Positioning ESG in Your Investment Marketing and Branding Efforts

Investing in companies that have strong environmental, social and governance (ESG) policies is doing well on the whole. Then why is marketing and positioning ESG companies so difficult?

Consider this:

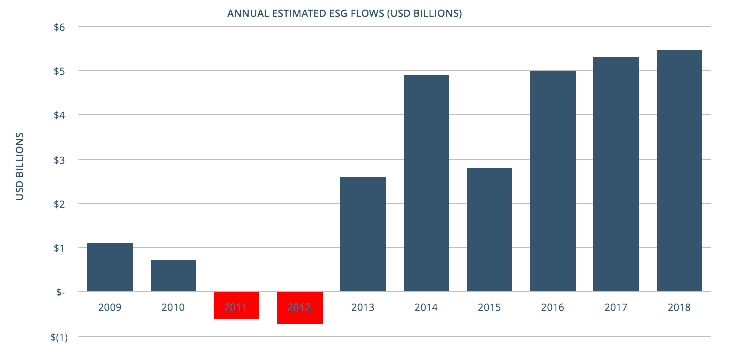

· Inflows into ESG strategies have been positive for the past 6 years1

· Nearly 25% of all professionally managed assets are subject to ESG methodology2

· Demand in demographics like millennials and women investors is rapidly growing

· Numerous studies are beginning to show positive correlation between ESG and performance

[3)Source: Morningstar Direct (Data as of 4/2019). Includes ESG Integration, Impact and Sustainable Sector funds as defined in Sustainable Funds U.S. Landscape Report, 2018.https://medium.com/the-esg-advisor/esg-funds-set-a-record-for-flows-in-q1-77b6ad3a98ae

The demand is clearly out there for these sustainable investments, but we see missteps in how ESG investments are being marketed and positioned, and in how they are getting supplied to the individuals that are demanding them.

Let’s consider one recent study around ESG Investing in 401(k) plans – less than 8% of company-sponsored retirement plans include a single ESG fund option but 74% of surveyed plan participants want access to ESG funds in their retirement plans.4

There is a clear gap here between what investors wants (access to ESG investments) and what the market and employers are offering. While individual plan participants might want to put some money into ESG because it aligns with their values, multiple studies have shown that they are even willing to sacrifice some amount of returns for their values. It is the plan sponsors and investment companies that are making the decision not to include these investment options. These individuals are beholden to their fiduciary responsibility to their clients and make investment decisions based solely on what is best for their clients from a risk and return perspective, disregarding the effects of ESG policies.

So, within one investment option you have to appeal to both the cold, analytical investment committees and the warmer, less sophisticated investors. Most investment committees can’t concern themselves with saving the oceans, but they will be interested in how some of the environmental factors in ESG analysis can uncover previously uncalculated risks. In the end, investors may not care about responsible board governance and will likely be more concerned with fair gender and racial representation in upper management.

Much of the gap in supply relative to the demand for ESG investment options in 401k plans is the idea of concessionary returns. That ESG is something outside of their fiduciary responsibility. Yet, as numerous studies are beginning to show, that is not the case at all. You need to craft your ESG marketing messaging and position it around the things they care most about—funding their liabilities. How does that additional layer of risk analysis help them achieve that end? The final marketing materials that end up in the hands of plan participants can be entirely different, more focused on values investing, but the first step is getting this vetted and on a list of investment options.

This is the delicate balance that ESG marketing strategies must walk. Each audience type wants a different narrative and you need a marketing strategy that addresses the ESG benefits of your specific audience. In the above example, it becomes more complex as your messaging becomes tiered between the various parties that will vet and include your products before they even get in front of the end investor.

Another example of an underserved market with divergent investor demands is impact investing. The current impact investing market is estimated at $500 billion,5 with over 1,340 organization managing impact investing assets globally. However, the International Finance Corporation (IFC) recently estimated that investor appetite and market potential for impact investing is $26 trillion. Now, think about how many 401(k) plans have access to impact investment options. Not enough? From millennials who show increased appetites for these types of responsible investments to family offices and institutions that are looking to align their values, the type of story and marketing messaging needed for impact investing is quite different. The key is to understand why these investor audiences are wanting and demanding these impact strategies, and then construct thoughtful impact investment marketing strategies to best meet those demands.

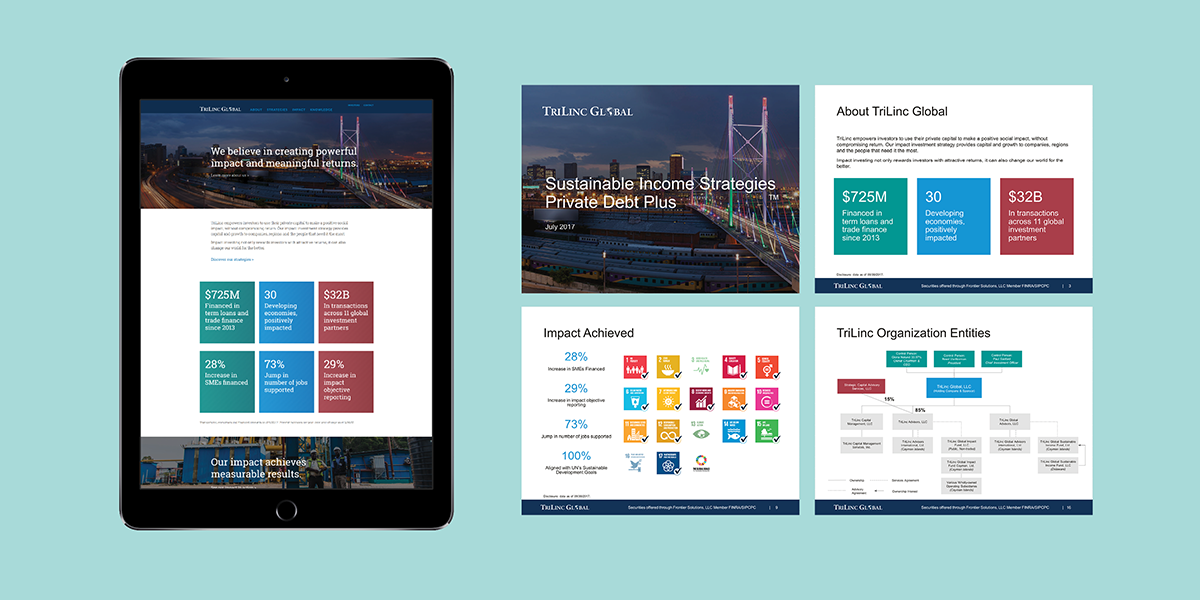

One such problem we helped solved was for a client who is engaged in impact investing through private debt. We believe that marketing strategy for impact investing is great for building a narrative around tangible change and gives many investors a feeling that their money is going toward creating impact for the arenas they care most about. The problem for this client was that their entire investor base was institutional — the same audience that is supposedly making decisions solely based on risk/return merit alone.

As we helped our client develop their new messaging strategy, we refined their core investment beliefs but also addressed the functional needs of their institutional investor audiences. We applied the investment process and strategy in the forefront while at the same time addressing the misconception that responsible investing meant concessionary returns. The impact they were creating was still in the messaging strategy but wasn’t in the forefront. Having a more powerful and concise messaging for their institutional audience allowed them to greatly grow their assets, increasing over 200% in just under two years.

The best way to start positioning your ESG marketing messaging is to get to know your audiences and their decision criteria. Even within millennials, different preferences exist. For instance, the top investment holding of Gen X is affordable pharmaceuticals, while older millennials tend to lean toward clean tech and education.6 Every investor wants to buy into a narrative, but you need to tailor that narrative to their specific interests. This can become a whole other discussion on its own. If you’d like to learn more about the importance of storytelling you can read our recent article on the Importance of Storytelling in Investment Branding and Marketing.

The demand for ESG and impact investing is there, both with retail and institutional audiences. But, to be successful, investment firms need to supply the right messaging based on what their audiences are demanding. Whether it is values investing or getting a more complete picture of risk, there are powerful ways to position your ESG investment strategy, but it must be informed by the needs of your target audiences.

[1] Morningstar Direct (Data as of 4/2019). Includes ESG Integration, Impact and Sustainable Sector funds as defined in Sustainable Funds U.S. Landscape Report, 2018.

[2] US SIF: The Forum for Sustainable and Responsible Investment

[3] Source: Morningstar Direct (Data as of 4/2019). Includes ESG Integration, Impact and Sustainable Sector funds as defined in Sustainable Funds U.S. Landscape Report, 2018https://medium.com/the-esg-advisor/esg-funds-set-a-record-for-flows-in-q1-77b6ad3a98ae

[4] https://www.investmentnews.com/article/20190316/FREE/190319951/esg-options-scarce-in-401-k-plans %40investmentnews

[5] Sizing the Impact Investing Market (Global Impact Investing Network (GIIN), April 1, 2019

[6] https://russellinvestments.com/us/blog/millennials-and-responsible-investing

Published:

Tags: ESG positioning, esginvesting, esg, benefits to financial marketing, esg investment brand marketing, Financial service brand identity, financial brand marketing, financial marketing initiatives, investment industry marketing, ESG Los Angeles, financial services industry marketing, los angeles investment marketing, award winning advertising agency, award winning financial service marketing, branding agency with investment experience, branding for investment industry, ESG investment marketing, investment brand strategy, investment marketing and branding, MBC Strategic, MBC Strategic investment marketing