. Investors like to feel that a product has been tailored to their personal situation, and that the services of a financial advisory firm will match that. There have been several strong examples recently, as some of the robo-advisors unleashed branding and communication packages that really spoke to and put the investor first.

5. Define your target market

Now that you know how to market your product or service, you can start counting the target customers: How many and where are they? Where are they and where do they spend their time online or consuming media? Why and how do they benefit from your product and service? Then you’ll need to decide on what format to use and how to distribute your message and marketing materials.

For example, for many product providers, a B2B strategy can be the right recipe, but finding the right partners, platforms, and advisor profiles can make a huge difference. Doing this right can help define what industry trades are best—is it the breakaway independent advisor or the team-based RIAs that best connect with your message or product?

At MBC Strategic, we understand the challenges of investment marketing, especially when introducing an innovative product or service in the financial services industry. Leveraging more than 20 years of experience, we help investment firms of all sizes, ranging from investment rebranding and messaging strategy, to websites, digital advertising, and a full suite of marketing materials. We understand the differences in investor audiences and the need to balance emotional appeal with rational sensibility.

Published:

Tags: investment industry marketing, financial services industry marketing, benefits to financial marketing, innovative financial services, innovative financial product marketing, Financial service brand identity, los angeles investment marketing, financial brand marketing, financial marketing initiatives, award winning advertising agency, award winning financial service marketing, branding agency with investment experience, branding for investment industry, investment brand strategy, investment marketing and branding, MBC Strategic, MBC Strategic investment marketing